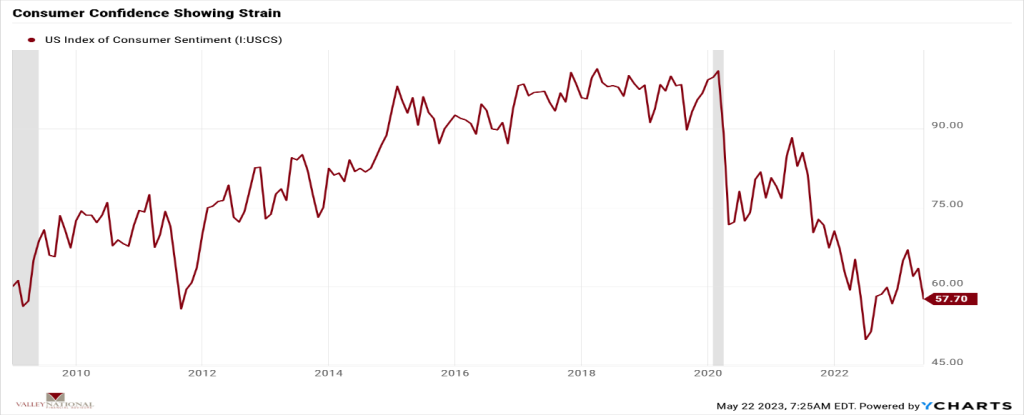

While Wall Street and D.C. continued to worry about a recession or a debt ceiling crisis., or both, the market meanwhile delivered another positive week with the Dow Jones Industrial Average notching a modest +0.38%, the more broadly based S&P 500 Index added +1.65%, and the NASDAQ added an impressive +3.04%. The question investors should be asking is: “What does the market see that Wall Street and D.C. do not?” All year, we have seen this doomsday scenario of a pending recession, the bank tremors in March/April when several large U.S. banks failed, and now the debt ceiling debacle that Washington lawmakers cannot seem to agree to fix. Further, year-to-date returns are quite healthy in stocks and bonds, as seen in the figures below. The 10-year U.S. Treasury bond ended the week at 3.70%, +0.20% higher than the previous week.

U.S. Economy

The big story (homage to retired Philadelphia T.V. News anchor Jim Gardner) in the economy is the debt ceiling mess in Washington. Both sides, the White House, and Lawmakers, know the debt ceiling needs to be raised, but neither side is budging on issues. U.S. House Speaker Kevin McCarthy and President Joe Biden are currently stuck on three “issues:” 1) a level of spending, 2) the length of any spending cuts, and 3) work requirements for persons on public assistance. Treasury Secretary Janet Yellen has stated that June 1st is the day the U.S. Treasury runs out of money to pay its bills. With the upcoming Memorial Day Holiday, this timeline gives Washington 1 week to solve the debt ceiling issue. That said, the only thing everyone on all sides and all Wall Street folks agrees on is that the U.S. will not default on its debt, and this, too, shall pass. As stated above, the market certainly sees this as it quietly ticks higher each week.

