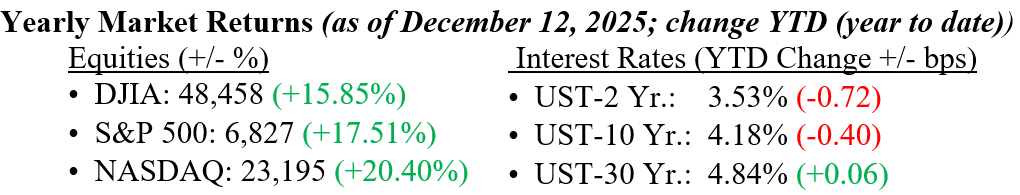

Equity markets ended the week with mixed results but moved in only small increments, nonetheless. Furthermore, year-to-date returns on all major indexes remain well into double-digit territory, as shown in the returns listed below. The 25-basis-point rate cut was what investors expected, and Fed Chairman Jay Powell reiterated his long-standing mantra that future rate movements are dictated by the data rather than opinion. We support this notion and expect only one or two more cuts in this cycle. Domestically, we maintain a preference for large-cap equities as the primary vehicle for capturing the continuing AI-driven investment cycle, which continues to provide a substantial structural boost to earnings growth. However, the recent shift away from mega-cap technology leaders toward broader sectors highlights the value of diversification and suggests a possible expansion of market leadership. The 10-year Treasury yield rose four basis points last week, closing at 4.18%.

U.S. & Global Economy

- Last week’s global economic activity reflected continued resilience, despite growth patterns diverging across regions. In the United States, incoming data reinforced a picture of steady consumer demand and moderating inflation, supporting expectations for an easier monetary policy stance soon. Europe showed tentative signs of stabilization, with manufacturing conditions still soft but services activity holding up better than feared. In Asia, momentum remained mixed; China continued to grapple with uneven domestic demand despite targeted policy support, while India and parts of Southeast Asia sustained strong growth driven by investment and consumption. Overall, the global economy appears to be navigating tighter financial conditions and geopolitical uncertainty with more durability than anticipated, reinforcing expectations for ongoing, if uneven, expansion rather than a synchronized slowdown.

Policy and Politics

- Last week in Washington, lawmakers and the administration focused on economic messaging, budget negotiations, and near-term growth priorities. With markets closely watching fiscal and monetary coordination, administration officials emphasized efforts to support households amid elevated living costs, rolling out a renewed affordabilitypush centered on lowering housing expenses, easing healthcare and prescription drug costs, and reducing everyday consumer fees. These initiatives were framed as complements to cooling inflation and a stabilizing labor market, aiming to improve real purchasing power without undermining growth. At the same time, discussions continued around tax policy, trade enforcement, and federal spending, underscoring the administration’s effort to balance longer-term fiscal objectives with near-term economic relief.

In the current climate, we remain cautious about small- and mid-cap stocks, despite their recent gains. About 40% of companies in the Russell 2000 are not profitable. In addition, larger companies are better positioned to absorb tariff pressures and be early adopters of artificial intelligence initiatives, given their stronger balance sheets. Private equity has also kept many of the highest-quality businesses private for longer, allowing them to enter the public markets at a larger and more mature stage, which has reduced the depth of quality in the small-cap universe. We believe that portfolio durability can be strengthened through geographic diversification, with international and emerging-market equities appearing attractive due to accelerating earnings trends and more favorable valuations compared to U.S. large-cap stocks. These allocation preferences are reinforced by last week’s FOMC rate cut and a continued favorable interest rate cycle. Diversification and balance have led the way this year, with long-term investors being rewarded in 2025. As always, please contact your financial professionals at Valley National Financial Advisors with any questions or comments.

Economic Numbers to Watch This Week

- U.S. Empire State Manufacturing Survey for December, prior 18.7

- U.S. Employment Report for November (delayed), prior 119,000

- U.S. Unemployment Rate for November, prior 4.4%

- U.S. Hourly Wages Year-over-Year for November, prior 3.8%

- U.S. Retail Sales for October (delayed), prior 0.2%

- S&P Flash U.S. Services PMI for December, prior 54.1

- S&P Flash U.S. Manufacturing PMI for December, prior 52.2

- U.S. Initial Weekly Jobless Claims for the week of December 13, prior 236,000

- U.S. Consumer Price Index (CPI) for November, prior 0.3%

- U.S. CPI Year-over-Year for November, prior 3.0%