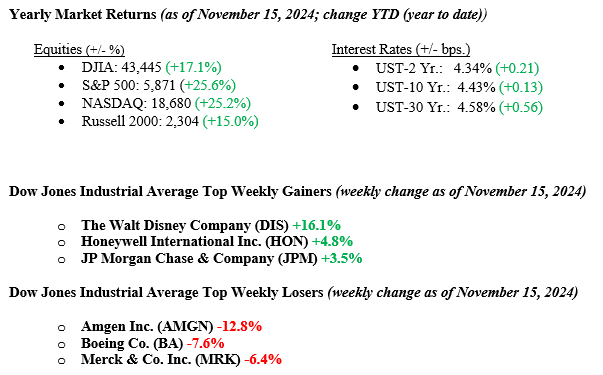

Equity markets reported negative returns across all major indexes as some Trump election euphoria wore off. Fed Chairman Jay Powell hinted that further rate cuts could be pushed off due to continued economic strength and sticky inflation indicators. Specifically, health and bio-tech sectors sold off as the several cabinet-level appointments by President-elect Trump shook the markets due to potential regulatory changes in those industries. Meanwhile, technology services and retail showed relative strength due to continued economic growth. Treasury yields moved higher based on Powell’s comments. The yield on the 10-year note ended the week at 4.43%, 12 basis points higher than the previous week.

U.S. & Global Economy

Treasury yields saw continued upward pressure last week, driven partly by shifting expectations around the Federal Reserve’s rate-cutting cycle. Jerome Powell indicated on Thursday that the Fed is in no rush to reduce interest rates, suggesting policymakers may even skip a meeting before making any rate cuts. This dovetails with last week’s economic data, which provided insights into consumer spending, small business sentiment, and inflationary trends. The U.S. retail sales report for October showed a 0.4% month-over-month increase, surpassing expectations, with notable gains in auto sales (1.6%), electronics and appliances (2.3%), and restaurant spending (0.7%). This suggests continued consumer resilience, albeit slower than September’s 0.8% rise. The NFIB Small Business Optimism Index also rose 2.2 points to 93.7, its highest level in three months, although still below its 50-year average.

Meanwhile, inflation data revealed that producer prices increased by 0.2% month-over-month in October, slightly above September’s 0.1% rise, with the annual increase accelerating to 2.4% from 1.87%. The Consumer Price Index (CPI) for October rose 2.6% year-over-year, with core CPI holding steady at 3.3%. Together, these data points suggest an economy marked by resilient consumer spending, cautious business sentiment, and manageable inflationary pressures, all of which are likely to influence future Federal Reserve policy decisions and the broader economic outlook.

Policy and Politics

President-elect Trump has indicated several key policy areas he plans to focus on early in his second term:

- Immigration & Border Security: Trump aims to prioritize border control and mass deportations, with Tom Homan overseeing the process.

- Energy Policy: He plans to boost U.S. fossil fuel production, including opening the Arctic for oil drilling.

- Tariffs & Trade: Trump proposes imposing a 10% tariff on imports, particularly from China, with higher rates for specific countries.

- Regulatory Rollbacks: He intends to reverse Biden-era policies on environmental, education, and gender identity issues.

- Abortion Restrictions: The administration is expected to reinstate policies limiting federal funding for abortion providers.

- Executive Orders: Trump will likely issue multiple executive orders to enact priority policies and reverse Biden’s late-term actions.

- China Policy: He plans to address trade, military, and technology issues with China, potentially ending its Most Favored Nation status.

- Ukraine Policy: Trump may significantly reduce or halt U.S. military and financial aid to Ukraine in its conflict with Russia.

Economic Numbers to Watch This Week

- U.S. Home builder confidence index for November 2024, prior level 43

- U.S. Building permits for October 2024, prior level 1.43 million

- U.S. Housing starts for October 2024, prior level 1.35 million.

- U.S. Existing home sales for October 2024, prior level 3.84 million

- U.S. Claims for Unemployment Insurance for Week of November 16, 2024, prior level 217,000

- U.S. Leading Economic Index for October 2024, prior level -0.5%

- U.S. Index of Consumer Sentiment for November 2024, prior level 73.00

For the week ahead, investors will focus on earnings reports from Walmart and Nvidia. Additionally, several key economic data points related to the housing market will be released, offering further insights into consumer behavior and the broader economic outlook. As we move into the seasonally stronger months of November and December, markets often experience positive momentum, particularly in election years. However, some gains may already be priced in after a strong year and a notable post-election rally. Still, business fundamentals appear solid, with economic growth remaining above trend. While growth may moderate next year, we don’t foresee a recession. Inflation remains largely contained, and although there may be fluctuations, a return to the high rates of 2022 seems unlikely. Policy uncertainty may cause occasional volatility, but pro-growth policies should help support the market unless there are significant disruptions. If you have any questions or need further insights, please get in touch with your advisor at Valley National Financial Advisors.