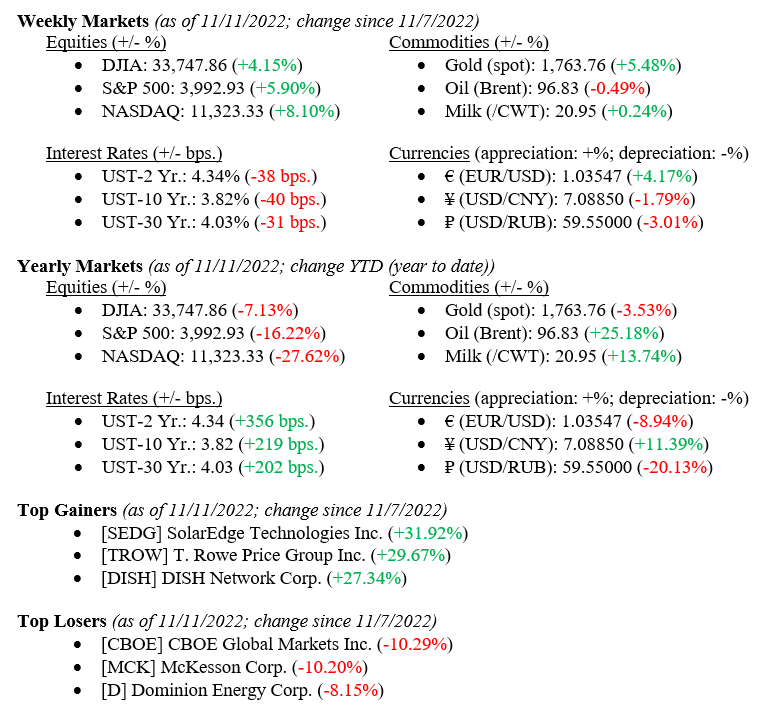

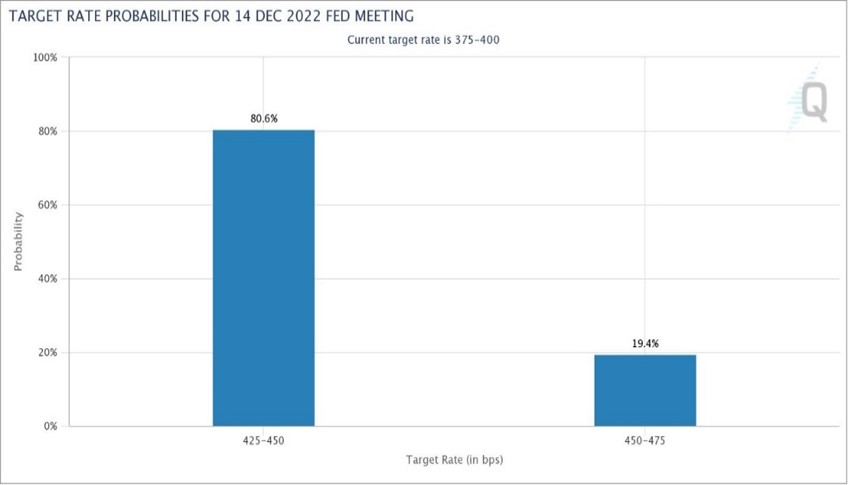

Financial markets got a triple dose of good news immediately before the Veteran’s Day holiday weekend. On Thursday, the U.S. Inflation report for October 2022 showed a drop in the rate to 7.75% from 8.20% the prior month (See Chart 1). Further, a reasonable cessation in the Russia/Ukraine war seems imminent as Russia retreated from the Kherson region of Ukraine. Lastly, China announced a sweeping overhaul to its “zero-tolerance” practice regarding COVID-19 rules allowing the country to truly reopen its economy. Equity markets rallied (higher prices) sharply on the news, especially the NASDAQ (+8.10% on the week) which reacted favorably to lower interest rates (10-Year U.S. Treasury dropped 40 basis points to 3.82%) which help growth and technology companies as borrowing rates decrease. It would not be prudent of us to ignore another big story last week as Cryptocurrency trading giant FTX collapsed wiping out a $32 billion company overnight.

