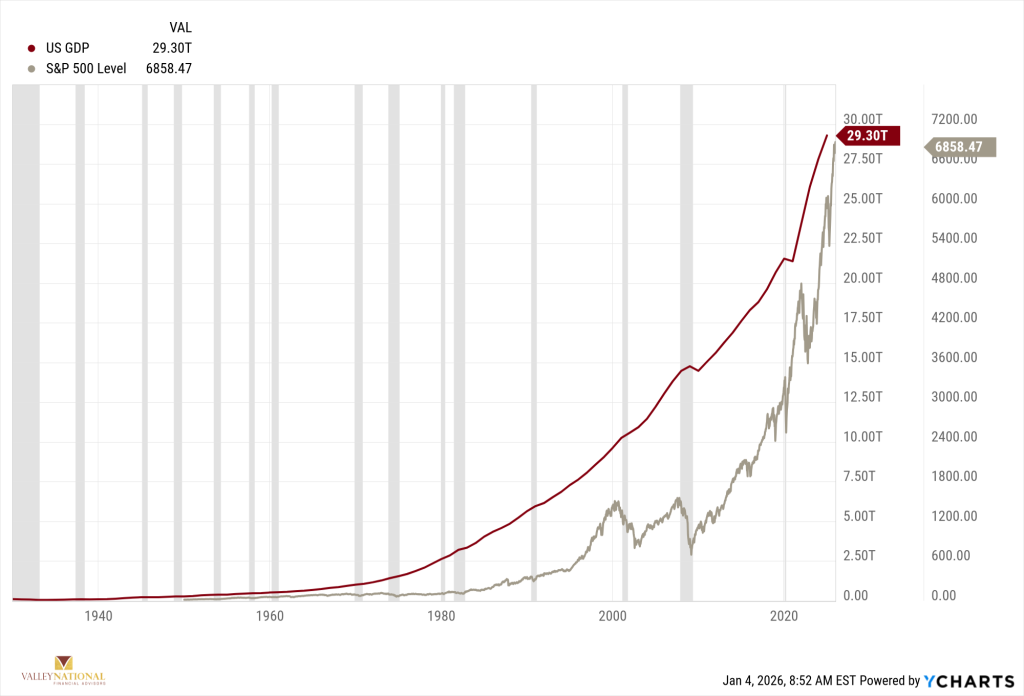

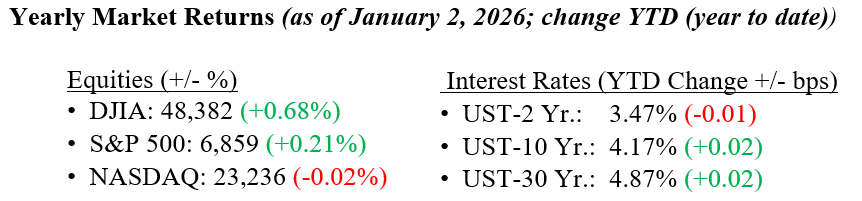

2025 ended with double-digit returns across all three major stock market indexes, marking the third consecutive year of gains at that level. The results rewarded investors who stayed the course and remained fully invested, despite a constant barrage of bad news and noise from the sidelines and investment professionals and economists. Readers of TWC know we have consistently reminded clients that the U.S. economy has remained resilient despite numerous external headwinds. That resilience was on full display in the third quarter, when U.S. GDP surged 4.3%, far exceeding expectations. A clear indicator of upward momentum on equity prices is the trajectory of the economy. Refer to the chart below, which shows nearly 100 years of U.S. GDP growth and the S&P 500 Index. Economic growth positively impacts EPS and thus stock market prices. Entering 2026, our investment focus remains centered on trends in the U.S. and global economies. In 2025, changes in inflation dynamics and central bank policy expectations benefited fixed-income markets, with the Bloomberg U.S. Aggregate Bond Index posting a total return of more than 7%. The yield on the 10-year U.S. Treasury note ended last week at 4.19%, two basis points higher than year-end 2025.

U.S. & Global Economy

- It was a quiet holiday week for economic data, but the updates we did get were mostly positive. Housing showed some momentum, with pending home sales posting their biggest monthly gain since early 2023 as lower mortgage rates and solid wage growth helped improve affordability, while home prices continued to rise modestly. The Fed released minutes from its December meeting, revealing some disagreement among policymakers on the need for further rate cuts, though markets reacted little and expectations for near-term cuts remain low. The labor market also stayed strong, with initial jobless claims falling for a third straight week to one of the lowest levels of the year and continuing claims edging lower as well.

Policy and Politics

- Global geopolitical tensions increased worldwide last week as U.S. foreign policy and diplomatic activity continued to unfold across several regions. Focus intensified in Latin America following the capture of Venezuelan President Nicolás Maduro, a dramatic and unexpected development. It came after President Trump’s earlier announcement of a naval blockade to restrict sanctioned oil exports, adding new uncertainty around Venezuela’s political future and broader regional stability. In Eastern Europe, the war in Ukraine continued, with Ukraine sustaining advanced operations against Russian assets while Russia escalated attacks on critical energy infrastructure. Against this backdrop, President Trump held a high-profile meeting with Ukrainian President Volodymyr Zelenskyy, signaling renewed U.S. engagement in exploring potential pathways toward a final resolution to the Russia-Ukraine War, which is soon entering its fourth year.

2025 proved once again that patience and discipline matter. Investors who remained committed through periods of volatility and headline-driven uncertainty were rewarded with strong double-digit equity returns, broader market participation, and solid progress toward long-term goals. Despite frequent noise around inflation, rates, geopolitics, and politics, markets ultimately reflected the underlying strength of earnings, innovation, and economic resilience. Looking ahead to 2026, we see a constructive environment taking shape. Corporate profits are positioned to grow further. Productivity gains, particularly from continued AI investment, remain a powerful tailwind, and the prospect of lower interest rates could provide additional support to both growth and valuations. While short-term risks and market distractions will undoubtedly persist, history continues to favor investors who stay invested, remain diversified, and focus on fundamentals rather than headlines. We believe 2026 offers another opportunity for disciplined investors to build on the success of the past year by tuning out the noise and staying the course. This week, we will get an early look at some important economic indicators, including Nonfarm Payrolls, the Unemployment Rate, and the Index of Consumer Sentiment. As always, please contact your financial professionals at Valley National Financial Advisors with any questions or comments.

Economic Numbers to Watch This Week

- U.S. ISM Services PMI for December 2025, prior 48.90

- U.S. Job Openings: Total Nonfarm for November 2025, prior 7.67M

- U.S. Initial Jobless Claims for the week of Jan 3, 2026, prior 199,000

- U.S. Productivity for Q3 2025, prior 3.30%

- U.S. Nonfarm Payrolls MoM for December 2025, prior 64,000

- U.S. Labor Force Participation Rate for December 2025, prior 62.50%

- U.S. Unemployment Rate for December 2025, prior 4.6%

- U.S. Index of Consumer Sentiment for January 2026, prior 52.90