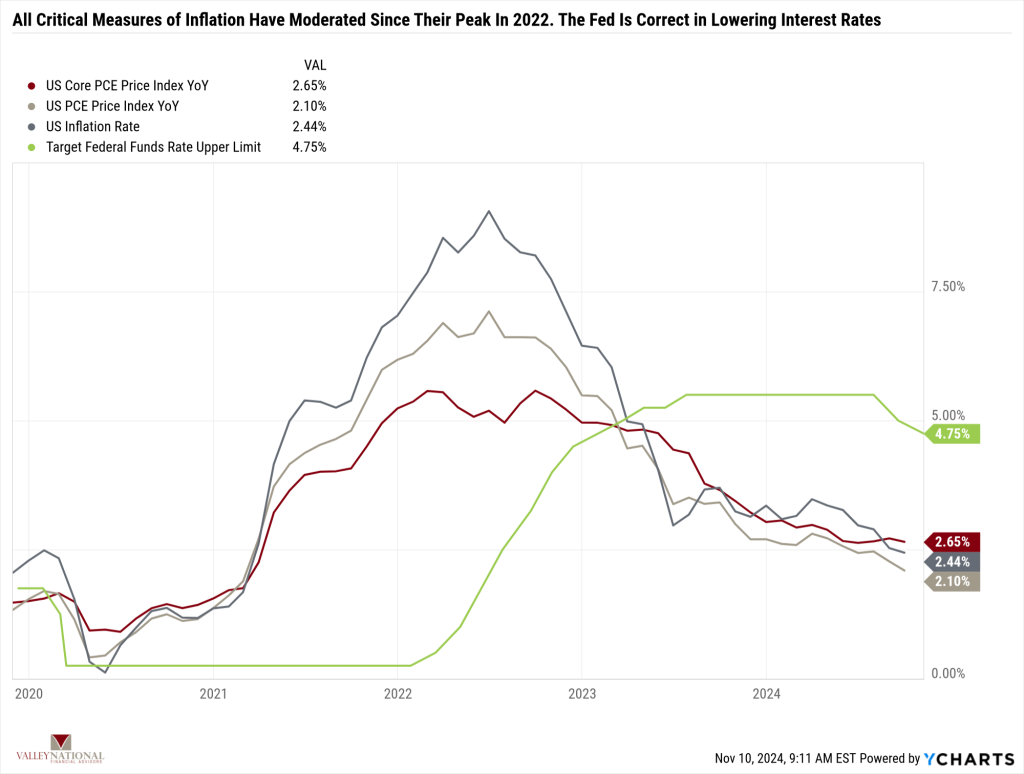

Last week, with the confirmed election of Donald J. Trump, the stock market recorded record highs across all major indexes. The Dow Jones Industrial Average increased by +4.6%, the S&P 500 Index jumped +4.7%, and the NASDAQ rallied +5.7%. Further, the FOMC met last week and lowered interest rates by 25 basis points, adding further stimulus to small capitalization stocks that rely on borrowing. As a result, the Russell 2000 Index of Small Capitalization stocks moved higher by +8.7%. Treasury yields moved modestly lower on the week, with the yield on the 10-year note ending at 4.31%. While inflation indicators for food and services remain elevated, the Fed’s preferred measure of inflation, the U.S. PCE Price Index, moved lower to 2.1% for September from 2.3% in August.

U.S. & Global Economy

The FOMC wrapped up their two-day meeting on Thursday and gave the markets exactly what they expected – a 25 basis point rate cut. Based on current estimates, we expect the FED to continue to lower interest rates until they get to a more normalized rate, which sits somewhere between 3.50% and 4.50%. Additional rate cuts will remain a predictable tailwind to markets, especially small capitalization stocks, which more heavily rely on borrowing than cash-rich large capitalization stocks.

As mentioned above, last week’s release of the U.S PCE Index and U.S. Core PCE Index showed declines since last month and year-over-year, which is further proof that inflation continues to moderate and normalize. See Chart 1 below from Valley National Financial Advisors and Y Charts showing the U.S. PCE Index and U.S. Inflation rate.

Policy and Politics

The results of last week’s U.S. Presidential Election are in the history books at this point, and Former President Donald Trump, now President-Elect, scored a major victory and potentially the greatest political comeback of anyone since Grover Cleveland in 1884, who won a second term as U.S. President having been previously defeated. President Trump not only won the White House, but the U.S. Senate will be majority Republican in 2025 and the U.S. House, although that race is still too close to call as we went to press this week. We expect President Trump to view his victory as a clear mandate by the people. He will govern as such with fewer regulations, an opening of our energy industries, and tariffs on foreign countries that do not play by the same rules as the U.S. does. There is still a lot to unpack in this victory, but it seems clear to us what the direction of the next administration will be.

Economic Numbers to Watch This Week

- U.S. NFIB (small business) optimism index for October, prior level 91.5

- U.S. Inflation Rate (CPI) for October 2024 YoY, prior rate 2.44%

- U.S. Core Consumer Price Index for October 2024 YoY, prior rate 3.26%

- U.S. Producer Price Index for October 2024 YoY, prior rate 1.76%

- U.S. Core Producer Price Index for October 2024 YoY, prior rate 2.81%

- 30-year U.S. Mortgage Rate for the week of November 14, 2024, prior rate 6.79%

- U.S. Initial Claim for Unemployment for the week of November 9, 2024, prior level 221,000

- U.S. Index of Consumer Sentiment for November 2024, prior level 70.5

- U.S. retail sales for October 2024, prior rate +0.4%

Next week will be busy with economic data and corporate earnings reports that could impact market sentiment. Retail sales are expected to rise 0.4% month-over-month, while the Consumer Price Index (CPI) will provide insights into inflation trends that may influence Federal Reserve policy. Additional data on the Producer Price Index (PPI), industrial production, and housing starts will offer a broader view of economic health. Major companies, including Home Depot, Cisco Systems, and Applied Materials, will report earnings, providing a snapshot of consumer spending and technology sector performance. Attention will also remain on President-elect Trump’s economic policies, with analysts debating the long-term effects of his proposed tariffs, tax cuts, and immigration reforms. These policies could impact key factors such as economic growth, inflation, and the federal deficit. If you have any questions or need further insights, please get in touch with your advisor at Valley National Financial Advisors.