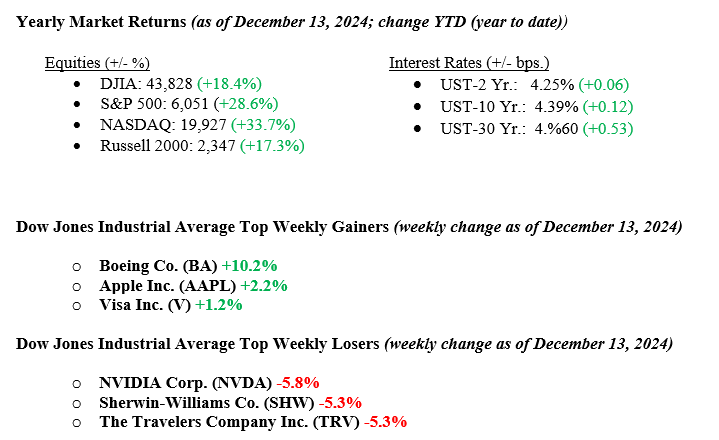

Last week, the Dow Jones Industrial Average (-1.8%) and the S&P 500 Index (-0.6%) both declined, while the NASDAQ (+0.3%) edged slightly higher. The mid-week U.S. inflation report indicated that some sectors of the economy are still experiencing “sticky inflation.” Meanwhile, the ongoing economic growth, optimistic Q4 earnings projections, and supportive central bank policies suggest a positive outlook for markets in 2025. Although the inflation report did not show a significant decrease in inflation, we believe the modest uptick in prices is unlikely to prevent the Fed from cutting interest rates by another 25 basis points at this week’s FOMC meeting. However, by adopting a more cautious approach, the Fed may slow the pace of future rate cuts. This could explain the sell-off in the fixed-income markets last week. In the bond market, Treasury yields rose sharply across the yield curve, with the 10-year U.S. Treasury bond ending the week at 4.32%, up from 4.17% the previous week.

