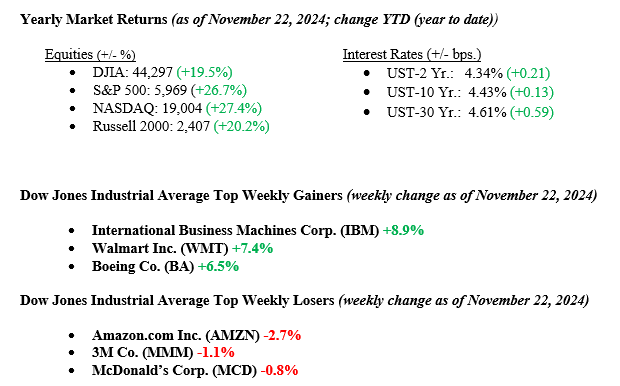

Equity markets rebounded nicely last week as good news outpaced bad news, and investors once again moved money into the markets. Each of the three major market indexes reported gains last week of just under 2.00%, while the Russell 2000 Index Small Cap (R2K) stocks rose +4.5%, putting the year-to-date return on the RTK at +20.2%, a stunning rebound for a sector many investors had counted out for the year. Most of the surge in the R2K has happened after the election, as investors believe a regulator-friendly administration will help small companies in the coming years. Additional news driving stock prices higher included EPS releases for the 3rd quarter of 2024. According to FactSet, with 75% of S&P 500 Index companies reporting earnings for the 3rd quarter, the average EPS increase has been +5.8%, marking the fifth consecutive quarter of year-over-year earnings growth. The yield on the 10-year note ended the week unchanged at 4.43%.

U.S. & Global Economy

The U.S. economy is on pace to achieve 2.8-3.0% GDP growth in 2024, providing strong support for the country’s competitive position in the global market. Consumers have been at the center of the economic surge as spending continues to be resilient despite more significant global concerns like wars and skirmishes. Last week, November’s University of Michigan Consumer Sentiment Index rose to 71.8 from 70.5 in October, showing increasing consumer confidence across the U.S.

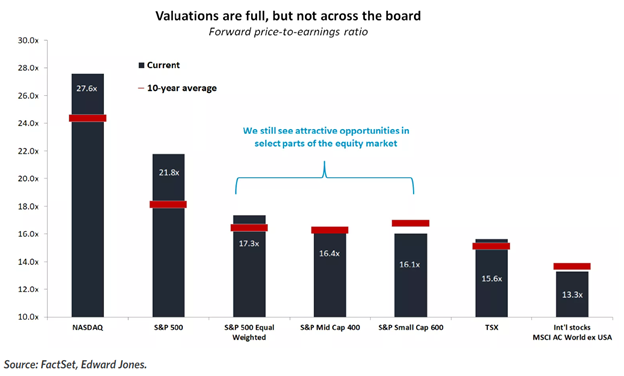

As mentioned above, equity markets had an excellent rebound last week, and year-to-date returns for all major indexes are well into double digits. The question for investors is, “Are valuations too high?” Indeed, some sectors are reaching peak valuations compared to 10-year levels, such as the tech-heavy NASDAQ. See Chart 1 below from FactSet and Edward Jones, which shows valuations across market sectors. Notice the persistence of attractive opportunities in Small and Mid-Cap Sectors and even international equities, which thus far in 2024 have performed poorly compared to the NASDAQ or S&P 500 Index.

Policy and Politics

Geopolitics will remain one of the market’s most significant risks in 2025, with escalating tensions, trade disruptions, and political instability continuing to shape the global landscape. Risks are rising in many countries, driven by frequent conflicts, government challenges, and trade restrictions. The return of Donald Trump to the U.S. presidency could lead to higher tariffs and fewer regulations, complicating global trade. Ongoing conflicts in Ukraine and the Middle East may escalate, spreading further instability. North Korea’s involvement in the Russia-Ukraine conflict and Putin’s move to lower the nuclear weapons threshold heighten global tensions. Civil unrest is also increasing, fueled by political divisions. Companies must navigate these challenges, especially in emerging markets with growing political risks. Geopolitics, trade, and conflict will remain key drivers of the global landscape in 2025.

Economic Numbers to Watch This Week

- U.S. PCE Price Index YoY for October 2024, prior 2.10%

- U.S. Core PCE Price Index YoY for October 2024, prior 2.65%

- U.S. Real GDP for 3rd Quarter 2024, prior 2.80%

- U.S. Initial Claims for Unemployment Insurance for the week of Nov 23, 2024, prior 213,000

- U.S. Durable Goods Orders MoM for October 2024, prior -0.78%

Despite the holiday-shortened trading week, key earnings reports are scheduled for release from technology companies CrowdStrike and Dell, along with consumer firms Best Buy and Dick’s Sporting Goods. Inflation and its impact on future monetary policy will be in focus with the release of the personal consumption expenditures (PCE) inflation data on Wednesday. Headline PCE is expected to rise by 2.3% year-over-year, up from 2.1% last month, and core PCE is projected to tick up to 2.8%. CPI data earlier this month suggested the path to the Fed’s 2% target could be bumpy. Markets are currently pricing in a 60% chance of a 0.25% rate cut at the December meeting. However, given persistent inflation, a strong economy, and potential fiscal policy inflation, the Fed may take a more cautious approach to rate cuts in 2025. If you have any questions or need further insights, please get in touch with your advisor at Valley National Financial Advisors.