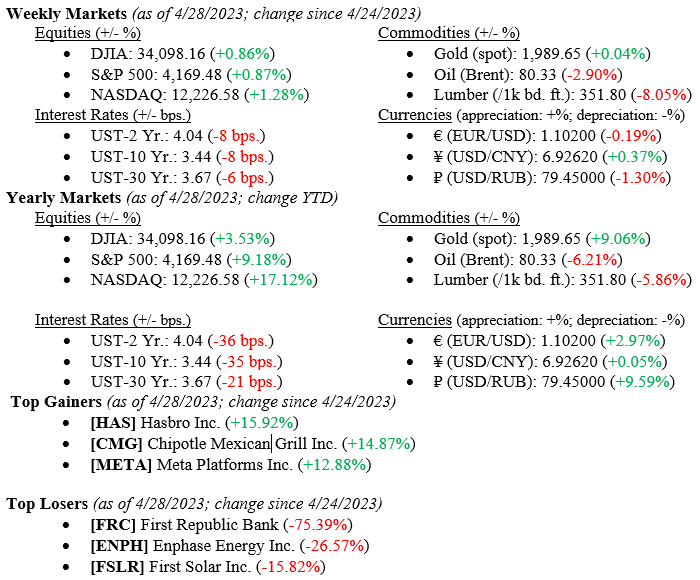

All three major market indexes quietly posted gains for the week ended April 28, 2023, adding to their positive results on a year-to-date basis. Last week, the NASDAQ, led by “Big Tech” names like META, Amazon, Microsoft, and Apple, notched a solid +1.3% gain, while the S&P 500 Index, also helped by “Big Tech” and the Dow Jones Industrial Average each gained +0.9% for the week. Last week also saw the release of 1st quarter 2023 U.S. GDP (Gross Domestic Product) at +1.10%, which was lower than the estimate of +2.60% but still a growth figure for the quarter. By the end of last week, it became imminently obvious that First Republic Bank, which announced that over $100 billion in deposits fled the bank during the 1st quarter of 2023, was in real trouble. Over the weekend, regulators, and the FDIC (Federal Deposit Insurance Corporation) engineered first a seizure of the bank and second a complete takeover by JP Morgan Chase, the largest bank in the U.S., once again adding needed calm to the banking sector.

US Economy

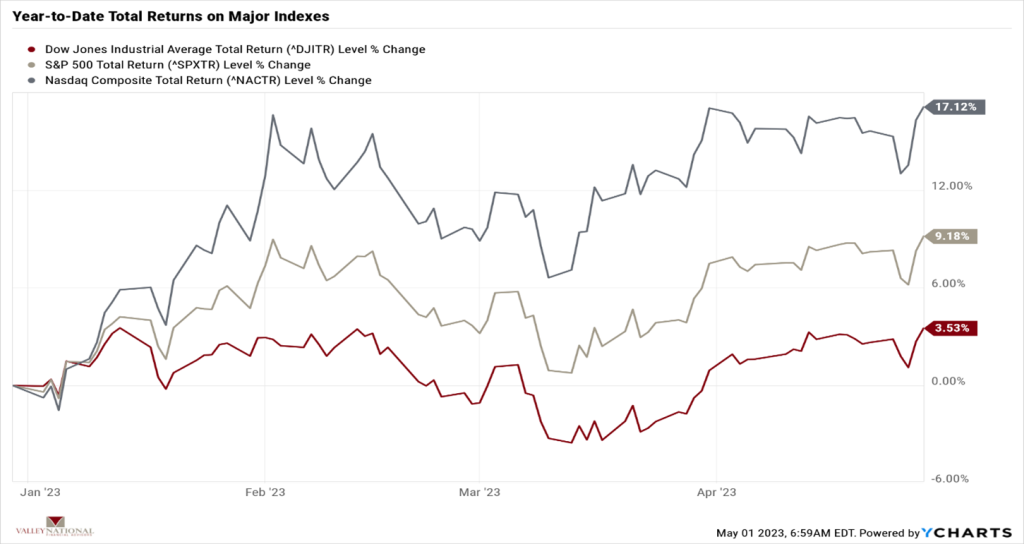

A hit song by the 1980s hair band Quiet Riot was called “Come on Feel the Noise.” Economists, market prognosticators, and business TV folks want investors to get buried in the “noise” of the markets. We at TWC say, “Ignore the noise and listen to what the markets tell you.” As mentioned above, the 1st quarter 2023 GDP came in lower than expected at +1.1%, but the economy still grew! For well over a year, since the yield curve first turned negative in March 2022, economists and others have been calling for a recession that has yet to appear, but the recession “noise” will not stop. Economic cycles are natural, and we could certainly see a mild recession in 2024, but listening to the noise is a distraction because, week by week, the markets are quietly moving higher; see Chart 1 below. Investors more concerned about recession “noise” in 2023 would have missed the gains in markets highlighted below in Chart 1.

Policy and Politics

The FOMC (Federal Open Market Committee) meets this week, and futures markets are pricing in another +0.25% rate hike, marking the 10th rate increase since March of 2022 when this cycle began and placing the upper limit on the Fed Funds Rate at 5.25%. Higher rates were needed to combat rampant inflation brought on by many factors, such as pandemic-related supply chain problems, shortages of many goods, and strong demand for all goods and services coming out of the pandemic. Higher rates have slowed the economy and brought inflation down from over 9% in July 2022 to under 5% as of March 2023. We expect the Fed to raise rates by +0.25% and expect warm language from Chairman Powell around “taking a pause” in rate hikes from here and allowing the data to dictate further actions.

Bank regulators will be busy doing another de-brief on failed First Republic Bank even though the ink is barely dry on the failure paperwork for Silicon Valley Bank and Signature Bank. One item to note is that all three banks above were niche banks and very regional in scope. All three dealt with the technology and venture capital sectors of the economy and were limited regionally to the coasts of the United States. While we at TWC are firm believers in the “there’s never just one cockroach” theory, it does seem like these three bank failures are localized and not endemic to the banking sector overall. Lastly, it is important to point out that in all three cases, depositors were made whole while investors, executives, and owners of the banks lost all.

What to Watch

- Monday, May 1st

- U.S. Recession Probability at 11:00AM (Prior: 57.77%)

- U.S. Retail Gas Price at 4:30PM (Prior: $3.765/gal.)

- Tuesday, May 2nd

- U.S. Job Openings – Total Nonfarm at 10:00AM (Prior: 9.931M)

- Wednesday, May 3rd

- Target Federal Funds Rate Upper Limit at 2:30PM (Prior: 5.00%)

- Thursday, May 4th

- 30 Year Mortgage Rate at 12:00PM (Prior: 6.43%)

It is easy to say, “ignore the noise,” but the noise can be deafening and sometimes impossible to ignore. Bank failures, debt-ceiling arguments in DC, and an aggressive Fed battling inflation shout noise to investors. Meanwhile, the stock and bond markets are moving higher, and the economy is still growing, albeit at a slower pace, but growing. There is a lot of economic news out this week (see What to Watch above), with the FOMC’s announcement on Wednesday topping the charts. Companies are continuing to release 1st Q 2023 earnings, many to the upside, and tech stocks are leading the way as their massive layoffs in 2022-23 are coming through via expense reductions and higher earnings. Do your best to ignore the noise and instead stick to your long-term financial plan. It is ok to listen to ‘80s hair band music (we like the ‘70s better) but avoid the noise.