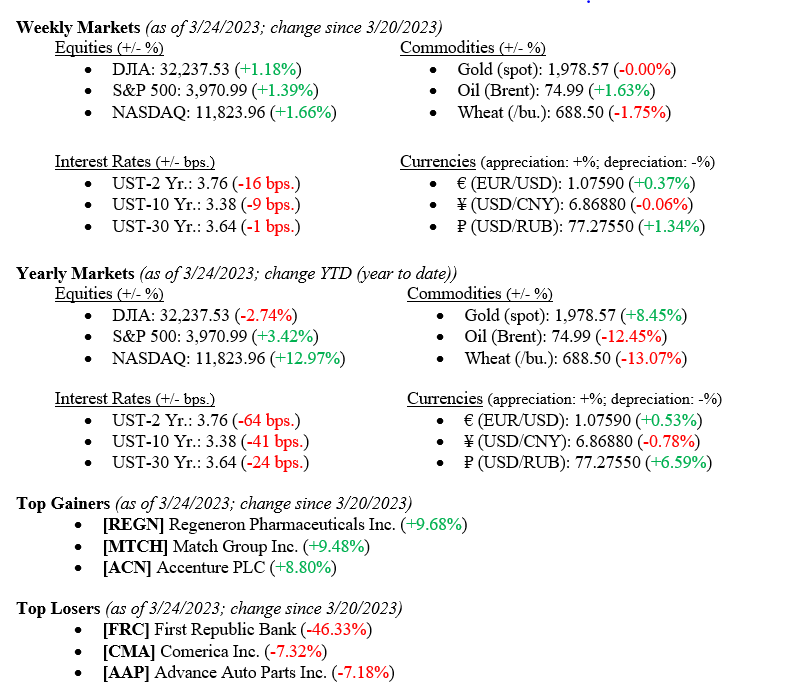

Equity markets this past week seem to be moving on from the tumult caused by some regional banks earlier this month. The Dow Jones increased 1.18%, the S&P up 1.39%, and the NASDAQ 1.66%. Fixed income markets have also continued to rally this past week, with 2-year and 10-year yields moving lower by 16 and 9 basis points, respectively, indicating a continued flight to quality amid concerns over regional banks. Additionally, the Federal Reserve decided unanimously to raise rates by 25 basis points last week, keeping on track with the prior hike in February and slowing from the 50-basis point hike in December. In general, we believe the Fed is in a tough position between balancing actions in response to regional bank failures, targeting price stability, and quelling inflation. Congress will also discuss activity surrounding the banking sector and how to prevent such failures in the future. At the time of this writing, First Citizen Bancshares, Inc., a Raleigh, NC bank holding company, agreed to acquire Silicon Valley Bank, including $56 billion in deposits and $72 billion in loans.

Global Economy

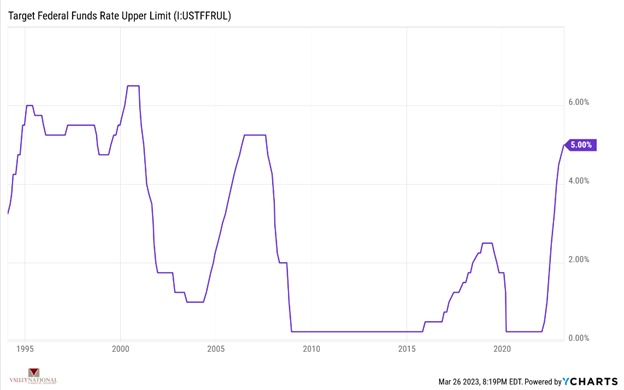

As mentioned, the Federal Reserve raised rates by a quarter-percentage point last week on March 22nd, marking the ninth time in a row that they have hiked. This brings the Fed Funds range between 4.75% and 5.00%. Members of the Fed’s rate-setting committee have made it clear that they believe higher rates will be necessary to quell inflation. Policymakers are anticipating another 25-basis point hike by the end of the year. This hike comes after calls for a pause due to the collapse of both Silicon Valley Bank and Signature Bank earlier this month. However, Treasury Secretary Yellen has implied that these pressures have eased, and large withdrawals have “stabilized.” Chart 1 below of the Federal Funds Rate since 1994 shows that current rates are still a way off from their peak of 6.50% in mid-2000.

The House and Senate committees that oversee banking are holding back-to-back hearings this week to examine regulatory lapses that contributed to the failing of Silicon Valley Bank and Signature Bank. Those testifying at the hearing include Federal Deposit Insurance Corporation Chairman Martin Gruenberg, Federal Reserve Vice Chair for Supervision Michael Barr, and the Treasury Undersecretary for Domestic Finance Nellie Lang. These hearings aim to try to understand what caused the two banks to fail, as well as contain further damage to the economy and reinforce confidence in the banking system. However, there will also be a discussion about whether tighter banking sector regulations are necessary. Keep in mind that, at the time of its failure, 94% of Silicon Valley Bank’s deposits sat above the FDIC’s $250,000 limit, which will likely become a point of scrutiny in these hearings.

What to Watch

- Monday, March 27th

- U.S. Retail Gas Price at 4:30PM (Prior: $3.534/gal.)

- Tuesday, March 28th

- Case-Shiller Composite 20 Home Price Index YoY at 9:00AM (Prior: 4.66%)

- Case-Shiller Home Price Index: National at 9:00AM (Prior: 297.08)

- Wednesday, March 29th

- U.S. Pending Home Sales at MoM 10:00AM (Prior: 8.13%)

- U.S. Pending Home Sales YoY at 10:00AM (Prior: -24.10%)

- Thursday, March 30th

- U.S. Gross Domestic Purchases Price Index QoQ at 8:30AM (Prior: 3.60%)

- U.S. Initial Claims for Unemployment Insurance at 8:30AM (Prior: 191,000)

- U.S. Real GDP (Gross Domestic Product) QoQ at 8:30AM (Prior: 2.70%)

- US Total Vehicle Sales at 10:30AM (Prior: 16.20M)

- 30-Year Mortgage Rate at 12:00PM (Prior: 6.42%)

- Friday, March 31st

- U.S. Core PCE (Personal Consumption Expenditures) Price Index MoM at 8:30AM (Prior: 0.60%)

- U.S. Core PCE Price Index YoY at 8:30AM (Prior: 4.71%)

- U.S. PCE Price Index YoY at 8:30AM (Prior: 5.38%)

- U.S. Personal Income MoM at 8:30AM (Prior: 0.58%)

- U.S. Personal Spending MoM at 8:30AM (Prior: 1.76%)

- U.S. Index of Consumer Sentiment at 10:00AM (Prior: 63.40)

- U.S. Crude Oil Production at 3:30PM (Prior: 375.14M bbl.)

The fallout from Silicon Valley Bank and Signature Bank’s failures is under control as the Federal Reserve and Congress act to understand and contain it. The Fed is committed to raising rates as it sees necessary to continue fighting inflation despite banking issues, but we believe that they are nearing the end of their hikes before a pause to digest data. The outcome of the upcoming congressional hearings is top of mind—will Congress reenact some of the changes made to Dodd-Frank in 2018? Despite all of this, we still believe in staying the course when it comes to investing. Trying to time the market means you must be correct at two points: first when you exit the market, and second when you attempt to reenter the market. Please reach out to your financial professional at Valley National Financial Advisors.