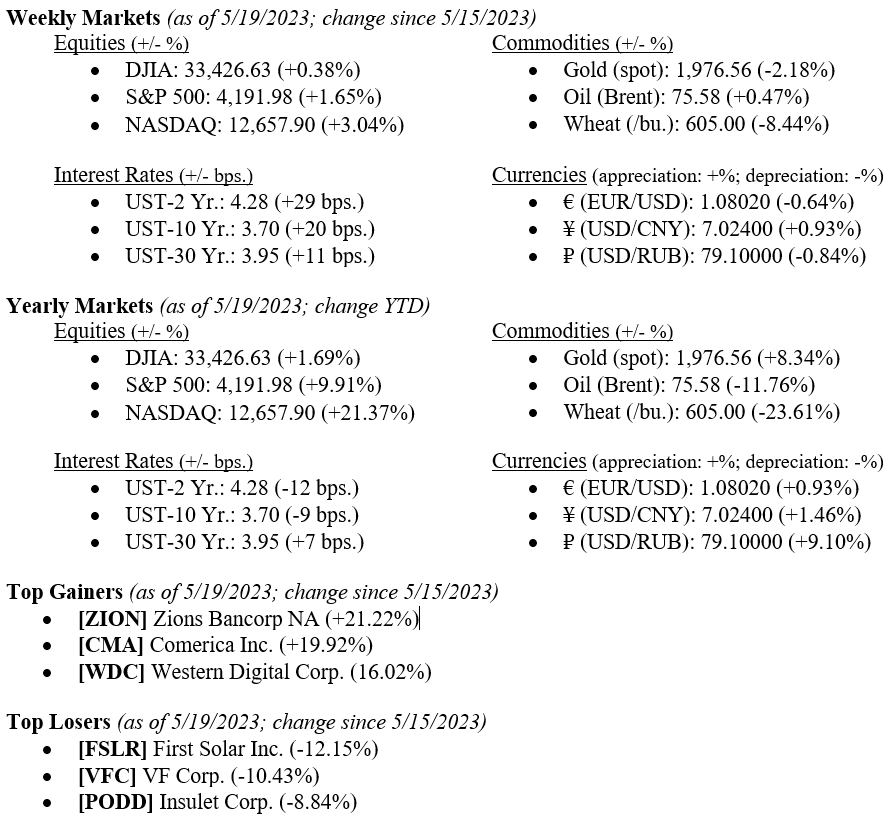

With all the ongoing turmoil and uncertainty being spewed about the markets, one would assume that risk levels are elevated. Rather, market risk, as measured by the Chicago Board of Exchange Volatility Index, is low and well-off recent highs hit during the March 2023 bank troubles. (See Chart 1 below from Valley National Financial Advisors and Y Charts showing the VIX).

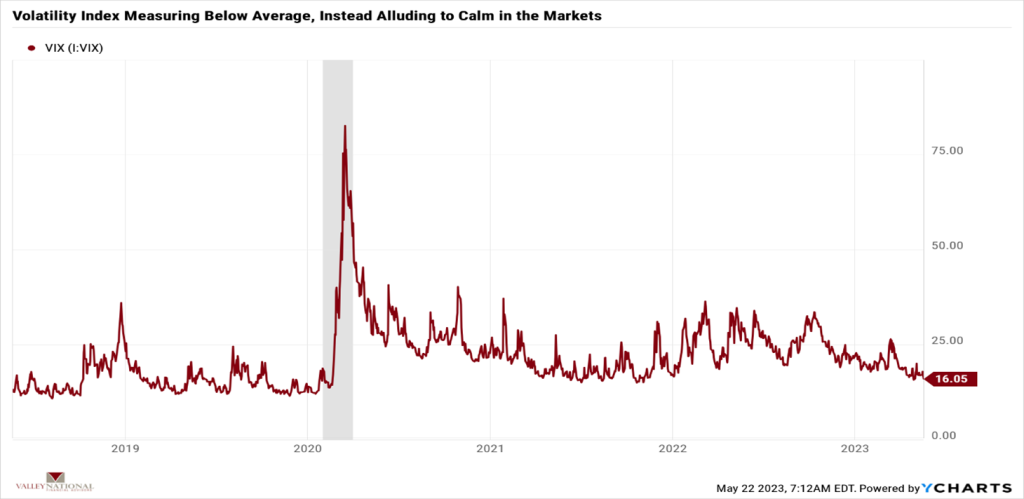

As mentioned above, there is continued uncertainty in the economy and the markets, especially during the debt ceiling issue. And this uncertainty is putting some pressure on consumers, as evidenced by the recent release of the University of Michigan Consumer Sentiment Index. (See Chart 2 below from Valley National Financial Advisors and Y Charts). Consumers make up 65-70% of the U.S. Economy, and their spending is critical to continued growth. This remains an important indicator to watch.

What to Watch

- U.S. Real GDP (Gross Domestic Product) for 1st Q 2023, released 5/25/23, prior Q 1.10%

- U.S. Initial Claims for Unemployment for week of May 20, 2020, released 5/25/23

- U.S. Core PCE Price Index YoY for April 2023, released 5/26/23, prior 4.60%

- U.S. Durable Goods New Orders for April 2023, released 5/26/23, prior 3.23%

- U.S. Index of Consumer Sentiment for May 2023, released 5/26/23, prior 57.70

Summary

One would assume that with the continued turmoil in Washington around the debt ceiling and uncertainty in the economy primarily related to high inflation levels and selective layoffs in the tech sector, the markets would be falling or, at a minimum, moving sideways. This is not the case, as we showed above in our year-to-date returns, particularly in the NASDAQ, which is up +21.37% in 2023 due to implied tailwinds in earnings exactly from the earlier layoffs we saw in this sector. There is one week left for President Biden and Speaker McCarthy to reach an agreement on the debt ceiling, and it is likely to go down the 11th hour before it is solved. Before we know it, the June 13-14 FOMC (Federal Open Market Committee) meeting will be upon us, and the debt ceiling issue behind us. Consumers, in the meantime, are growing weary of the drama yet remain gainfully employed with cash still in their coffers.