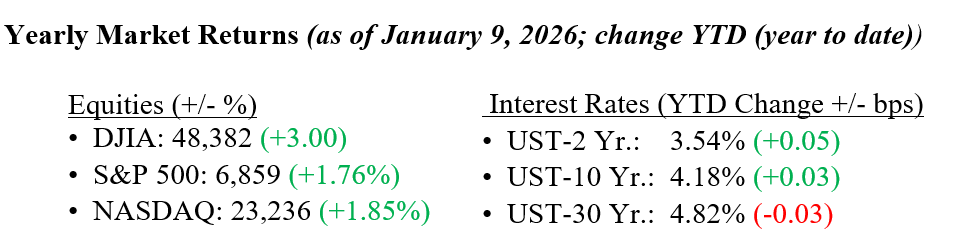

Markets are off to a strong start in 2026, with major indexes posting solid year-to-date gains across the board. The Dow Jones Industrial Average is up roughly 3%, while the S&P 500 and Nasdaq have each advanced about 1.8%. Small-cap stocks are leading the rally, with the Russell 2000 up an impressive 5.7%. Market participation is also broadening, as the equal-weight S&P 500 has outperformed the traditional cap-weighted index, which is more heavily influenced by a handful of mega-cap technology stocks. This momentum has persisted despite rising geopolitical tensions and industry-specific concerns tied to a recent wave of policy announcements from President Trump. Meanwhile, last week’s Consumer Electronics Show highlighted the widespread use of AI and its continued role as a secular force shaping the technology landscape. The yield on the 10-year U.S. Treasury note ended last week at 4.19%, two basis points higher than at year-end 2025.

U.S. & Global Economy

- Recent economic data continues to paint a mixed but generally stable picture of the U.S. economy. Consumer sentiment improved for a second consecutive month and reached its highest level in four months, suggesting that households are feeling somewhat better about current conditions. At the same time, the labor market is showing signs of cooling, with December job growth coming in below expectations, prior months revised lower, and measures like job openings and hires continuing to decline, though the unemployment rate edged down to 4.4%. Manufacturing remains a weak spot, contracting for the tenth straight month and facing ongoing cost pressures while the services sector continues to show resilience, posting solid growth in activity, new orders, and employment, with price pressures easing slightly but still elevated.

Policy and Politics

- Over the past week, U.S. policy and politics have been unusually active on both foreign and domestic fronts. The U.S. military captured Venezuela’s President Nicolás Maduro and is moving to control and market large volumes of Venezuelan oil, intensifying geopolitical tensions and contributing to oil price volatility even as longer-term price pressures remain subdued. The Trump administration also revived talk of asserting U.S. influence in places like Greenland and scrutinized Chinese and Cuban activities in the region. In addition, ongoing conflict in Ukraine and political uprising in Iraq continue to shape global risk dynamics. Domestically, a flurry of policy headlines from the Trump administration whipsawed stocks lower and then higher. Defense stocks initially moved lower on news of potential restrictions on dividends, buybacks, and executive pay, only to rally later as investors focused on plans for higher overall defense spending. Following a similar pattern, homebuilders initially fell after plans to curb institutional single-family home purchases and later rebounded on a directive for Fannie Mae and Freddie Mac to buy $200 billion in mortgage bonds to lower lending rates, driving shifts in credit spreads and housing-related sectors.

Looking ahead, the coming week is set to be an active one for markets as fourth-quarter earnings season gets underway, led by reports from major banks including JPMorgan, Bank of America, Wells Fargo, and Morgan Stanley. These results should provide insight into the health of the U.S. consumer. Earnings from Delta Air Lines and Taiwan Semiconductor are also scheduled this week. On the economic front, investors will be closely watching CPI, PPI, and Retail Sales for clues on inflation trends and consumer demand. Attention will also turn to Washington, where updates are expected around the January 30 federal government funding deadline, as the risk of shutdown-related headlines could rise if Congress does not act. Finally, markets are closely monitoring a potential Supreme Court ruling on tariffs, which could be announced in the coming days. If the tariffs are struck down, yields may rise due to lower Treasury revenue, adding uncertainty for corporate America. As always, please reach out to your financial professionals at Valley National Financial Advisors for questions or comments.

Economic Numbers to Watch This Week

- NFIB Small Business Optimism Index for December 2025, prior 99.0

- U.S. Consumer Price Index for December 2025, prior 0.3%

- U.S. Core CPI for December 2025, prior 0.2%

- U.S. New Home Sales for October 2025, prior 800,000

- U.S. Retail Sales for November 2025, prior 0.0%

- U.S. Retail Sales ex-Autos for November 2025, prior 0.4%

- U.S. Producer Price Index for November 2025, prior 0.3%

- U.S. Core PPI for November 2025, prior 0.1%

- U.S. Existing Home Sales for December 2025, prior 4.13 million

- U.S. Initial Jobless Claims for the week of January 10, 2026, prior 208,000

- Empire State Manufacturing Survey for January 2026, prior -3.9

- Philadelphia Fed Manufacturing Survey for January 2026, prior -10.2