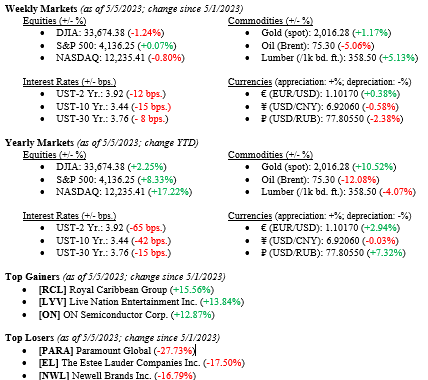

Last week’s market returns perfectly described the feeling of the market these days – lukewarm to cool. The Dow Jones Industrial Average fell –1.2%, the S&P 500 Index dropped -0.8%, yet the NASDAQ squeaked out a paltry +0.1%. These returns matched the mixed results of the week in terms of economic data released, the Fed’s +0.25% rate hike, and continued tremors among regional banks, which sent conflicting signals to the markets and investors. Further, Treasury Secretary Janet Yellen implored Congress to settle the debt ceiling as soon as possible, given her desire to “pay the nation’s bills on time.” Year-to-date returns remain favorable across the board, with the Dow Jones Industrial Average at +2.3%, the S&P 500 Index at +8.3%, and the tech-heavy NASDAQ at +17.2%. In a continued flight to quality trade, the 10-year U.S. Treasury fell 15 basis points last week to close the week at 3.44%.

U.S. Economy

The big news last week that was not news at all was the FOMC’s decision to raise interest rates by +0.25%. Everyone everywhere expected this decision so that markets snoozed on the data. What was important and what moved markets later was Chairman Jay Powell’s emphasis on the change in Fed Statement language, where they removed the phrase “some additional policy firming may be appropriate” and replaced it with data assessment would be used to determine “the extent to which” additional tightening is appropriate. The modest change in wording and Powell’s determination to point it out twice was a nod to investors hoping for a pause in the current rate-hike cycle.

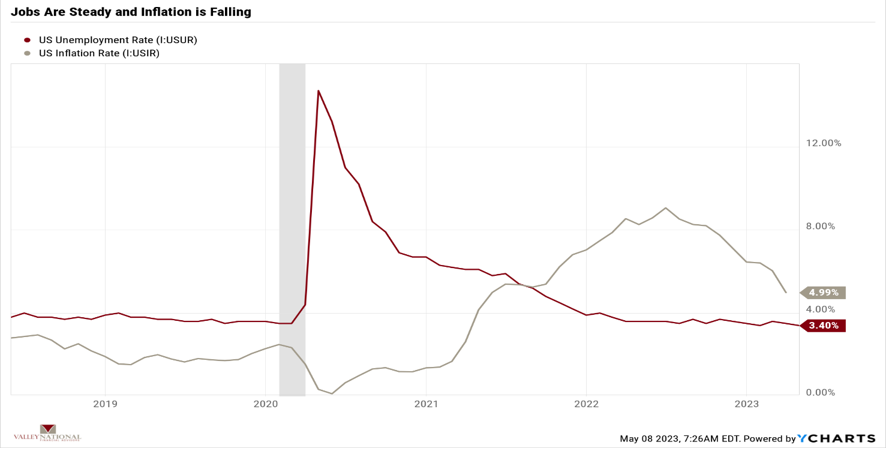

We particularly liked Chairman Powell’s comment about the prospects for an economic “soft landing” regardless of the recent aggressive interest rate hikes. Powell said, “I continue to think there’s a path to getting inflation back to 2% without significant economic decline or significant increase in unemployment.” We are seeing this play out in the economy and markets right now. While the inflation rate has fallen from over 9% last July to just under 5% today, the unemployment rate continues to set multi-decade lows and remains at 3.4%, see Chart 1 below.

We are watching the continued tremors in the regional banking sector, which started in March with the dual failure of Silicon Valley Bank and Signature Bank. Last week, JP Morgan scooped up the failing First Republic Bank, which was near death and suffering from massive deposit outflows. Investors, sharks, and the markets are endlessly searching for “who’s next” among regional banks. From the standpoint of JP Morgan, buying high-quality banks for pennies on the dollar is an excellent value proposition, and we expect consolidation and mergers to continue among the 4,000+ regional and commercial banks in the U.S. While this process takes time to stabilize, the salient point for depositors is that the Fed and the government are standing behind the banking systems with needed support and liquidity.

Policy and Politics

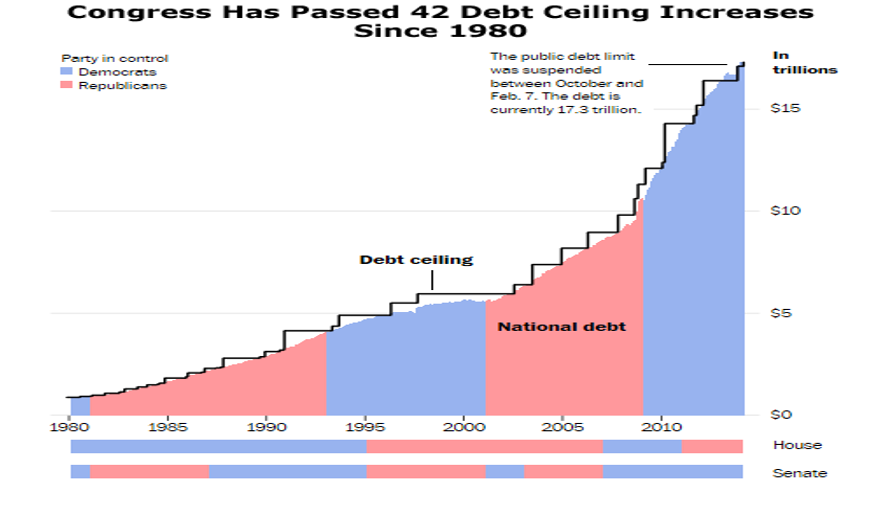

The debt ceiling dance continues in Washington, and investors are getting weary of this dance. Treasury Secretary Janet Yellen has set the latest date that we run out of money to pay bills around June 1, 2023. The current debt ceiling is $31.46 trillion (about $97,000 per person in the U.S.). Yellen was correct when she warned of “catastrophic economic consequences” if the debt ceiling was not raised, forcing the U.S. to default on its debt. Our government has increased the debt ceiling 42 times since 1980, and we expect it to do so again before June 1. Further, this is not a partisan issue per se, as both parties have voted to increase the debt ceiling many times, see Chart 2 below.

What to Watch

- U.S. Inflation Rate for April 2023, released May 10, 2023, prior rate 4.98%

- U.S. Core Consumer Price Index YoY (Year Over Year) for April 2023, released May 10, 2023, prior 5.59%

- U.S. Index of Consumer Sentiment for May 2023, released May 12, 2023, prior 63.5%

The markets are moving sideways because the information out there is sanguine and oddly non-directional. Fed Chairman Jay Powell raised interest rates to combat inflation, which is moving lower all the while, and employment remains solidly strong. Chair Powell is reaching for the dual mandate – 2% inflation and full employment while not crashing the economy but instead hoping for a soft landing. Treasury Secretary Yellen is sounding the alarm on the debt ceiling while Washington DC fiddles. Sadly, DC will fiddle until just before the fire starts. Regional banks are mired in a crisis of confidence among depositors, but thus far, depositors have all fared well in the morass, not so much so for shareholders. We at TWC continue to express our 2023 call of being cautiously optimistic about the markets and the economy for 2023. Speak to your advisor at Valley National Financial Advisors for more information.