Mixed inflation data released last week put a new tenor of concern into the markets as investors worried that the latest data challenged the current consensus that the Federal Reserve Bank would be slowing its pace of interest rate increases. All major market indexes posted negative returns for the week, with the tech-heavy NASDAQ selling off -3.99% while the Dow Jones Industrial Average fell by only -2.77%. Additional U.S. inflation data is due this week, and a Fed policy decision will follow on Wednesday when the central bank is expected to raise interest rates by +0.50% percentage points.

Global Economy

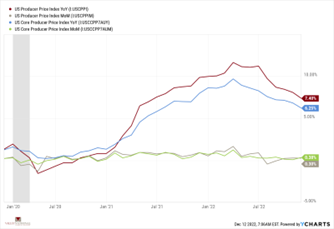

As mentioned above, last week’s inflation data weighed heavily on the market, sending a mixed message to investors. Chart 1 below from Valley National Financial Advisors and Y Charts shows monthly U.S. PPI, U.S. Core PPI, and yearly U.S. PPI and U.S. Core PPI. Year-over-year data shows that inflation is falling, having peaked in July of 2022. However, monthly data – in this case from October to November 2022 – still showed a modest uptick. This mixed message puzzles investors because it does not give the Fed a true green light to halt further interest rate hikes. Additional information is due this week that will show U.S. Consumer Price Index and U.S. Core Consumer Price Index data, as well as the U.S. Inflation rate for November 2022.

The U.S. Federal Reserve Bank wraps up this week’s meeting on Wednesday, and the bank is widely expected to raise interest rates an additional +0.50%, marking the seventh-rate hike for 2022. Fed Chairman Powell will hold a press conference after the meeting announcement, and investors will watch for any signs that point to the crucial “Fed Pivot” or change in the interest rate path. We believe there will be a reasonable period (six to 12 months) before the Fed changes its interest rate path from hiking to cutting rates. The U.S. Inflation rate is still running well above their “target” rate of +2.50% (~7.75% in October 2022), and there needs to be time for the rate hikes we saw in 2022 to percolate through the economy and thereby slow the inflation rate.

What to Watch

- U.S. Consumer Price Index Month-over-Month for November 2022, released 12/13/22 (prior +0.44%)

- U.S. Consumer Price Index Year-over-Year for November 2022, released 12/13/22 (prior +7.75%)

- U.S. Inflation Rate for November 2022 released 12/13/22 (prior +7.75%)

- Target Federal Funds Rate (upper limit) released 12/14/22 (prior 4.00%)

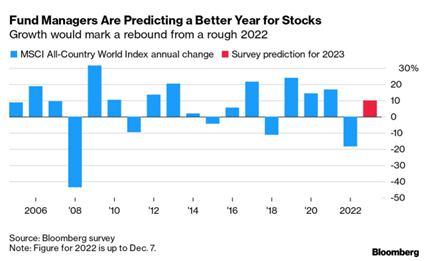

Indeed, inflation is coming down, as we have seen in prices for crude oil and retail gasoline. But the Fed still has work to do – we know this, and it is common knowledge on the street. However, uncertainty about a pivot continues to weigh on the markets and investors. The consumer continues to show resilience, especially regarding spending. (Watch for retail sales data being released this week.) The labor market also remains healthy, with the unemployment rate below 4.00%. We are ending this week’s observations on a positive note. Last week, Bloomberg released a survey of Fund Managers’ predictions for 2023 (Chart 2) and showed an optimistic outlook for markets. We may see some softening in corporate profits or even a modest recession, but watch for 2023 to offer positive returns for stocks.