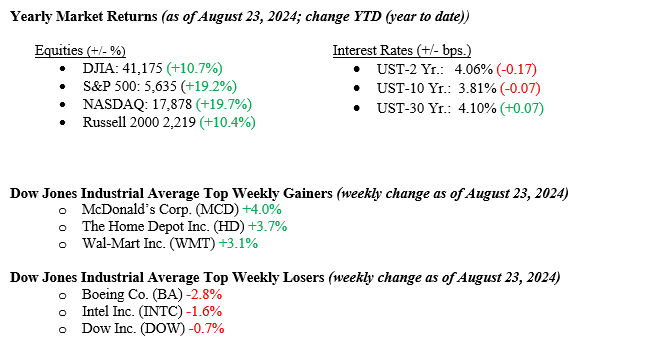

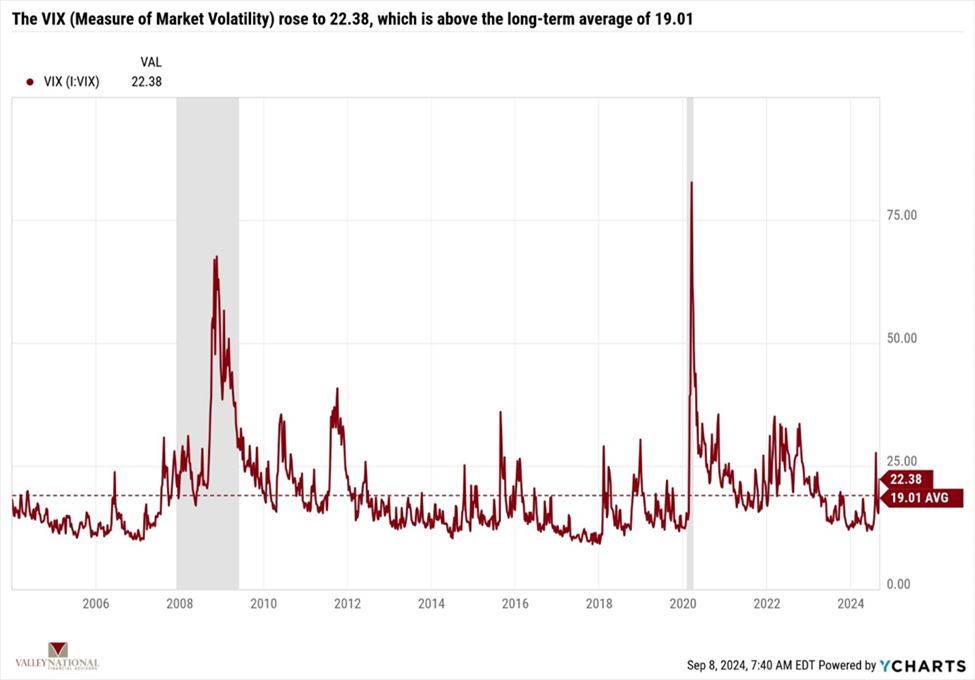

Last week, U.S. stock indexes fell across the board. Each primary index posted significant weekly losses due to a mixed jobs report, concerns about actual profit gains from artificial intelligence, and continued global turmoil. The Dow Jones Industrial Average fell by 2.4%, the S&P 500 Index dropped by 3.3%, and the technology-larded NASDAQ dropped by 4.7%. Volatility surged for the week, with the CBOE Volatility Index rising about 49% to 22.38, above its long-term average of 19.01. See chart one below from Valley National Financial Advisors and Y Charts. Due to worries about demand, oil prices fell 8% to their lowest in about 14 months. In response to the sell-off in equities, investors flocked to the safety of U.S. Treasury bonds, and as a result, the 10-year U.S. Treasury bond yield fell 19 basis points, closing Friday at 3.72%.

U.S. & Global Economy

Last week’s economic updates showed a mixed picture. The August nonfarm payrolls report revealed that the U.S. added only 142,000 jobs, below the expected 165,000, with previous months’ job numbers revised by 86,000. The unemployment rate fell slightly to 4.2%, still higher than April’s 3.4%. Average hourly earnings rose by 0.4% to $35.21. Job openings continued to decline in July, according to JOLTS. The ISM Manufacturing PMI dropped to 47.2, marking five months of contraction, while the ISM Services PMI inched up to 51.5%, indicating growth in the services sector. The Business Activity Index within the Services report fell to 53.3%, but the New Orders Index improved to 53%. The economy is cooling in some areas while the services sector shows continued growth.

Also noteworthy from last week was JPMorgan’s downgrade of its outlook on Chinese stocks from overweight to neutral. The bank cited concerns about increased volatility from the upcoming U.S. elections, potential trade tensions, and ongoing economic challenges in China. JPMorgan warned that a trade war between the U.S. and China and underwhelming economic stimulus efforts by President Xi Jinping’s government could negatively impact Chinese shares.

Policy and Politics

A recent hot topic in the presidential race has been Vice President Kamala Harris’s proposed changes to capital gains taxation. She suggests increasing the top capital gains tax rate from 20% to 28% for households earning over $1 million annually. She also proposes raising the Net Investment Income Tax from 3.8% to 5%. Additionally, Harris advocates for increasing the tax on stock buybacks from 1% to 4% and introducing a “Billionaire Minimum Tax” of 25% on households with over $100 million in wealth, including taxing unrealized capital gains. These changes could generate $750 billion to $900 billion in revenue over the next decade. These measures might discourage some investments and affect market behavior, particularly among the wealthy and corporations. However, these proposals could face intense legal challenges and would require congressional approval to be implemented.

Lastly, this week, Vice President Kamala Harris and former President Donald Trump are set to face off in their highly anticipated debate on Tuesday night at the National Constitution Center in Philadelphia. Given that this debate is scheduled early in the election cycle and may be the only debate, it may be a deciding element for many undecided voters.

Economic Numbers to Watch This Week

- U.S. Consumer Price Index YoY for August 2024, prior 2.89%

- U.S. Core Consumer Price Index YoY for August 2024, prior 3.21%

- U.S. Inflation Rate for August 2024, prior 2.89%

- U.S. Producer Price Index YoY for August 2024, prior 2.25%

- U.S. Core Producer Price Index YoY for August 2024, prior 2.42%

- U.S. Index of Consumer Sentiment for September 2024, prior 67.90

Despite recent market volatility, there are positive aspects to consider: Inflation is easing, economic growth remains stable, and sectors like utilities have posted strong earnings alongside technology, highlighting strength and opportunities in various sectors. Falling bond yields suggest potential rate cuts by the Fed, which could support future investment returns significantly as the economy cools slowly to a more normal growth rate. For average investors, staying focused on long-term goals and maintaining a diversified portfolio can help manage risk and offer opportunities to take advantage of broader market trends. Please contact your advisor at Valley National Financial Advisors with any questions.