Overview of Liberation Day Tariffs – Navigating Market Challenges with a Long-Term Perspective

William Henderson | Chief Investment Officer

Chris Holland | Director of Research & Investments

On Wednesday, April 2, President Trump introduced a broad set of tariffs called “Liberation Day” to support U.S. manufacturing and reduce dependence on foreign goods. These tariffs represent a significant shift in U.S. trade policy, the largest since the Smoot-Hawley Tariff Act of 1930. It is the first time the U.S. has implemented such an extensive import tax in decades, marking a clear change from decades of free-trade policies. The policy includes:

- A 10% universal tariff on all imports starting April 5, 2025.

- Reciprocal tariffs targeting specific countries with higher rates, effective April 9, 2025, such as:

- China: 34% (on top of the existing 20%, totaling 54%).

- European Union: 20%.

- Japan: 24%.

- Vietnam: 46%.

- Taiwan: 32%.

- A 25% tariff on auto imports starting April 3, 2025.

- Closure of the “de minimis” loophole for low-value packages (under $800) from China and Hong Kong, effective May 2, 2025, to curb cheap imports and fentanyl smuggling.

Announced tariffs vs. Expectations

- Scale: The tariffs are broader and more aggressive than economists and market experts had anticipated, which has triggered the sharp market reaction. While a 10% universal tariff aligns with Trump’s campaign message, the reciprocal tariffs (e.g., 54% total on China) exceed earlier hints of a 20% baseline or focus on just the countries with big trade deficits.

- Surprises: The auto tariff and de minimis closure were expected, but the immediate implementation and high rates on allies like the EU and Japan caught analysts off guard. Canada and Mexico dodged new reciprocal tariffs, which were milder than feared after prior 25% threats.

Long-term tariff benefits

- U.S. Industry Boost: Tariffs could incentivize domestic production, especially in autos and steel, potentially creating jobs.

- Revenue Potential: Tariffs could raise hundreds of billions annually, offsetting tax cuts.

- National Security: Reducing reliance on foreign supply chains (e.g., electronics, antibiotics) might strengthen resilience.

Short-term tariff challenges and risks

- Higher Prices: Economists widely agree U.S. consumers will face increased costs for goods like cars, electronics, and everyday imports.

- Trade War Risk: Allies (EU, Canada) and rivals (China) are already planning retaliation, which could hurt U.S. exporters like farmers and tech firms.

- Economic Drag: Estimates suggest a 1-1.7% GDP hit if retaliation escalates, with risks of stagflation (high inflation, low growth).

Future Impacts and Developments

- Retaliation: The EU is eyeing tariffs on U.S. goods (e.g., bourbon, tech revenue), while China may hit back with export curbs. Canada and Mexico might escalate if USMCA (United States-Mexico-Canada Agreement) talks sour.

- Negotiation Phase: President Trump has hinted at deal-making to lower tariffs, so rates could soften if countries concede on trade terms.

- Market Volatility: Stocks dipped post-announcement, and further swings are possible as impacts unfold.

- Policy Tweaks: Details on exemptions (e.g., pharmaceuticals, semiconductors) are pending, and Congress or courts could challenge Trump’s emergency powers.

During periods of instability, such as the one we are currently experiencing, it is essential to maintain a long-term perspective and understand how markets behave in challenging times.

