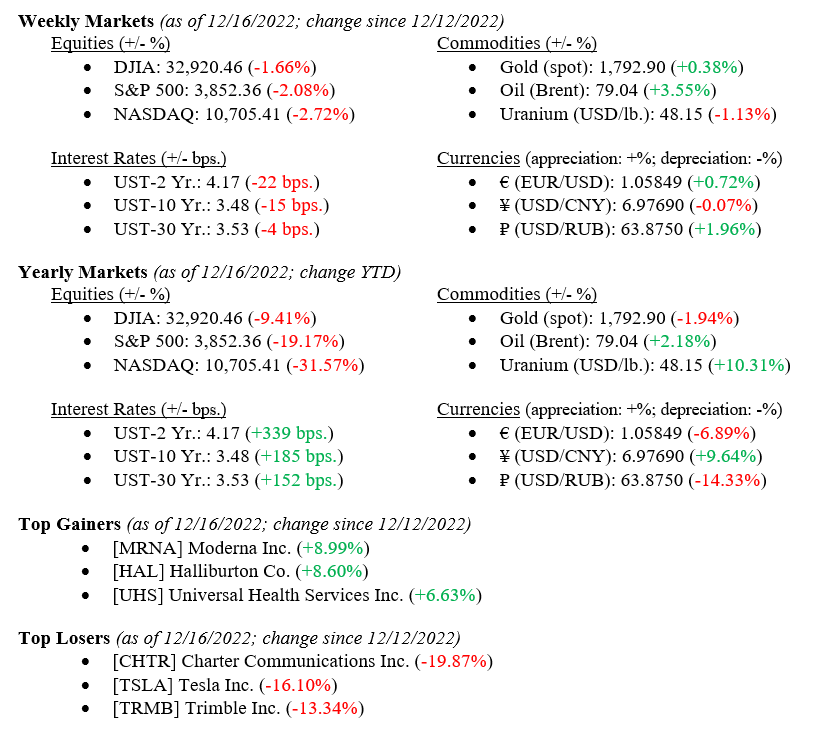

The brief “Santa Claus Rally” investors had hoped for was dashed by Fed Chairman “Ebeneezer” Powell last week at his press conference after the FOMC (Federal Open Markets Committee) meeting when he doubled down on the Fed’s hawkish stance on interest rates insisting that persistent inflation remains, and higher interest rates are still necessary. Even though several inflation indicators reported last week were lower than expected – e.g., U.S. Consumer Price Index (CPI), U.S. Core CPI and the U.S. Inflation Rate – and the Fed raised rates an expected +0.50%, equity markets sold off all week. The Dow Jones Industrial Average ended at -1.66%, the S&P 500 Index sold off -2.08% and the NASDAQ ended a full -2.72% lower. Lastly, a lower-than-expected retail sales figure was reported on Friday that sent additional jitters into markets, adding further uncertainty around an already wobbly economy.

Global Economy

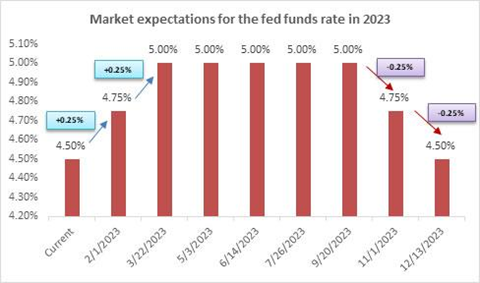

As mentioned above, the Fed raised interest rates by +0.50%, which Wall Street economists and others widely expected. However, Chair Powell’s statements after the meeting indicated that further rate hikes in 2023 are expected and that it was much too soon to discuss long-sought-after rate cuts. Regardless of Powell’s hawkish remarks, future markets continue to price in the possibility of rate cuts late in 2023. Chart 1 below from Bloomberg shows Market Expectations for the Fed Funds Rate in 2023.

