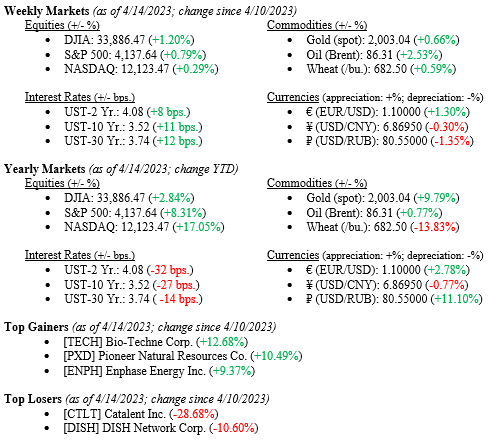

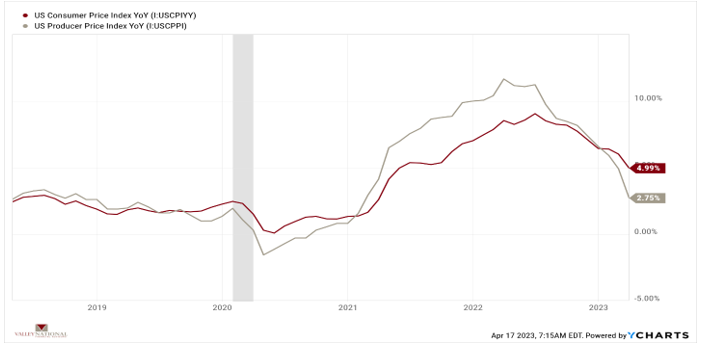

Equity markets notched a positive week across all three major indexes while bonds quietly sold off as interest rates, (as measured by the 10-year US Treasury Bond) moved higher by 11 basis points to 3.52%. Last week’s inflation report showed U.S. Consumer Prices and U.S. Producer Prices each falling year-over-year; see Chart 1. Falling inflation is good for the economy and consumers and demonstrates the Fed’s efforts at taming inflation are working, and their aggressive interest rating hiking cycle is nearing an end. Last week the Dow Jones Industrial Average rose +1.20%, the S&P 500 Index rose +0.79%, and the NASDAQ rose +0.29%. Year-to-date returns on all three indexes remain positive as well, with the tech-heavy NASDAQ leading the charge at +17.05% (see complete data immediately below).

Global Economy

As mentioned above, last week’s inflation reports were seen as positive catalysts for the equity markets as further proof higher interest rates are whittling away painful inflation. Recall just last summer; inflation was running at 9.0%, a level not seen in decades. Since then, all inflation reports have softened and moved lower. See Chart 1 below from Valley National Financial Advisors and Y Charts showing recent inflation data.

While both inflation reports are still running below long-term averages, the U.S. Producer Price Index (PPI) fell to 2.75%, just slightly above the long-term average of 2.70%. The U.S. PPI measures price changes in outputs at the producer level; further, a change in PPI often anticipates a corresponding change in CPI (Consumer Price Index). The Fed’s job is not done yet, but the end is certainly near for further rate hikes by the FOMC (Federal Open Market Committee). Markets expect this, as should investors.

While the unemployment rate remains at a 50-year low of 3.5%, retail sales for March 2023 fell last week from February 2023 by 1.0%, showing that the consumers may be reigning in all important spending. Continued news of layoffs, albeit from the tech sector and not yet retail, consumer services, healthcare, or leisure, weighs on consumers and eventually can impact spending habits as concerns mount. Seasonal travel and leisure are just starting to pick up as vacation spending ramps up heading into the summer. Finally, regarding the economy, last week, folks from JP Morgan and BlackRock both tempered their 2023 recession warnings and quietly walked back predictions to potentially 2024 rather than 2023.

Policy and Politics

Global tailwinds continue to propel markets higher. Aggressive cost-cutting vis-a-vis layoffs, lower input costs (see PPI comments above), less disruptive supply chains, and falling FX (foreign exchange) pressures will have a positive impact on corporate earnings. China’s grand reopening will increase demand worldwide for inputs as Chinese consumer ramp up spending, and China’s massive production machine revamps.

What to Watch

- U.S. Housing Starts for March 2023, released 4/18/2023, prior level 1.45M

- U.S. Job Openings: Total Nonfarm for March 2023, released 4/19/2023, prior level 9.931M

- U.S. Initial Claims for Unemployment Insurance for the week of April 15, 2023, released 4/20/2023, prior level 239,000

- U.S. Existing Home Sales for March 2023, released 4/20/2023, prior 4.58M

Inflation is moderating, and there may be one more rate hike coming at the May 2023 FOMC meeting, but it is unlikely that we will see higher interest rates from there. Consumers, while remaining resilient, are showing some modest signs of fatigue; at the same time, corporate earnings could rebound as cost-cutting tailwinds persist. We at VNFA have been firm in not calling for a recession in 2023, and we stand by that prediction. We are now seeing large asset managers, banks, and economists walking back their original recession predictions for 2023. We remain cautiously optimistic about the markets this year and urge you to contact your financial advisor with any questions or concerns.