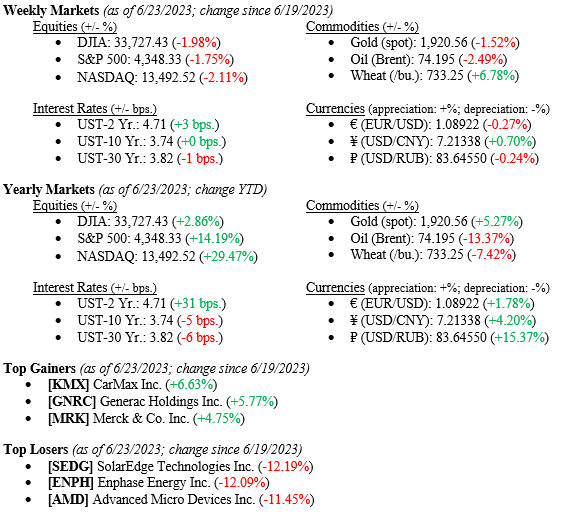

Equity markets snapped a multi-week streak of rallies and ended lower last week. All three major indexes notched losses for the week, with the Dow Jones Industrial Average closing down –1.98%, the S&P 500 Index down –1.75%, and the NASDAQ down –2.11%. Equity markets traded lower as Fed Chairman Jay Powell and other Federal Reserve speakers casually noted that more rate hikes are needed to tame the continuously hot inflation infecting the American economy. Further global economic concerns weighed heavily on economists even as the U.S. economy continues to defy all previous calls for a recession in 2023. The 10-year U.S. Treasury, which we believe to be a harbinger of economic strength, was unchanged last week, closing at 3.74%.

U.S. Economy

As mentioned above, the U.S. Economy has remained resilient in 2023 even as economists and market prognosticators have called for a recession since mid-2022 when the yield curve first turned negative. Recall we at TWC have been consistent in our position that we would not see a recession in 2023. Our call was based on the five simple factors: 1) the housing market, which remains healthy even with higher mortgage rates; 2) corporate earnings continuing to beat expectations, albeit softer ones; 3) a strong labor market with decades-low unemployment rates; 4) bank balance sheets are clean, but lending conditions have certainly tightened after the mid-March bank tremors brought on my failed Silicon Valley and Signature Banks and lastly; 5) the consumer; who continues to spend on things like travel, entertainment, and experiences.

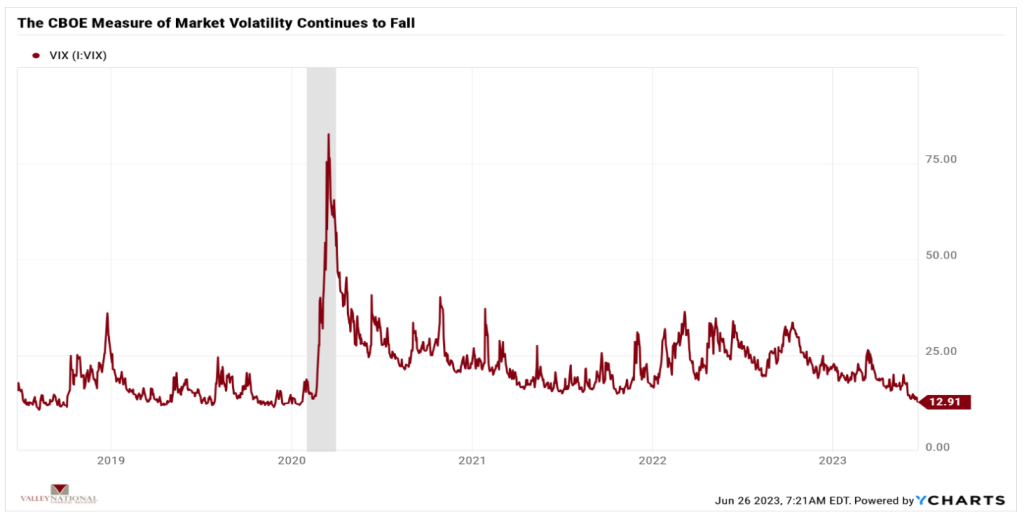

At this point in 2023, a recession is even less likely than at the beginning of the year, as there are even fewer reasons to believe it is possible. Last week, the Federal Reserve Bank increased their estimates for 2Q U.S. GDP (Gross Domestic Product) to a 2.0% growth rate. The markets, which are always more efficient and certainly better predictors of economic activity, are pointing to continued growth and lessening volatility. (Chart 1 below from Valley National Financial Advisors and Y Charts showing the VIX (Volatility Index)). The current VIX reading is 12.9, down from the previous week of 13.2 and down from 29.0 a year ago. The VIX is used as a barometer for how fearful and uncertain the markets are. For a dramatic comparison, the VIX hit 80.9 during the Great Financial Crisis in 2008-09.

What to Watch

- U.S. Durable Goods Orders for May 2023, released 6/27/23, prior 1.39%

- U.S. Initial Claims for Unemployment Insurance for Week of June 24, released 6/29/23, prior 264,000

- U.S. Core PCE Price Index YoY for May 2023, released 6/30/23, prior 4.70%

As noted above, markets took a pause last week in their 2023 rally. Fed Chairman Jay Powell is hinting at more rate hikes this year, potentially 2 more 0.25% hikes, because inflation, while trending lower, has been persistent. The markets have fared well during the Fed’s recent aggressive rate hike cycle, and we expect that an additional 0.50% in rates will be easily absorbed as well. Global concerns persist as well, with the Russia/Ukraine War escalating to include stories of mutiny and coups within Russian leadership. Markets hate uncertainty, as we all know. Energy prices have stabilized since Russia first invaded Ukraine in 2022; further escalations in the war risk a destabilization in energy markets. Market volatility is muted for now, and the US Economy continues to hum along nicely, defying all the negative naysayers. Consumers see the strength in the economy that the markets are seeing, but economists ignore it, and our economy is 70-75% consumer driven. As always, stay focused on your long-term financial plan and realize that generational wealth is gathered over decades, not months or years.