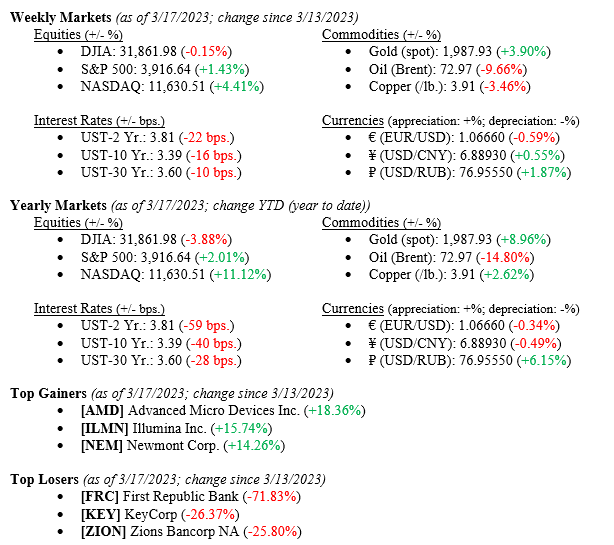

Equity markets posted mixed results last week as issues surrounding U.S. Regional Banks continued to roil investors. Further, Swiss banking giant Credit Suisse, beleaguered for decades, finally found a merger partner in fellow Swiss Bank UBS. While seemingly good news on the surface, investors took this news as more of a “canary in a coal mine” signal that further unwelcome news could follow in the banking sector. As a result, there was a large flight to quality trade as investors scooped up U.S. Treasury Bonds. By week’s end, the bellwether 10-year U.S. Treasury Bond had moved lower by 16 basis points to close the week at 3.39%. Just three short weeks ago, the rate on the 10-year U.S. Treasury was 4.06%. Last week, the Dow Jones Industrial Average returned -0.15%, the S&P 500 Index moved higher by +1.43%, and finally, the NASDAQ rallied higher by +4.41%.

US Economy

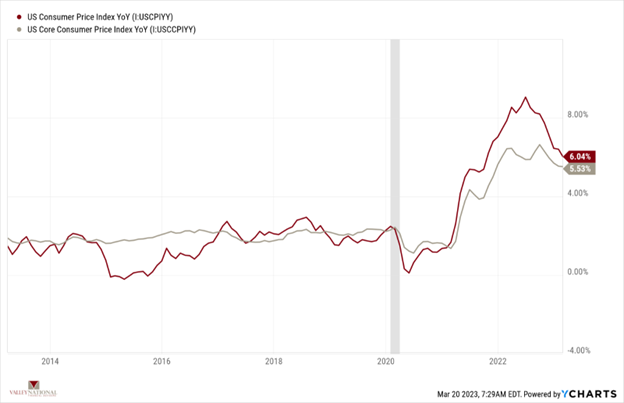

Certainly, with all the focus on Silicon Valley Bank (seized by regulators), Signature Bank (seized by regulators and then partially bought by New York Community Bancorp), First Republic Bank (received a $30 billion cash injection from JP Morgan, Citi, Bank of America, and Wells) and Credit Suisse (bought by UBS for a mere $3.3 billion), few investors paid much attention to the inflation report released on Tuesday which further easing in inflationary pressures. Chart 1 below by Valley National Financial Advisors and Y Charts shows U.S. Consumer Price Index Year over Year and U.S. Core Consumer Price Index Year over Year for February 2023. Higher interest rates, as imparted on the economy by the Fed, continue to push inflation lower.

It will take some time for 2022’s interest rate tightening to be completely felt in the economy, but the direction is correct – lower inflation. The Federal Open Market Committee meets this week. Several Wall Street analysts are calling for a pause in further rate hikes, given the recent inflation reports and the continued economic uncertainty surrounding the banking sector. While Fed Fund Futures are still pricing in a +0.25% rate hike this week, we at VNFA certainly believe a pause is more appropriate.

Policy and Politics

Several factions in the U.S. House and the U.S. Senate call for the Federal Deposit Insurance Corporation to guarantee all deposits at U.S. Depository Institutions (banks, savings and loan associations, and credit unions) rather than only to the current limit of $250,000. A change in the FDIC limit would require an act of Congress, which is possible should a crisis in confidence in the banking sector continue.

What to Watch

- Monday, March 20th

- U.S. Retail Gas Price at 4:30PM (Prior: $3.568/gal.).

- Tuesday, March 21st

- U.S. Existing Home Sales at 10:00AM (Prior: 4.00M).

- U.S. Job Openings: Total Nonfarm at 10:00AM (Prior: 10.82M).

- Wednesday, March 22nd

- Target Federal Funds Rate Upper Limit at 2:30PM (Prior: 4.75%).

- Thursday, March 23rd

- U.S. New Single-Family Houses Sold at 10:00AM (Prior: 670.00K).

- 30-Year Mortgage Rate at 12:00PM (Prior: 6.60%).

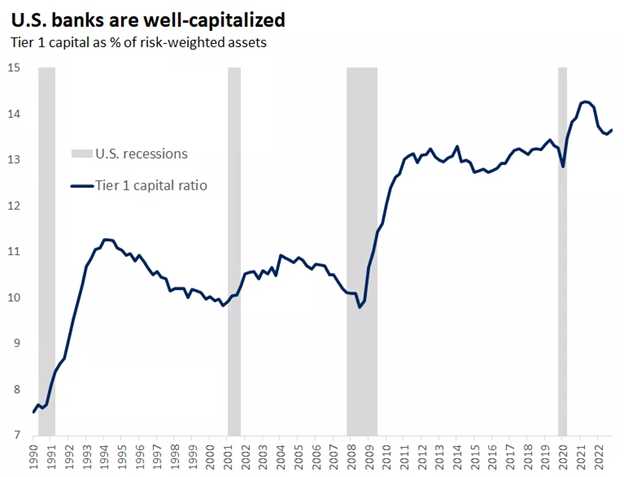

Wall Street insiders, executives, regulators, and lawmakers have managed to quell the current banking problem, which thus far has been limited to very few banks specifically catering to the technology and crypto world. Banks remain very well capitalized, especially compared to the 2008-08 Global Financial Crisis, see Chart 2 below from the FDIC & Bloomberg. Contagion is a tricky beast, and the markets need to see just the right amount of government and private intervention before taking a directional turn. We remain cautiously optimistic about the equity and fixed-income markets for 2023. Watch for cues from Chairman Powell this week on whether we get a pivot in policy this year.