U.S. & Global Economy

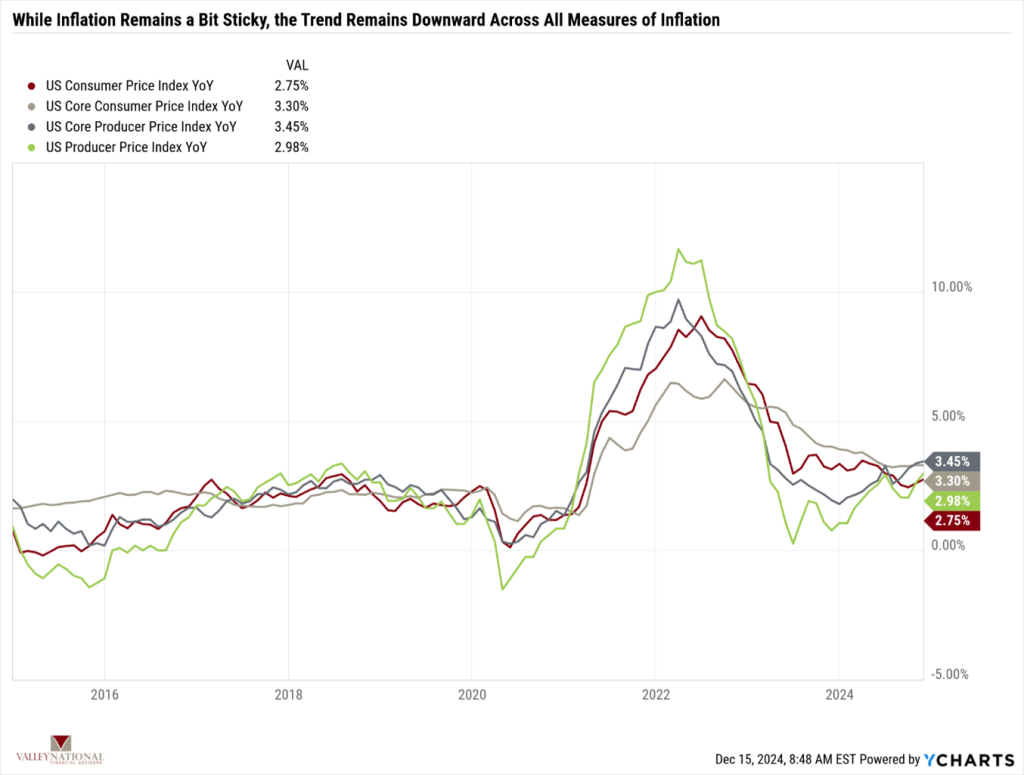

U.S. economic activity remains strong across nearly all sectors, although some services are experiencing more persistent inflation than the markets anticipated. While a month or two of inflation readings are insufficient to derail the Fed from further rate cuts, it could slow their pace or magnitude of cuts. See Chart 1 below, showing four measures of inflation (CPI, Core CPI, PPI, and Core PPI). Since the pandemic, when inflation peaked near 9%, the trend has been downward; we expect this to continue, although the path to 2% may not be completely linear. We also anticipate healthy economic growth, supported by fewer regulatory burdens, the potential extension of the Tax Cuts and Jobs Act in 2025, and central bank rate cuts.

Policy and Politics

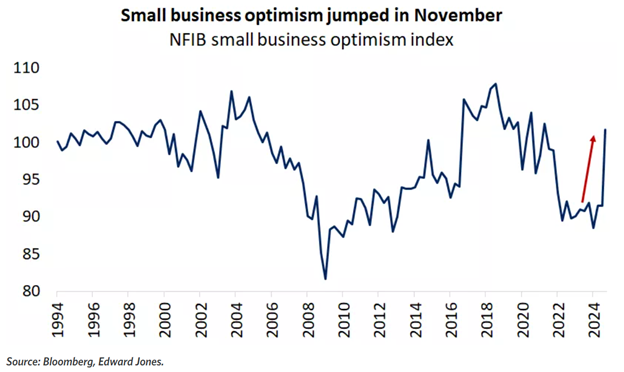

As we approach 2025, there is apparent optimism in the markets and economy as the Trump Administration takes office. Last week, the NFIB Small Business Optimism Index saw the most significant month-over-month increase in 30 years as CEOs and investors brace for tax cuts and pro-growth, pro-business policies. See Chart 2 belowfrom Bloomberg & Edward Jones. Policies and politics in the U.S. that promote growth and expansion remain favorable, and looking into 2025, we see more of the same. Outside the U.S., we are worried that economic activity will continue to stagnate and grow at a much slower clip. Tariffs on imports could temporarily negatively impact some sectors of the economy. Still, we expect the tariffs to be more like initial bargaining chips to bring countries like Canada and Mexico to the negotiation table.

Economic Numbers to Watch This Week

- U.S. Building Permits for November 2024, the prior level was 1.416M.

- U.S. Housing Starts for November 2024, the prior level was 1.311M.

- Target Upper Federal Funds Rate, the current level is 4.75%.

- U.S. Real GDP (R) for 3rd Q2024, current rate is 2.80%.

- U.S. Initial Claims for Unemployment Insurance for the week of Dec 14, prior level 242,000.

- U.S. PCE Price Index YoY for November 2024, prior level 2.31%

- U.S. Core PCE Price Index YoY for November 2024, prior level 2.80%

Next week, investors will be focused on the Federal Reserve’s final meeting of 2024, taking place December 17-18. The Fed’s comments on its rate decision and outlook for 2025 could influence the market’s near-term direction. The bond market is currently pricing in a 94% chance of a 25-basis point rate cut. The key inflation data—the Personal Consumption Expenditures (PCE) Price Index—will be released on December 20. While earnings season is mostly over, several major companies will report quarterly earnings next week, including Micron Technology, Lennar (one of the largest U.S. homebuilders), and Nike. As we’ve seen recently, while current quarter results are significant, investors will be even more focused on the outlooks for 2025 provided by management teams. If you have any questions or need further insights, please get in touch with your advisor at Valley National Financial Advisors.