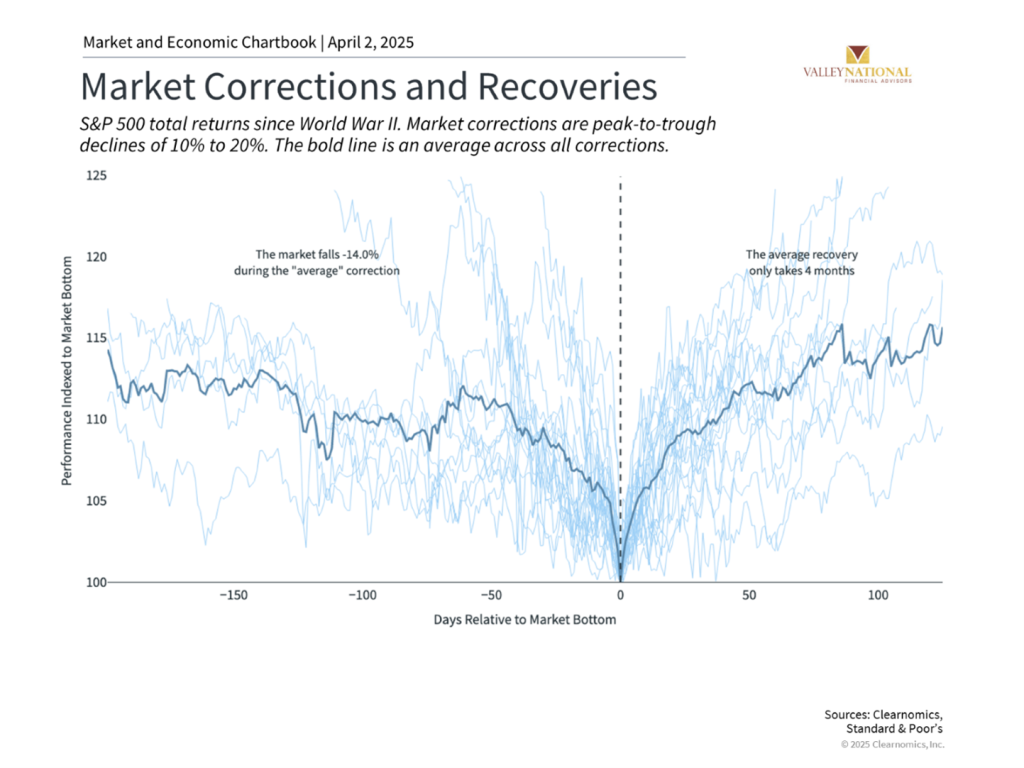

Market cycles, much like natural cycles, include both periods of growth and decline. While market corrections can feel unsettling and endless, history demonstrates that these periods typically resolve themselves as uncertainty clears. Though current trade policy concerns present unique challenges, experience suggests that markets tend to stabilize once clarity emerges.

Historical data shows market corrections are common, and recoveries often surprise investors.

Currently, the S&P 500 is approaching correction territory, which occurs when markets decline 10% from their previous high, while the Nasdaq has been in correction for approximately one month.

Recent weeks have witnessed significant market volatility, with major indices frequently experiencing daily swings of one to two percentage points.

A common market observation notes that prices tend to rise gradually but fall quickly – similar to taking stairs up and an elevator down. This pattern reflects how bull markets typically develop slowly through steady gains, while corrections often occur rapidly in response to sudden negative events, as we have seen this year. However, it is worth noting that even after corrections, market levels tend to remain above previous cycle peaks, suggesting a pattern of higher highs over time.

This context is particularly relevant today, as the current S&P 500 correction is measured against February’s record high. From a broader perspective, the market has only retreated to levels seen last September, highlighting the importance of maintaining a longer-term view.

The chart above illustrates that market corrections are regular occurrences, with an average decline of 14.3% since World War II. Despite these periodic setbacks, markets have historically recovered within months, often when sentiment is most negative. Recent examples include the recoveries following the pandemic in 2020, the technology-driven bear market in 2022, the banking sector stress in 2023, and numerous other instances.

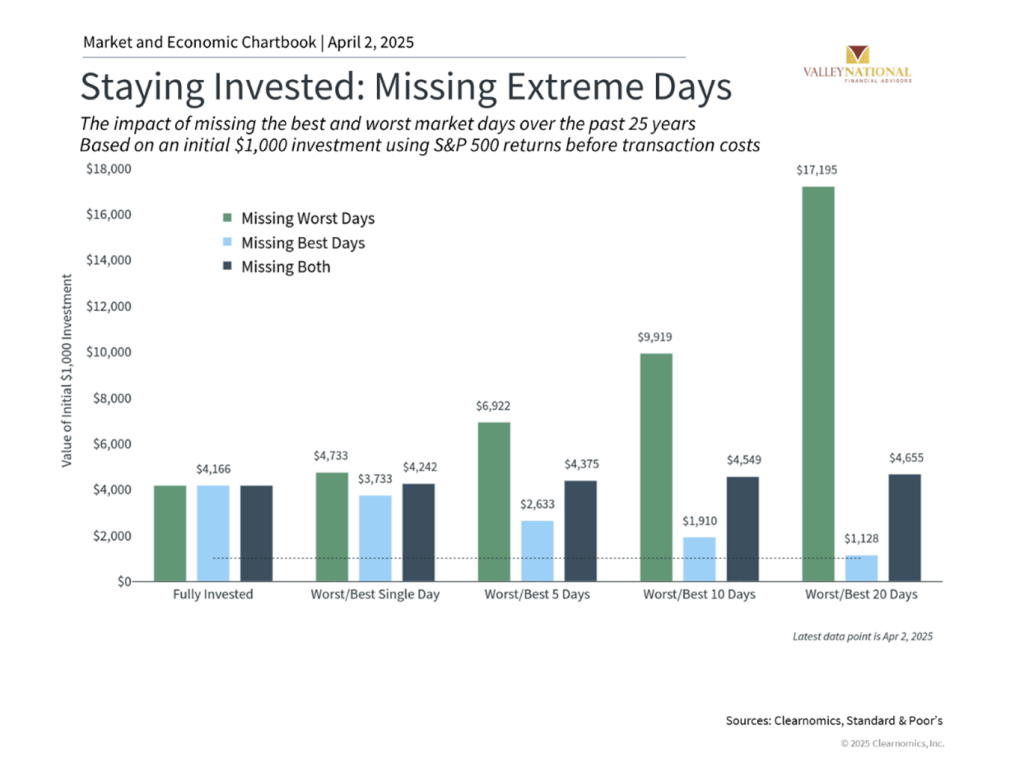

Market timing strategies often lead to suboptimal results

The volatile nature of market cycles sometimes tempts investors to attempt market timing, seeking to avoid downturns. However, this strategy frequently proves counterproductive, as investors often miss the initial stages of recovery. Similarly, waiting for obvious signs of market improvement can significantly impact long-term returns. The accompanying chart demonstrates how missing both the best and worst market days over the past 25 years affects overall returns.

