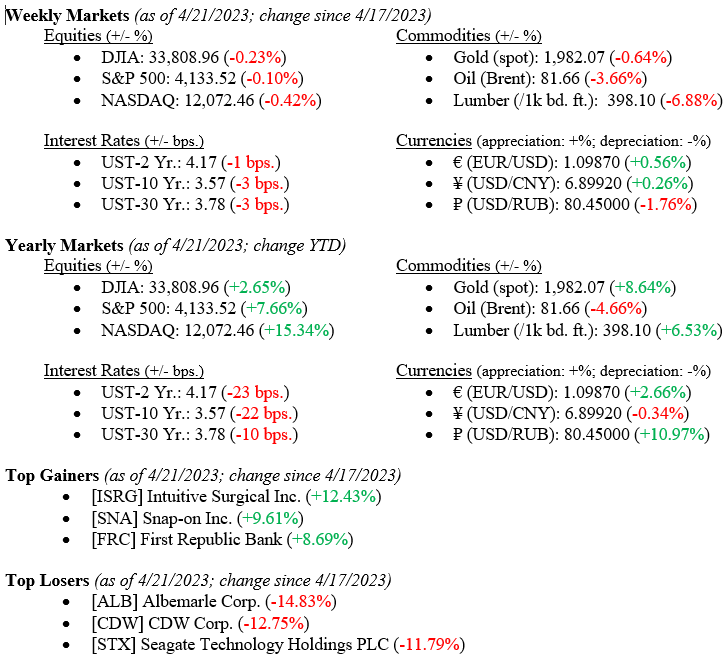

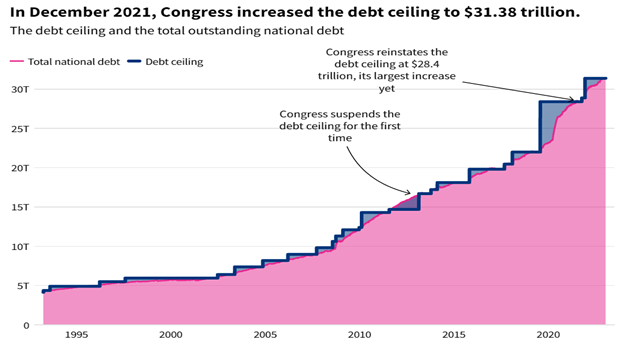

It was a rare quiet week on Wall Street, with significant market indexes moving down only slightly as investors were given a week without major economic activity or market-moving events. The Dow Jones Industrial Average moved down –0.23%, the S&P (Standard & Poor) 500 Index fell –0.10%, and the NASDAQ fell by –0.42%. More importantly, year-to-date returns remain comfortably positive for all major markets sectors, including the fixed-income market. Technology stocks have notched a +15.3% year-to-date return as measured by the NASDAQ, the broad S&P 500 Index is up +7.7%, and the Dow Jones Industrial Average is up a modest +2.7%. The 10-year U.S. Treasury Bond fell 3 basis points last week to close at 3.57%. Pay close attention to the markets as they have quietly but consistently been building positive returns all year.

U.S. Economy

This week we get the release of the 1Q GDP (Gross Domestic Product) (estimated +2.0%), and next week the FOMC (Federal Open Market Committee) will meet and probably announce another +0.25% interest rate hike but could signal a pivot or pause in their rate cycle, see Chart 1 below. Watch for market prognosticators to predict, “This is the most important FOMC this year!” While we believe every FOMC meeting is important, the markets are already telling us the FED is done with their rate hikes, as the 2-year U.S. Treasury is now signaling as much since it rallied on the heels of the Silicon Valley Bank failure but did not move higher again once the markets moved past the brief banking tremor.

As mentioned, we expect the FOMC to raise rates another +0.25% as they continue to focus on inflation even as other more modest indicators are pointing to an economic slowdown. Granted, it is a tough balancing act to combat inflation with higher interest rates which effectively slows the economy but attempt to not slow things so much that the economy moves into a recession. The yield curve has been signaling “recession” since early last year when it first became inverted (short term bonds yielding more than long term bonds), but we believe this yield curve inversion was FED created rather than market created. Unlike many economists, but not all, we do not anticipate a recession in 2023. Conversely, if the FED does pause or pivot next week, we expect the markets to react favorably to this news.

