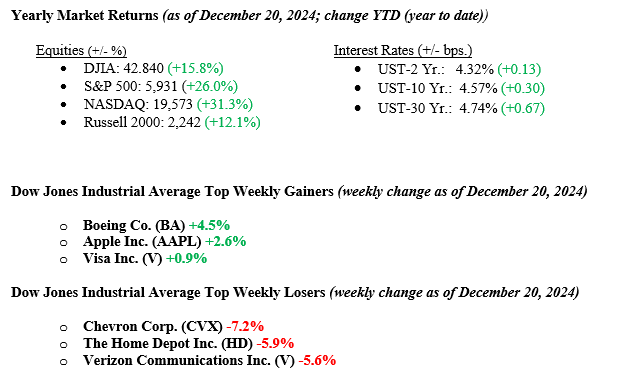

For the week ending December 22, 2024, U.S. stock indexes finished lower. The S&P 500 dropped 2.0%, while the Dow Jones Industrial Average fell 2.3%. The Nasdaq Composite fared slightly better, dropping only 1.8%. Year-to-date returns (see immediately below) remain strong and set up 2024 as a good year for investors. One of the primary factors influencing market behavior was the Federal Reserve’s latest announcement regarding interest rates and their expectations for 2025. The central bank signaled fewer rate cuts were likely in the coming year than anticipated, leading to a strong market reaction as investors adjusted their expectations. This news triggered a rise in Treasury yields, adding pressure to stock prices and contributing to the broader market decline. Despite the overall downturn, there was a rebound on Friday. The S&P 500 rose 1.1%, the Dow Jones Industrial Average climbed 1.2%, and the Nasdaq Composite increased by 1%. This positive shift was partially fueled by a report showing that a key inflation metric, the PCE Index, closely watched by the Fed, was slightly lower than expected in the previous month, which reassured investors and offered hope that inflationary pressures might be easing. Treasury yields rose sharply across the yield curve last week, with the 10-year U.S. Treasury bond ending the week at 4.57%, up from 4.32% the previous week.

U.S. & Global Economy

In addition to the PCE Index reported on Friday, several other key economic reports last week provided insights into the U.S. economy. November retail sales rose 0.7%, beating expectations of a 0.6% increase, signaling strong consumer spending at the start of the holiday season. Building permits jumped 6.1% to a seasonally adjusted annualized rate of 1.505 million, the biggest increase since February 2023. However, housing starts fell slightly by 1.8% compared to October. The Kansas City Fed’s Manufacturing Production Index dropped to -4 in November, indicating ongoing challenges in the manufacturing sector. On the labor front, weekly jobless claims fell by 22,000 to 220,000 for the week ending December 14, showing continued strength in the job market. Third-quarter GDP growth came in at 3.1%, higher than the initial estimate of 2.8%, suggesting the economy was more resilient than previously projected. This could have contributed to the Federal Reserve’s decision to be more cautious with rate cuts. At the Fed’s meeting, Chair Jerome Powell highlighted the economy’s solid position and noted that the recent rate cut was part of a policy recalibration. Powell’s remarks indicated a balanced approach to future rate decisions aimed at supporting growth while controlling inflation.

Policy and Politics

Last week, Congress narrowly avoided a government shutdown by passing a temporary funding measure, which President Joe Biden signed into law on December 21, 2024. The bill extends government funding through March 14, 2025, keeping spending levels the same and providing about $100 billion for disaster relief and $10 billion for farmers. The process was rocky, mainly due to opposition from President-elect Donald Trump and Elon Musk, who criticized the original bipartisan spending bill. Musk voiced his disapproval on social media, and Trump echoed his views, leading to the collapse of the initial proposal. Trump’s push for a debt ceiling increase, which wasn’t included in the final bill, added to the tension. Despite these challenges, the final bill passed with strong bipartisan support, preventing a government shutdown and ensuring continued pay for federal workers. However, it left the debt ceiling unresolved, setting the stage for another fiscal showdown in 2025.

Economic Numbers to Watch This Week

- U.S. New Single-Family Houses Sold, prior level 610,000.

- U.S. Durable Goods New Orders for November 2024, prior 0.24%

- U.S. Initial Claims for Unemployment Insurance for the week of Dec 21, prior level 220,000.

Recent performance in the stock and bond markets has been volatile. However, underlying trends show that the U.S. economy remains strong. Despite short-term volatility, the U.S. remains a top investment destination, with solid consumer spending, robust GDP growth, and a healthy labor market. The Federal Reserve’s cautious stance on rate cuts reflects confidence in economic stability and steadily easing inflation. As we enter 2025, sectors like retail and infrastructure-related spending are showing positive momentum, reinforcing the outlook for sustained growth. For investors, it’s crucial to stay focused on the long term. With strong economic momentum heading into the new year, maintaining a long-term perspective offers promising opportunities for continued success. If you have any questions or need further insights, please get in touch with your advisor at Valley National Financial Advisors.