While avoiding market downturn days may seem appealing, accurately predicting market movements is extremely challenging. Even with perfect timing – an unrealistic assumption – the benefits compared to staying invested are minimal. Since investors typically react to events after they occur, maintaining a long-term investment approach often proves more effective than attempting to time market movements.

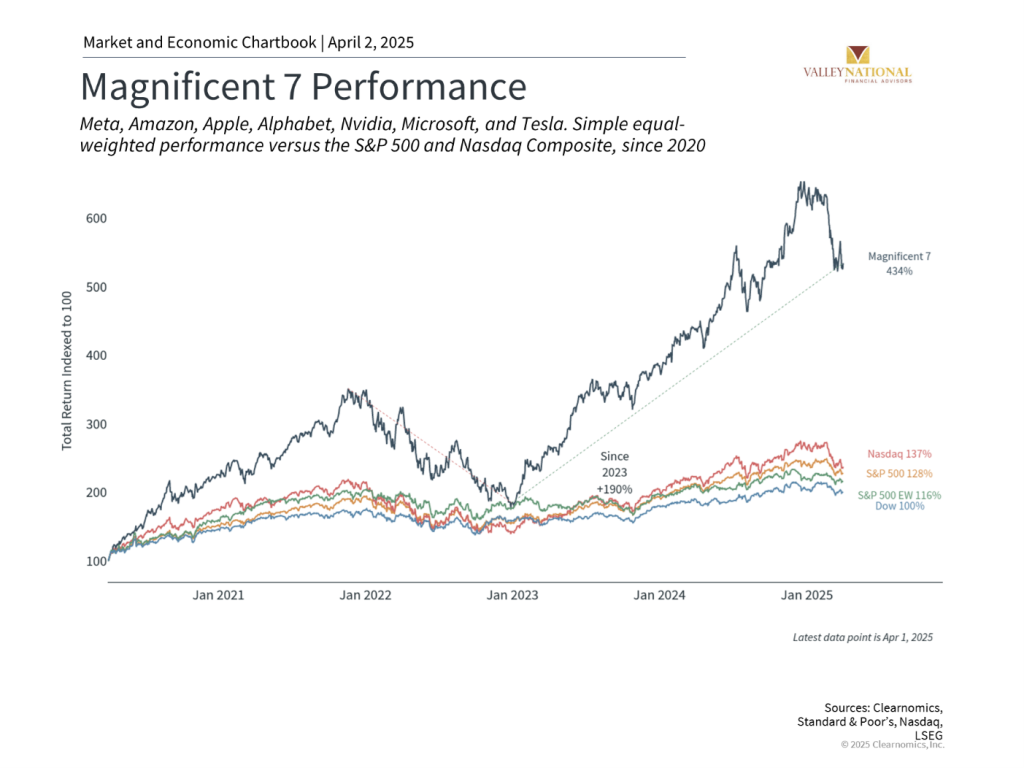

Trade policy uncertainty and technology sector impact

Markets continue to assess the various potential outcomes of the administration’s tariff policies, which are often employed as negotiating tools on broader issues including immigration. Consumer sentiment and inflation expectations have already been affected by concerns over higher prices. More extensive implementation of tariffs, including potential retaliation from trading partners, could impact global economic growth over time.

The full economic implications of trade policies typically become clear over extended periods. It requires multiple quarters to understand how businesses adapt their supply chains, whether increased costs affect consumer prices, and how international trading partners respond.

As shown in the accompanying chart, technology stocks, which previously led market gains, have experienced the sharpest declines recently. These movements should be viewed within the broader context of the market cycle, particularly noting the substantial gains achieved by Magnificent seven stocks during this period. These significant fluctuations exemplify why certain stocks and sectors are more volatile than others.

Meanwhile, several other sectors have demonstrated resilience, including Energy, Healthcare, Utilities, and Financials. Despite recent market turbulence, eight of eleven S&P 500 sectors remain positive over the past year. This highlights the value of diversification across market sectors and maintaining balanced portfolios aligned with long-term financial objectives.

The bottom line? While tariff-related concerns have increased market volatility and pressured equity markets, historical evidence suggests that maintaining a long-term investment focus remains the most effective approach to achieving financial objectives.

1

S&P 500 declined 9.2% between February 19, 2025, and March 28, 2025. The Nasdaq fell 14.1%, between December 16, 2024, and March 28, 2025

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange-traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.