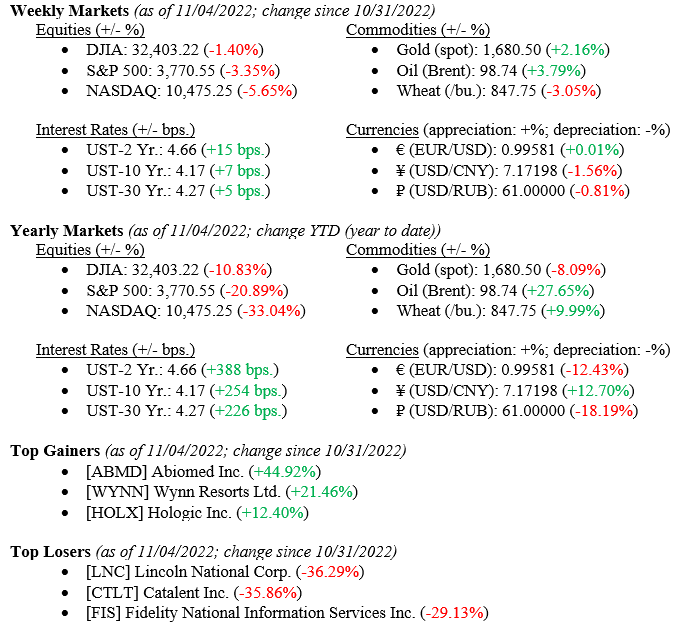

Markets reacted negatively to Fed Chairman Jay Powell’s press conference, which occurred after the Federal Open Markets Committee announced an added 0.75% hike in the Fed Funds Rate, bringing the range to 3.75% to 4.00%. While the 0.75% rate hike was expected, Chair Powell’s “hawkish” comments at the press conference, where he noted that the pace of added hikes is not slowing, were not expected. Stock markets immediately sold off and bond yields rose because of a similar sell-off in the fixed income markets (See Weekly Markets below). Unemployment moved slightly higher during October, but it is important to note that the labor market still is robust. Additionally, midterm elections are this week and, regardless of what happens, market results tend to be agnostic to party over the long-term.

Global Economy

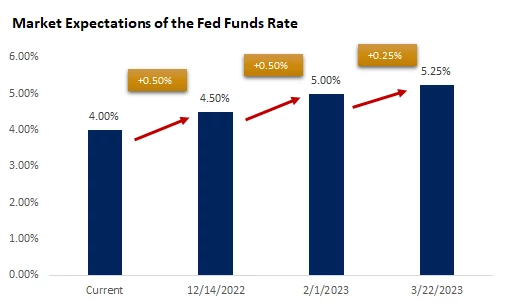

As noted above, the Fed hiked interest rates 0.75% last week. Chair Powell noted that this year’s interest rate hikes have affected the economy, the Federal Open Markets Committee believes that further tightening is necessary to slow the economy enough to deal with the decades-high hot inflation currently weighing on the markets, economy, and the consumer. According to the Chicago Mercantile Exchange, futures on Fed Funds Rate are now pricing in three added hikes with a final terminal level near 5.25%. (See Chart 1 below)

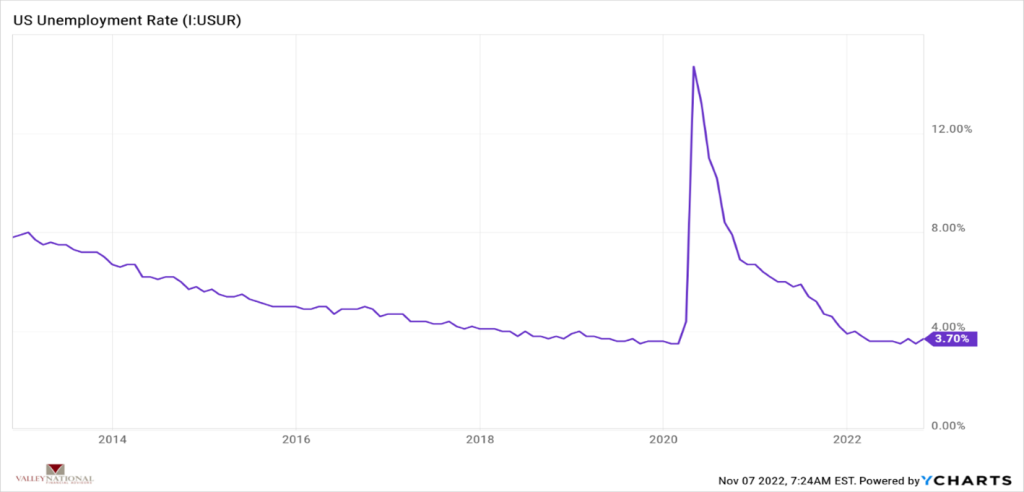

Higher interest rates weigh heavily on consumers (loans, mortgages, credit card interest rates) and directly affect areas of the economy that rely on loans and loan demand (housing). Higher rates also affect those companies that rely on loans for growth such as high-tech, and impact less so on well established companies such in the industrial segment. We saw the divergence of returns last week with the NASDAQ down -5.65% while the Dow Jones Industrial Average was down -1.4%. The labor market remains healthy and last week we saw that 261,000 new non-farm jobs were created during October while the unemployment rate ticked up to 3.7% from 3.5. (See Chart 2 below).

Policy and Politics

U.S. midterm elections happen this week and historically the party in power (currently the Democrats) loses seats in both the House and the Senate. This is expected to happen this week as well, what to watch will be the extent of the losses that the Democrats suffer. From a markets perspective, results are historically agnostic to election results over the long-term and neither really shows an edge on the other for markets returns to investors.

What to Watch

- U.S. Retail Gas Price on Nov. 7th @ 4:30 PM EST (Prior: $3.857/gal)

- U.S. Consumer Price Index (Year over Year) on Nov. 10th @ 8:30 AM EST (Prior: 8.20%)

- U.S. Inflation Rate on Nov. 10th @ 8:30 AM EST (Prior: 8.20%)

- 30 Year Mortgage Rate on Nov. 10th @ 10:00 AM EST (Prior: 6.95%)

- U.S. Index of Consumer Sentiment on Nov. 11th @ 10:00 AM EST (Prior: 59.90)