Last week, the Dow Jones Industrial Average rose by 1.6%, outperforming gains of 0.2% for the NASDAQ and 0.9% for the S&P 500. One of the standout events from last week was the Russell 2000 Index, a small company-focused stock index surging by 6.00%, marking its strongest performance since November. Trading volumes remained subdued, attributed to the summer lull and anticipation surrounding key earnings reports. The kickoff of earnings season saw mixed results from major banks like JPMorgan Chase and Wells Fargo, with some missing estimates and adjusting outlooks, setting a cautious tone despite overall expectations for robust S&P 500 earnings growth of 9.3% in the second quarter. Following a lower-than-anticipated inflation report on Thursday, the 10-year Treasury yield fell ten basis points to end the week at 4.18%.

U.S. & Global Economy

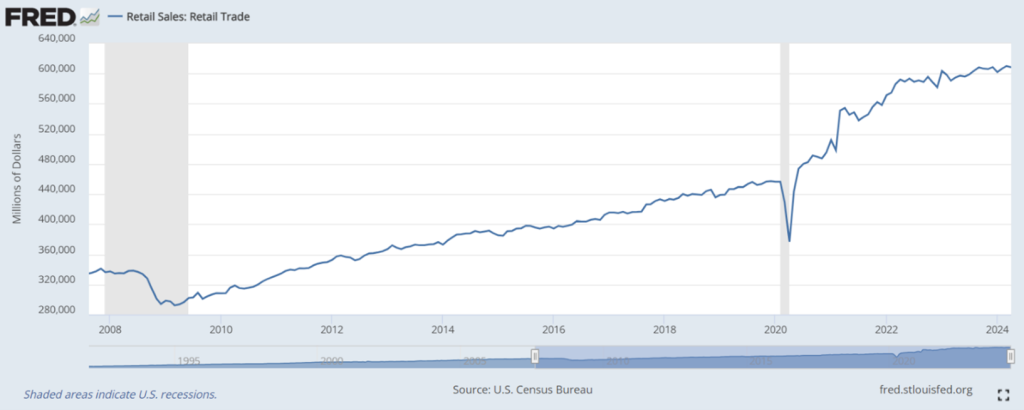

A surprise drop in the Consumer Price Index for June sparked speculation about potential future interest rate cuts. Annual inflation eased to 3.0% from 3.3% the previous month, contrasting with a larger-than-expected increase in wholesale prices reported on Friday. Meanwhile, the University of Michigan’s Consumer Sentiment Index declined, hitting its lowest point in eight months despite improved consumer inflation expectations. Looking ahead, analysts are eagerly awaiting Tuesday’s retail sales data to assess whether recent sluggishness persisted into June, following modest gains in May after declines in April. See Chart 1 below from the St. Louis Fed, which shows the recent trend in Retail Sales.

Policy and Politics

The recent shooting incident targeting Donald Trump at a rally in Pennsylvania has left the former president injured in an assassination attempt. According to numerous political experts, this event can swing the presidential election firmly to the Republicans. The incident could significantly impact the electoral landscape as the campaign progresses.

Political analysts anticipate a shift towards a more aggressive trade policy, reduced regulation, and relaxed climate change regulations under the Trump administration. They also anticipate extending corporate and personal tax cuts set to expire next year, raising concerns about potential budget deficit increases during Trump’s tenure.

Economic Numbers to Watch This Week

- U.S. Empire State manufacturing survey, for July 2024, prior –6.0

- U.S. Retail Sales for June 2024, prior 0.1%

- U.S. Home builder confidence index for July 2024, prior 43

- U.S. Housing starts for June 2024, prior 1.28 million.

- U.S. Building permits June 2024, prior 1.39 million.

- U.S. Weekly jobless claims for the week of July 13th, 2024, prior 222,000

- U.S. Philadelphia Fed manufacturing survey for July 2024, prior 1.3

- U.S. U.S. leading economic indicators for June 2024 prior –0.5%

All eyes this week will be focused on corporate earnings reports for Q2. Beyond the financial metrics reported, investors will listen closely to the insights management teams share about current activity and trends in their end markets. Goldman Sachs, BlackRock, United Health, Bank of America, Johnson & Johnson, and Taiwan Semiconductor are just a small sample of reports that will be released this week. Thus far in 2024, we have seen strong economic growth across all sectors, which has comfortably propelled all major stock market indexes higher. Long-term investors with sound financial plans have thus far been rewarded for their steadfastness. We will remain vigilant, distinguishing between short-term fluctuations and enduring secular trends propelling companies through favorable and challenging periods. Please contact your advisor at Valley National Financial Advisors with any questions.