US Economy

Chart 1 below from Valley National Financial Advisors and Y Charts shows the U.S. monthly inflation rate. The sharp drop in the rate is the first tangible evidence that the Federal Reserve Bank’s tight monetary policy is finally curbing inflationary pressures.

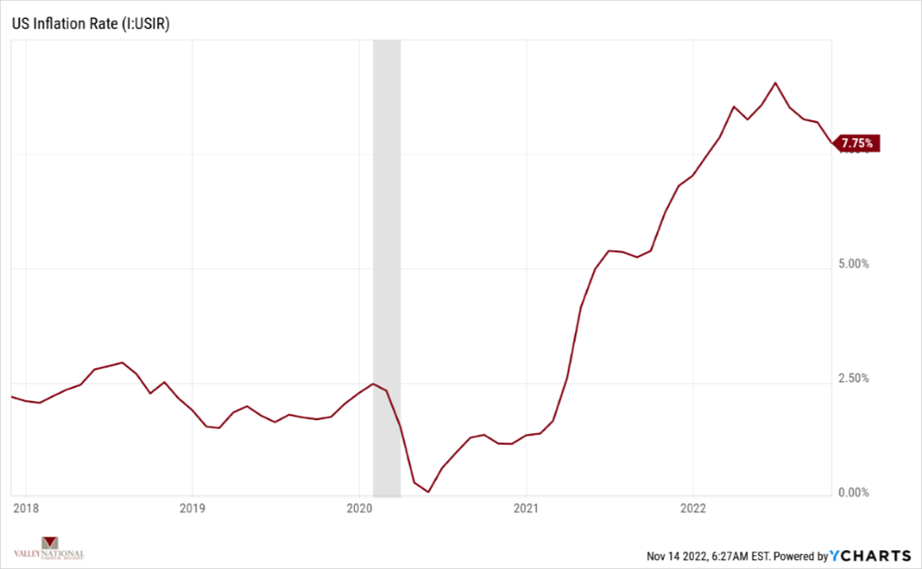

The move in the inflation data immediately impacted financial markets. The CME Group (Chicago Mercantile Exchange) Fed Watch Tool (Chart 2 below) now shows an 80% probability of “only” a +50 basis point rate hike at the December Federal Open Markets Committee meeting rather than a +75 basis point hike, which had been priced into the markets prior the lates inflation report. Chart 2shows the probabilities of changes to the Fed rate and U.S. monetary policy, as implied by 30-day Fed Funds futures trading data.This is a meaningful change in the futures markets as it shows that the end of the Fed’s current interest rate hiking cycle is nearing an end. The question remains around whether Chairman Powell can deliver the mythical “soft-landing” (slowing the economy to combat inflation but not slowing it so much that the economy falls into a recession).

Policy and Politics

The midterm election has concluded, and the results give us a weakly divided government with the Democrats maintaining control of the Senate and the Republicans gaining control of the House. As we have stated many times, financial markets appreciate a divided government because it ties the hands of any one party and prevents “unknown” events from impacting the markets. Overall, gridlock works – oddly, but truthfully.

President Biden is meeting with Chinese leader Xi Jinping today, marking the first time the two leaders have met since Joe Biden took office. While more of a political show, the event does mark a time when relations between the U.S. and China are at a relative low point due to tensions between China and Taiwan. Any warming between the two countries will be viewed as a net positive for global markets.

What to Watch

As mentioned above, FTX, previously one of the world’s largest cryptocurrency exchange platforms, collapsed into bankruptcy wiping out a $32 billion company overnight. When we have discussed cryptocurrencies and we have always told investors to understand and research what you are buying. FTX is only one company in the swiftly growing world of cryptocurrencies but the old Wall Street adage “there’s never just one cockroach” rings true right now and we implore our readers to continue to exercise caution in this market. One thing for sure is that regulators and law makers will take a much greater interest in the crypto market.

RELATED VIDEO: CIO Bill Henderson on Cryptocurrency

Last week we saw some great news around the Fed, Russia/Ukraine War and China. Softening inflation data gives the Fed some room to slow down its interest rate hiking cycle, which growth stocks (NASDAQ) view favorably. We are cautiously optimistic that we have seen the peak in inflation. Remain vigilant nonetheless and watch events unfold around the cryptocurrency markets, the Russia/Ukraine war and whether President Biden and Xi Jinping announce any actual results of their meeting.