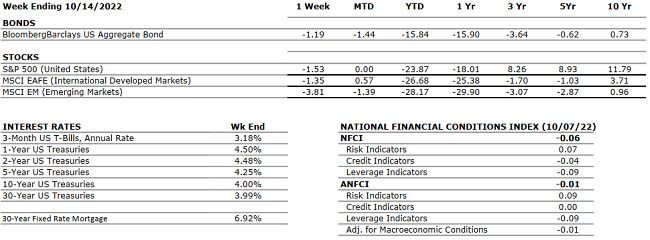

THE NUMBERS The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Q1 2022 Real GDP shrunk at a 1.6% annual rate. The main factors that resulted in a decrease in GDP were a surge in imports and trade deficit highlighting that the U.S. is buying more goods from foreign countries. According to the second estimate, real GDP for Q2 2022 decreased at an annual rate of 0.6% (up from the first estimate of -0.9%) marking the second consecutive quarter of declining GDP. Some retail outlets are reporting excess inventories which could signify a slowdown in consumer demand. |

|

CORPORATE EARNINGS |

NEUTRAL |

The estimated growth rate for Q3 2022 is 1.6%, which was adjusted downward from 9.8% in June and 2.4% last week. So far, with 7% of S&P500 companies reporting actual results, 69% of them reported a positive EPS surprise and 67% beat revenue expectations. |

|

EMPLOYMENT |

NEUTRAL |

U.S. Nonfarm Payrolls for September 2022 increased by 263,000 and the unemployment rate fell back to the June and July level of 3.5% after spiking slightly in August to 3.7%. Professional and business services, health care, and leisure and hospitality were among the sectors with the most notable job gains. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the U.S. increased by 8.2% for September 2022 — down slightly from 8.3% in August but still a stubbornly high result and above expectations. Core CPI increased by 6.6% year-over-year marking the highest gain since August 1982. Food and shelter were the main contributors to the increase in CPI, gasoline index fell slightly but overall energy prices are expected to rebound again. Used car prices are also not declining as much as expected. |

|

FISCAL POLICY |

NEUTRAL |

Senator Manchin and Majority Leader Schumer reached an agreement on the latest tax and energy bill with incentives for green energy, electric cars, and conversely oil & gas companies for exploration. No changes in private equity taxes or higher tax rates for the very wealthy were enacted. The bill has been officially passed by the Senate. Last week, President Biden announced student loan forgiveness of up to $20,000 subject to income limitations. |

|

MONETARY POLICY |

NEGATIVE |

With inflation still running hot, Fed Chairman Jay Powell is clear on his path to slow the economy enough to cool inflation. The Fed raised rates by 0.75% in September, bringing its target rate to 3.00-3.25%, and suggesting that additional 75bps rate hikes are likely in the coming months. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Russia held controversial referendums for the annexation of four Ukrainian regions and the Russian Parliament unanimously recognized these regions as part of Russia. Ukraine and Western countries have condemned these actions by Russia by declaring them illegitimate and illegal. Additional sanctions are being imposed on Russia by many countries. |

|

ECONOMIC RISKS |

NEGATIVE |

COVID-19 lockdowns in China are persistent and the ongoing Russian-Ukraine war is causing a major energy crisis in Europe. Putin shut down the pipeline that supplies Europe with natural gas indefinitely until all sanctions affecting Russia are lifted. Gas supplies from Russia to Europe have decreased by 88% over the past year and EU countries have agreed to cut gas usage by 15% as gas prices have more than doubled. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.