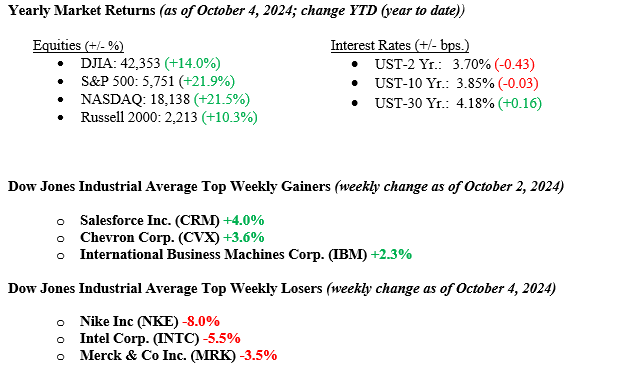

Last week, U.S. stock markets demonstrated resilience, finishing with modest gains despite earlier volatility. The S&P 500 climbed 0.2% to close at 5,751, the Dow Jones Industrial Average increased 0.1% to 42,353, and the Nasdaq Composite rose 0.1% to 18,138. Energy was the best-performing sector (+5.9%), while Consumer Discretionary was the worst-performing sector (-2.8%). Early in the week, markets grappled with uncertainty from concerns about the U.S. labor market, East Coast port strikes, tensions in the Middle East, and the upcoming presidential election. However, a robust jobs report on Friday and a tentative resolution to the East Coast port strike helped ease some concerns. In the bond market, the 10-year Treasury yield increased by 23 basis points over the week, finishing at 3.98%. This rise in yields reflected investors adjusting their expectations for future Federal Reserve rate cuts, with projections now indicating fewer cuts by the end of the year than previously thought.

U.S. & Global Economy

While it was a relatively calm week as far as economic data releases are concerned, Friday’s employment report was a blockbuster. The U.S. economy created a whopping 254,000 new jobs in September, beating economists’ estimates of 140,000. Job creation numbers for July and August were also revised higher, and the U.S. Unemployment Rate dropped to 4.1% from 4.2%. These numbers were all bullish for investors in equities but led to a sell-off in fixed-income markets as market forecasters cut back expectations for aggressive rate cuts by the Fed.

Global markets continue to see several pockets of unrest with the Israeli/Hamas War erupting into Lebanon and the Iranian-backed Hezbollah Terrorist Organization. Oil markets reacted by sending the price of a barrel of WTI Crude oil 9% higher to $75. Last week, we noted that oil was not moving higher due to events in the Middle East, and just one week later, all that changed as the war escalated well beyond Israel/Hamas. Thus far, oil producers like Saudi Arabia have ramped up production, and oil remains below $85/bbl, which we saw earlier this summer.

Policy and Politics

Global conflicts are not decreasing and, conversely, are growing beyond the small regional events. We worry that Israel/Iran will be the next stage for war. While still local to the Middle East, these events have a way of boiling over and dragging in the U.S. beyond any original intentions.

The U.S. Presidential Election is just one month away (11/5/24), and both candidates are speeding to the finish line, and the race is still too close to call. It will come down to the five swing states (AZ, GA, MI, PA & WI), and voter turnout will be critical. We believe the outcome of Congress is much more important as any significant law change will require both the U.S. House and the U.S. Senate.

Economic Numbers to Watch This Week

- U.S. Consumer Price Index YoY for September, prior rate 2.53%

- U.S. Core Consumer Price Index YoY for September, prior rate 3.27%

- U.S. Initial Claims for Unemployment Ins. for the week of October 5, 2024, prior level 225,000

- U.S. 30-year Mortgage Rate for the week of October 10, 2024, prior rate 6.12%

- U.S. Producer Price Index for September YoY, prior rate 1.73%

- U.S. Core Producer Price Index for September YoY, prior rate 2.44%

- U.S. Index of Consumer Sentiment for October, prior rate 70.10

In the coming week, investors will look for further signs of the cooling inflation trend, with the Consumer Price Index update on Thursday and the Producer Price Index on Friday. Given the Fed’s easing of interest rates, expectations of moderating inflation, and strong earnings growth, we believe the fundamentals of the bull market remain solid, supporting both equity and bond markets. The near-term recession risk appears low, as robust consumer spending is likely to sustain steady economic growth through 2025. However, it’s worth noting that the S&P 500 is currently trading at a high price-to-earnings ratio of nearly 22, which may dampen investor enthusiasm, though solid earnings growth could help improve valuations in the future. If you have any questions, please contact your advisor at Valley National Financial Advisors.