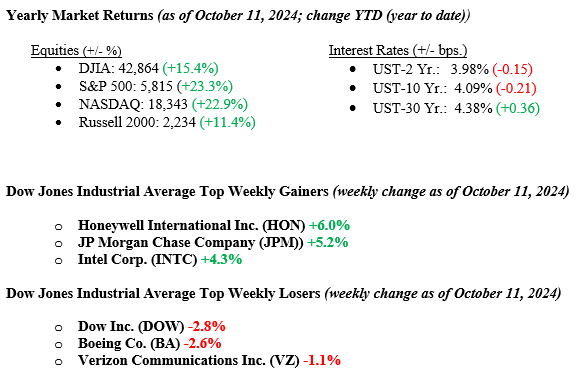

Last week, markets continued their upward trend, with the Dow Jones, S&P 500, and NASDAQ all rising by more than 1%. A key driver of this momentum was the strong start to earnings season, highlighted by robust JP Morgan and Wells Fargo results. JPMorgan’s management team noted on its earnings conference call that consumers are “fine and on strong footing,” The Information Technology sector led the way last week, gaining 3.6%. At the same time, Utilities lagged, declining by 3.6%. We are encouraged by the ongoing broadening of market leadership, with cyclical stocks outperforming technology in recent weeks. In the bond market, the 10-year Treasury yield rose by 11 basis points, closing at 4.09%. We believe the underlying strength of the U.S. economy can withstand the recent move to higher U.S. yields. Additionally, the higher yields offered by money market funds and bonds continue to benefit investors.

U.S. & Global Economy

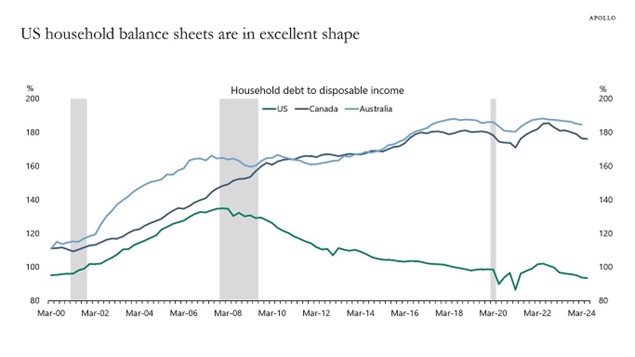

The U.S. Economy continues to hum along nicely, and the American consumer is in healthy shape by historical standards. A straightforward health measure is the U.S. Household Balance; see Chart 1 below from Apollo. Household debt to disposable income is lower than during the Financial Crisis of 2008-09. It has been falling for several years as the stock market rally and substantial gains in home prices have propped up household net worth.

Policy and Politics

The current geopolitical landscape is marked by significant uncertainty, particularly regarding the potential Israeli response to escalating tensions with Iran and Hezbollah, which has driven oil prices up over 10%. Concurrently, the Russia-Ukraine war persists on multiple fronts, with both sides making incremental gains and losses. The international community remains engaged, supporting, and pursuing diplomatic efforts to address the ongoing conflict.

Economic Numbers to Watch This Week

- U.S. Initial Claims for Unemployment Insurance for the week of October 12, prior 258,000

- U.S. Industrial Production MoM for September 2024, prior 0.81%

- U.S. Retail & Food Service Sales MoM for September 2024, prior 0.05%

- 30-year Mortgage Rate for the week of October 17, prior 6.32%

- U.S. Housing Starts for September 2024, prior 1.356M

Looking ahead to the coming week, our focus will remain on corporate earnings reports, particularly the insights and forward financial guidance management teams share. Economic data releases this week are relatively sparse, with only retail sales and jobless claims standing out. We anticipate that recent weather-related disruptions could muddy near-term employment and inflation data, adding complexity to the economic landscape, especially as we enter the final weeks of the presidential race, a period often marked by increased volatility. Nevertheless, recent updates from corporate leaders and Federal Reserve officials paint a picture of a healthy U.S. economy that continues to grow. If you have any questions or need further insights, please don’t hesitate to contact your advisor at Valley National Financial Advisors; we are here to help you navigate these developments.