Certainly, headwinds always exist, and this year is no different. The bank tremor we saw in March will tighten financial lending conditions and force borrowers (small growth and venture capital start-ups) to seek funding from higher cost sources with tighter controls and covenants. This will increase borrowing costs and thereby slow expansion and hiring in this important growth sector of the economy. The tech sector absorbed most layoffs thus far in 2023.

Policy and Politics

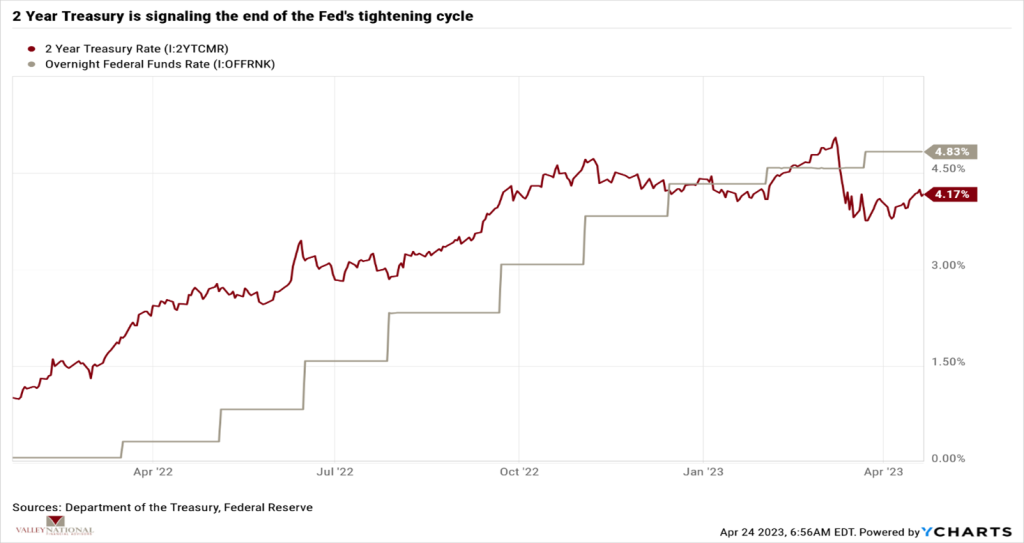

Political headwinds also exist with the debt ceiling showdown looming more significant as we approach the June/July deadline—the moving target is subjective because of April’s tax receipts which have not yet been fully calculated into the equation. The debt ceiling restricts how much the federal government can borrow to pay its bills and allocate funds for the future, see Chart 2 below. Expect congressional and White House brinkmanship to continue as the deadline approaches. Still, if the past is any indication, the ceiling will be raised, lest our current leaders become responsible for either another downgrade of the U.S. credit rating from AAA/AA, a default, or the loss of the U.S. Dollar as the reserve currency for world trade. The downside risk is much greater than simply raising the debt ceiling again.

What to Watch

- Monday, April 24th

- U.S. Retail Gas Price at 4:30PM (Prior: $3.769/gal.)

- Tuesday, April 25th

- Case-Shiller Home Price Index: National at 9:00AM (Prior: 296.12)

- Thursday, April 27th

- U.S. Initial Claims for Unemployment Insurance at 8:30AM (Prior: 245k)

- U.S. Real GDP QoQ at 8:30AM (Prior: 2.60%)

- U.S. Pending Home Sales MoM/YoY at 10:00AM (Prior: 0.85% / -21.14%)

- U.S. Total Vehicle Sales at 10:30AM (Prior: 15.34M)

- 30 Year Mortgage Rate at 12:00PM (Prior: 6.39%)

- Friday, April 28th

- U.S. Personal Income MoM at 8:30AM (Prior: 0.32%)

- U.S. Personal Spending MoM at 8:30AM (Prior: 0.15%)

- U.S. Index of Consumer Sentiment at 10:00AM (Prior: 63.50)

We have repeatedly stated that the markets are more efficient than investors expect. Tailwinds and headwinds like buyers and sellers make the economy hum and markets function. Economists and weather forecasters, unlike foul shooters, can always miss and simply blame “the markets.”

We always blame the markets. Year-to-date, the stock and bond markets have quietly rewarded those investors staying the course and sticking to their long-term plan designed to gather and create generational wealth.