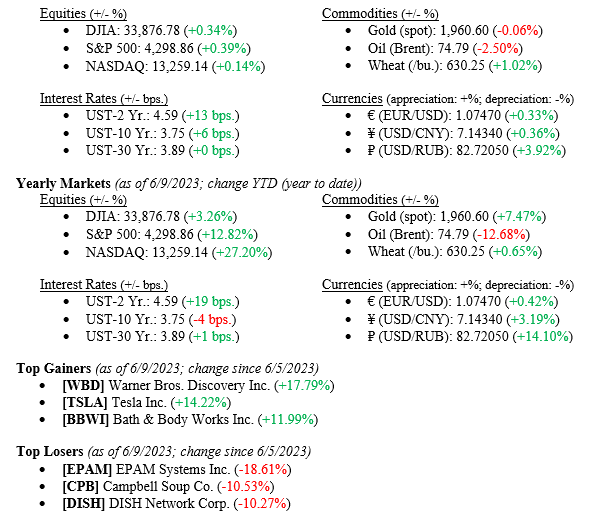

Last week added modest fractional gains to each major index (see weekly returns below) and pushed year-to-date returns even higher across the board. Year-to-date, the Dow Jones Industrial Average is up +3.3%, the S&P 500 Index is up +12.8%, and the NASDAQ is up +27.2%, proving again that diversification across market sectors is important. A major turning point in last week’s market was the S&P 500 Index marking +20% higher since its October 2022 low, which in some market circles means we have officially moved out of the bear market and into a bull market. Had one waited for this “official” marker, you would have missed the +20% in the S&P 500 Index over the past eight months. With the FOMC (Federal Open Market Committee) meeting being held this week, the fixed-income markets were quiet last week, with the 10-year U.S. Treasury increasing six basis points to close the week at 3.75%.

Economy

As mentioned above, the FOMC meets this week, and economists are split on the outcome of either a pause in further rate hikes or a +0.25% rate hike with a pause thereafter. At this point in the interest rate cycle, another 0.25% moving higher does not add a significant amount of tightening to the economy, so we at TWC are agnostic to the outcome of the meeting. Instead, we will be paying attention to Fed Chairman Jerome Powell’s press conference, where the future direction of rates will be discussed. For all the talk about interest rates and concomitant tightening in the economy as a reaction, the U.S. Economy has continued to grow nicely. We have mentioned a famous quote from banker JP Morgan that we will paraphrase here: “Anyone betting against the future direction of the U.S. Economy will surely go broke.”

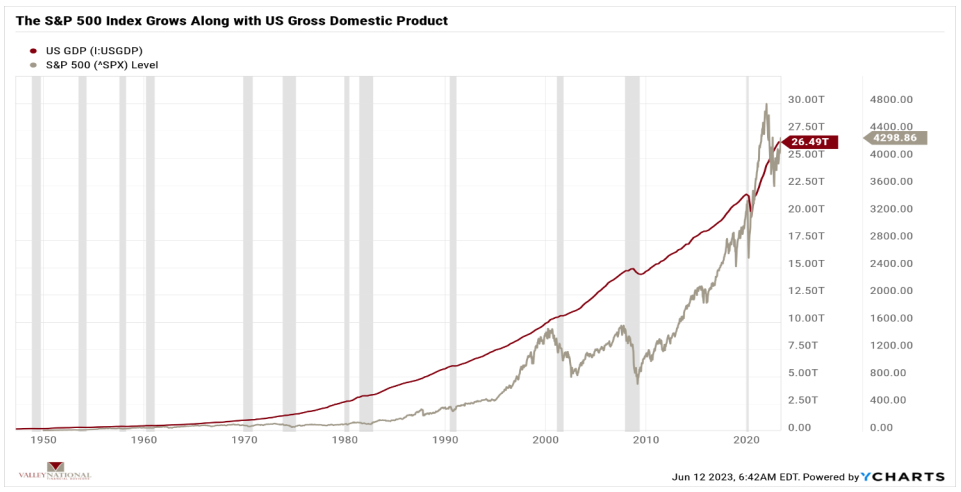

See Chart 1 below from Valley National Financial Advisors and Y Charts showing the U.S. GDP (Gross Domestic Product) and the S&P 500 Index with recessions shaded. Growth in the two is correlated with plenty of dips along the way, but the clear direction is from the bottom left of the chart to the top right of the chart. It would seem true to us at TWC that JP Morgan’s “famous” quote still holds today.

What to Watch

- Tuesday, June 13th

- U.S. Inflation Rate at 8:30AM (Prior: 4.93%)

- Wednesday, June 14th

- Target Federal Funds Rate Upper Limit at 2:30PM (Prior: 5.25%)

- Thursday, June 15th

- 30 Year Mortgage Rate at 12:00PM (Prior: 6.71%)

- Friday, June 16th

- U.S. Index of Consumer Sentiment at 10:00AM (Prior: 59.20)

Last week’s quiet trading session added to year-to-date returns across the board and moved the S&P 500 Index out of bear market territory. We have some important news out this week to watch, including data on U.S. inflation for the month of May on Tuesday and the results of the FOMC meeting on Wednesday. Economists are estimating that the annual rate of U.S. Inflation will fall to 4.1% from 4.9% the previous month, and the FOMC will leave rates unchanged this month. Watch for any major deviations from these estimates, which could be seen as a catalyst to move markets in either direction. Typically, the summer is a quiet period in markets, but we have not seen typical in several years. Reach out to your professionals at Valley National Financial Advisors for assistance or questions.