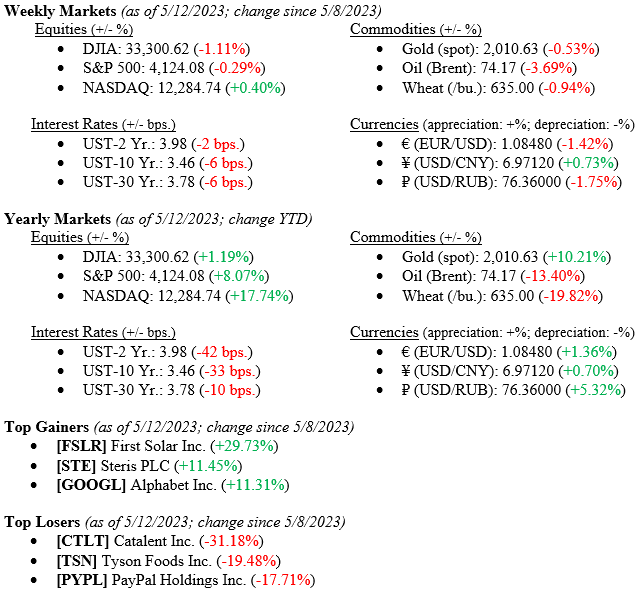

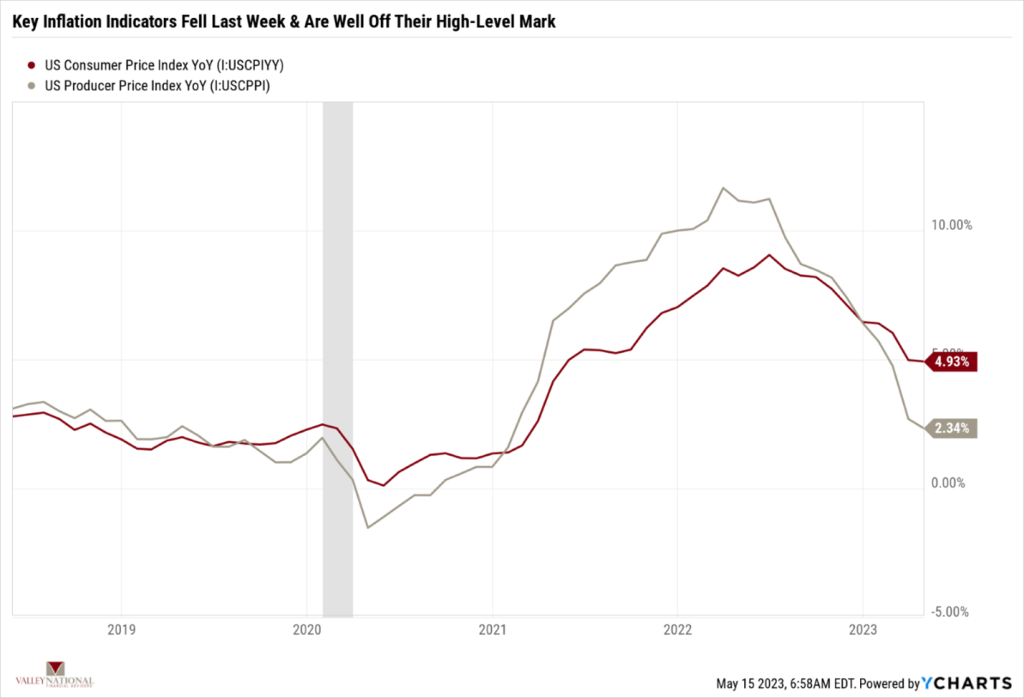

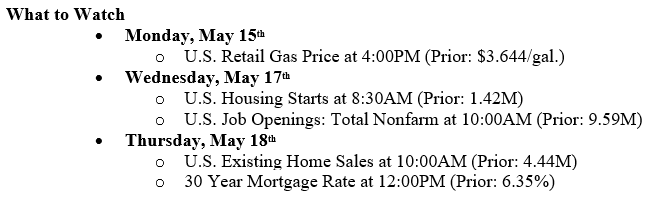

Equity markets continued to languish as the biggest non-news was the lack of a debt ceiling agreement out of Washington, DC. The broader S&P 500 Index and Dow Jones Industrial Average both fell for the week, -1.11% and –0.29%, respectively, while the tech-heavy NASDAQ eked out a paltry gain of +0.40%. The markets have been moving sideways since the April 15th tax payment date as the classic mantra “no news is bad news” only when it comes to Washington. Meanwhile, the regional bank tremors have been quelled to the point where additional issues have subsided. Corporate earnings continue to modestly beat analysts’ expectations, with over 90% of S&P 500 companies reporting 1st quarter results. Last week’s inflation information showed a modest decline in both CPI (Consumer Price Index) and PPI (Producer Price Index) (See Chart 1 Below). Oddly, even with a whispered risk of U.S. government bond default, bond prices rose, and yields fell, with the 10-year U.S. Treasury ending the week at 3.46%, six basis points lower than the previous week.

US Economy

As mentioned above, two key inflation indicators released last week show a further drop in the prices of goods and services that Americans are paying. (Chart 1 below, from Valley National Financial Advisors and YCharts shows U.S. CPI and U.S. PPI). While the average U.S. Inflation Rate (currently 4.93%) is still above the Fed’s target rate of 2.00%, the level has come down from the 9.06% peak we saw in August of 2022. The aggressive interest rate hiking cycle we have seen from Fed Chairman Jay Powell over the past year is certainly working. Understand that the indicators are backward-looking rather than estimates of prices to come. Certainly, the softening in inflation readings that we are seeing gives the Fed the needed “Air Cover” to pause any further rate hikes and allow the economy to continue to react to all the tightening in economic conditions that have already taken place.

Last week also saw a modest tick-up in claims for unemployment benefits. The four-week moving average of claims rose 6,000 to 245,250, the highest level since November 2021. While claims rose, most of the layoffs were concentrated in the technology and housing sectors. Economists noted that while claims rose modestly last week, there are 9.6 million job openings in the U.S. currently, or about 1.6 jobs for every person currently on unemployment. Further, the unemployment rate remains at 3.4%, a near 50-year record low.

Policy and Politics

Nothing else is on the DC policy watch than the debt ceiling crisis. Last week, we showed you that Congress had passed debt ceiling increases 42 times since 1980 under Republican and Democratic Presidents. We expect another vote by Congress to increase the debt ceiling to occur before the June 1 deadline. In the meantime, expect continued brinkmanship and posturing by both sides until an agreement is reached. These are the times when we at TWC wished Washington cared about its constituents rather than simply getting reelected – AGAIN.

Inflation is tracking downward, S&P 500 companies are reporting earnings, not losses, the Fed is nearing or has reached the end of this interest rate cycle, and the labor market, while softening a bit, remains strong with a plethora of job openings and record low unemployment. Why are stocks moving sideways and bonds rallying? Easy answer – uncertainty around the debt ceiling is casting a nasty pall over investors and wearing on consumer confidence. These are sometimes the most challenging times to remain vigilant with your investment plan but remember that long-term wealth is created over many years and through many cycles. Reach out to the experts at Valley National Financial Advisors for advice or questions.