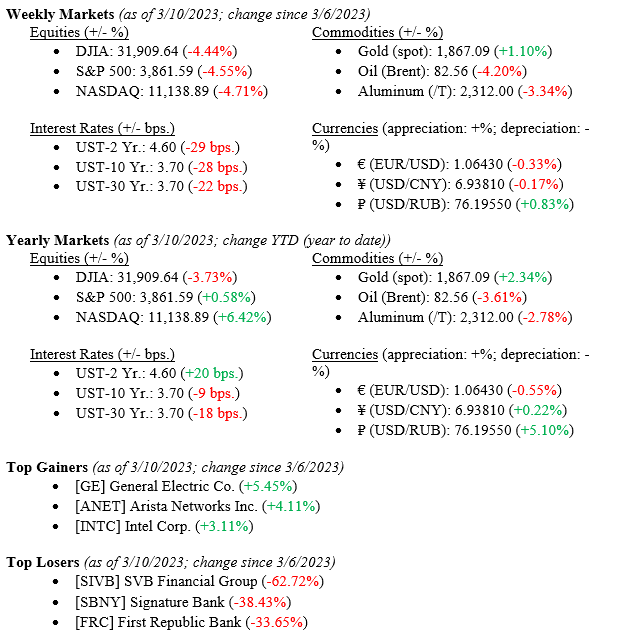

Despite last week’s dramatic sell-off across all equity market sectors, the –4.55% drop in the S&P 500 Index fails to tell the week’s full story. The Dow Jones Industrial Average was down –4.44%, and the NASDAQ fell –4.71%, in concert with the broader S&P 500 Index. The stock market’s decline directly implied strong jobs data released Friday and very hawkish comments made by Fed Chairman Jay Powell earlier in the week during his congressional testimony. By the end of the week, Silicon Valley Bank, a bank catering to tech start-ups, was on the brink of failure due to losses on bond reserve holdings, customer withdrawals, and shrinking liquidity. The FDIC seized Silicon Valley Bank, and by late Sunday evening, a new Fed liquidity facility was created and announced that depositors at Silicon Valley Bank would be made whole. We will discuss each of these events below. Meanwhile, in a massive flight-to-quality move, the 10-year US Treasury fell 28 basis points to close the week at 3.70%.

US Economy

Fed Chairman Jay Powell testified to congress for two days, first to the U.S. House of Representatives and secondly to the U.S. Senate. Chair Powell was adamant about his objectives to quell still hot-running inflation at these hearings. This message was factored into the markets and moved expectations on further Fed interest rate hikes to moves in the +0.50 – 0.75% at the March 21-22 meeting next week. As expected, markets reacted negatively to even higher than previously expected interest rates as higher rates increase funding costs, slow the economy, and increase the overall cost of expansion for corporations. This turn of events was a solid negative for markets, but the unwelcome news continued.

- As mentioned above, last week Silicon Valley Bank, the so-called one-stop shop for technology start-ups in the U.S., failed as losses on its bond holdings created a liquidity crisis as depositors lined up to withdraw funds created an old-fashioned “run-on-the-bank.” Following this collapse, another tech-central bank, Signature Bank, also failed. These bank failures, while small by bank standards, prompted the Fed, the FDIC, and bank regulators to:

- Seize Silicon Valley Bank and Signature Bank

- Label Silicon Valley Bank and Signature Bank as new “Systemic Institutions.”

- Guarantee depositors’ access to their accounts, even those over the $250,000 FDIC limit.

- Create a new Bank Term Funding Program, which will provide liquidity to U.S. depository institutions by allowing them to pledge U.S. Treasury securities to the facility as collateral at PAR value. (This move by the government negates current book losses on U.S. Treasury holdings of banks and provides needed liquidity.)

- This special Bank Funding program smooths/negates the duration risk that bank bond portfolios had as their holdings have lost money due to the rise of interest rates over the past year (remember, as interest rates rise, bond prices fall).

- Certainly, these actions by the Fed and FDIC have stabilized the current issue impacting the banking sectors. These bank failures, again small by bank standards (Silicon Valley Bank assets were ~$200 billion compared to JP Morgan Chase assets ~ $2.6 trillion), point to a crack in the technology start-up funding world. Technology start-ups and start-up companies provide new jobs across all markets; funding these ideas is critical to their success until a replacement to funding institutions like Silicon Valley Bank are found, whether venture capital, private equity, or large banks like JP Morgan or Wells Fargo. This nascent industry will face headwinds.

Policy and Politics

There will be a lot of naysaying and gnashing of teeth this week in Washington as regulators, Fed officials, and Law Makers clash and cross-blame each other for 1) allowing banks to fail at all and 2) permitting yet another bailout by the Fed of another financial institution.

What to Watch

- U.S. Core Consumer Price Index YoY for February 2023, released 3/14/2023, (prior 5.55%).

- U.S. Inflation Rate for February 2023, released 3/14/2023, (prior 6.41%).

- U.S. Core Producer Price Index YoY for February 2023, released 3/15/2023, (prior 5.37%).

- U.S. Building Permits for February 2023, released 3/16/2023, (prior 1.339M).

- U.S. Index of Consumer Sentiment for March 2023, released 3/17/23 (prior 67.00).

A massive batch of economic data is on deck for this week. Early in the week, important inflation information will be released, which will help gauge whether the Fed is impacting hard-hitting inflation that continues to hurt businesses and consumers. Mid-week building permits will add information about the housing industry and whether a spring bounce is on deck. Lastly, we will see how consumers feel as U.S. Sentiment for March 2023 is released.

In a conversation with our Founder and Chairman, Tom Riddle, over the weekend, we called on his previous experience as a bank examiner working for the U.S. Treasury Department. Tom recalled his methods for judging a bank’s health, “One does not only look at a bank’s balance sheet. A far more accurate reading is to evaluate a bank’s growth, or decline, of its net interest income.” “By this measure, banks we invest with at Valley National Financial Advisors are not those with declining or poor net interest income. However, Silicon Valley Bank would have been on such a list.” Tom continued, “banks with poor net interest income growth exhibit very unusual balance sheet characteristics such that they are lending money and offering deposit rates at levels that are higher than their investment returns.” Tom closed with, “It is a stressful time for banks that have ventured away from traditional banking.”

- Looking beyond the Silicon Valley Bank meltdown, we have a busy week ahead with economic data, regulators, and lawmakers all helping to navigate the markets. The Fed may use this issue to slow or halt further interest rates, but inflation will need to continue to cool for this to happen. Meanwhile, corporate America is experiencing an unexpected earnings tailwind from cost cutting, supply chain stabilization, a declining dollar, and increased demand from China. Don’t hesitate to contact your financial advisor at Valley National Financial Advisors for help or guidance.