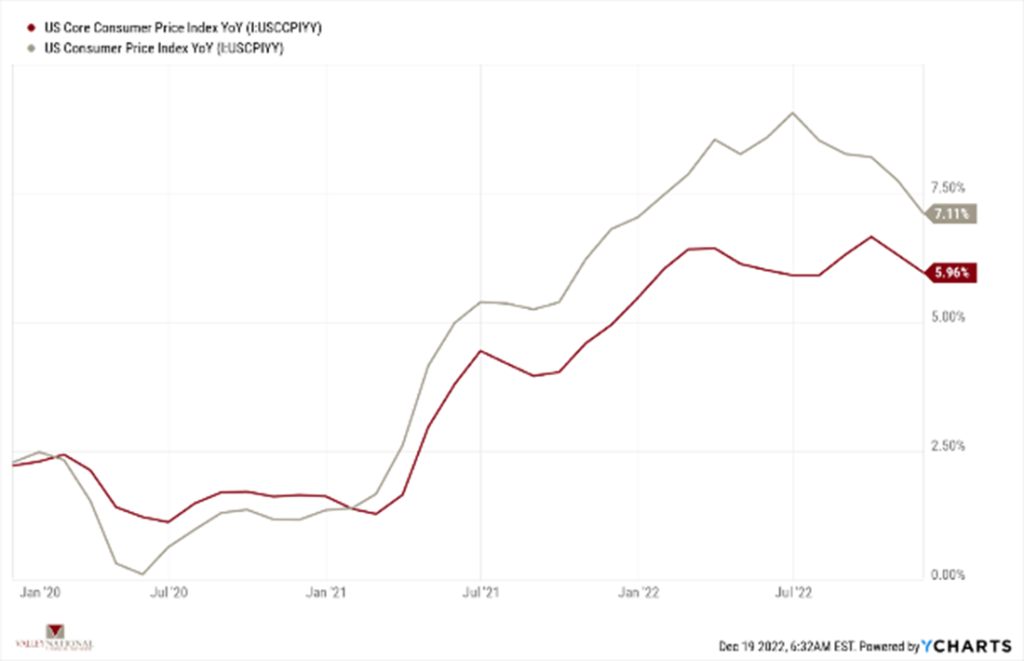

Future markets are pricing in rate cuts, which seems unlikely at this point, and we believe that inflation will continue to moderate all year but also remain elevated and above the Fed’s 2.5% target all year. Last week’s inflation data, while modest, did report lower rates for November, which assists our statement above that inflation will continue to moderate, just at a slower pace than the Fed desires. Chart 2 below from Valley National Financial Advisors and Y Charts showing U.S. CPI and U.S. Core CPI for November. Yes, inflation is moderating, but an inflation rate of +7.11% is still too high for the Fed and too high for U.S. consumers, so more work needs to be done, and that work is done via higher interest rates.

A final issue that worried markets was last Thursday’s retail sales report. The worse-than-expected number (-0.58% for November vs. October’s +1.31%) added concerns that higher rates worry consumers enough to impact spending. Importantly, recall that consumer spending makes up 65%-70% of the U.S. GDP (Gross Domestic Product), and a slowing in consumer spending added to worries about a pending recession in 2023.

Global Policy and Politics

Following the Fed’s move last week, the Bank of England and the European Central Bank (ECB) also raised their policy rates by +0.50%. Similarly, both foreign Central Banks echoed the U.S. Fed that further interest rate hikes are necessary as their inflation levels remain soundly above target ranges. We believe a strong possibility exists for a Eurozone recession due to higher interest rates and extraordinarily high energy prices resulting from the Ukraine/Russia war.

What to Watch

- U.S. Housing Starts for November 2022, released 12/20/22 (prior +1.425M)

- U.S. Claims for Unemployment Insurance for week of 12/17/22, released 12/22/22 (prior +211K)

- U.S. Real GDP for Q3 2022, released 12/22/22 (prior +2.90%)

- U.S. Core PCE (Personal Consumption Expenditures) Price Index Year-over-Year for November 2022, released 12/23/22 (prior +4.98%)

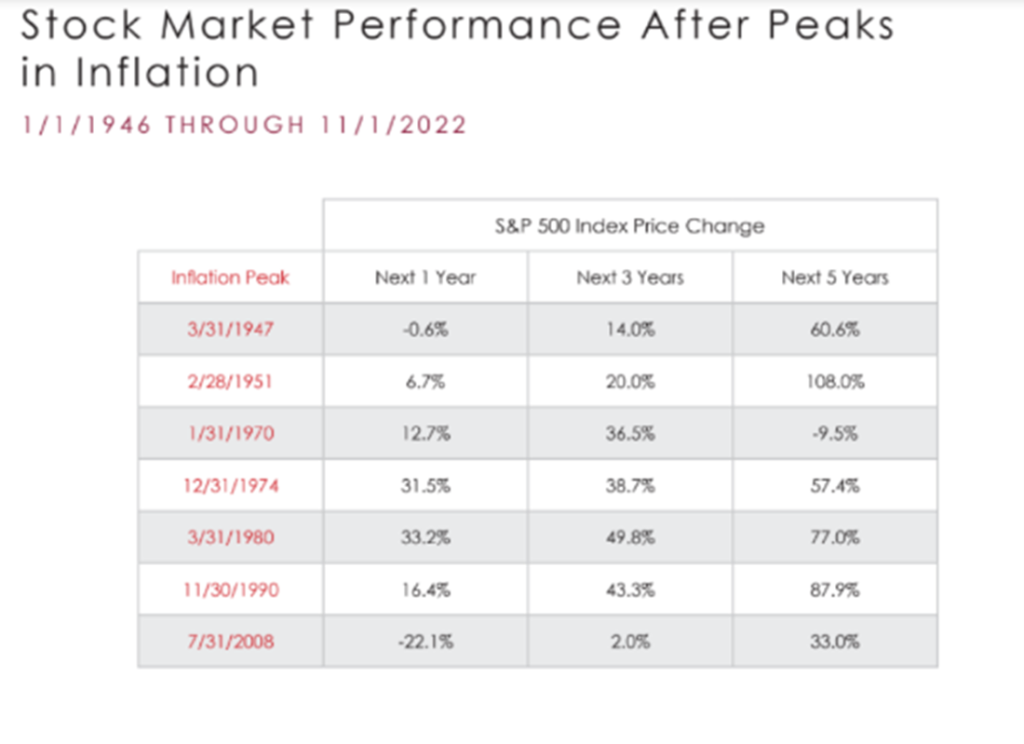

With most of 2022 behind us, we are now looking to 2023 and setting expectations for the year. Most economists are calling for a recession in 2023. There is a possibility for a modest recession especially given the recent softening in consumer spending, higher mortgage rates impacting housing, and weaker earnings releases by U.S. companies. That said, U.S. labor remains strong, and U.S. banks are healthy, both of which are critical to future economic growth. Any recession in 2023 will be short-lived and modest. The Fed will continue to hack away at inflation and eventually hit a “pivot point” on interest rates. We expect inflation to have already peaked, and lower levels are upon us. Historically, the markets perform well after peak inflation. Chart 3 below from Bloomberg shows the last seven inflationary periods and the S&P 500 Index performance over the next one. three, and 5 years.

- Watch for inflation indicators, labor strength, consumer activity and finally EPS (Earnings Per Share) results as we move into 2023.