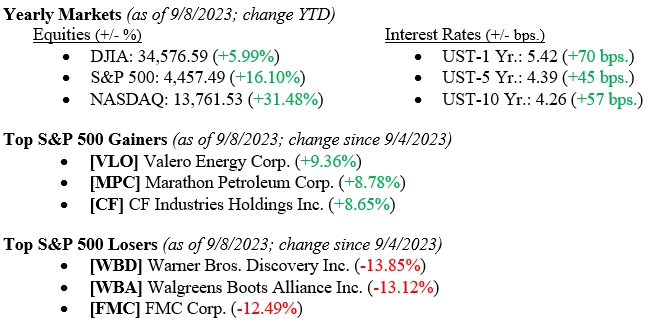

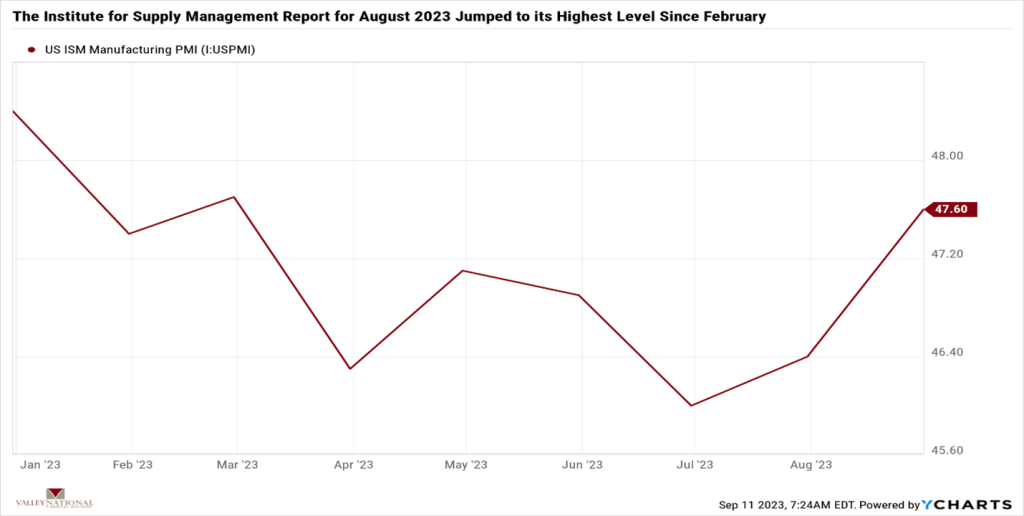

Equity markets closed lower across the board in a holiday-shortened trading week, while interest rates increased in response to modestly positive economic reports. For the week, the Dow Jones Industrial Average fell –0.42%, the S&P 500 Index fell –1.11% and the NASDAQ fell -1.95%. Economic releases during the week included a positive jump in the Institute for Supply Management Report (a gauge of services activity), U.S. Productivity (a measure of labor productivity), and an unexpected drop in weekly unemployment claims; see all charts below. These economic reports pressured bond markets and interest rates rose, with the 10-year U.S. Treasury ending the week at 4.26%, eight basis points higher than the previous week.

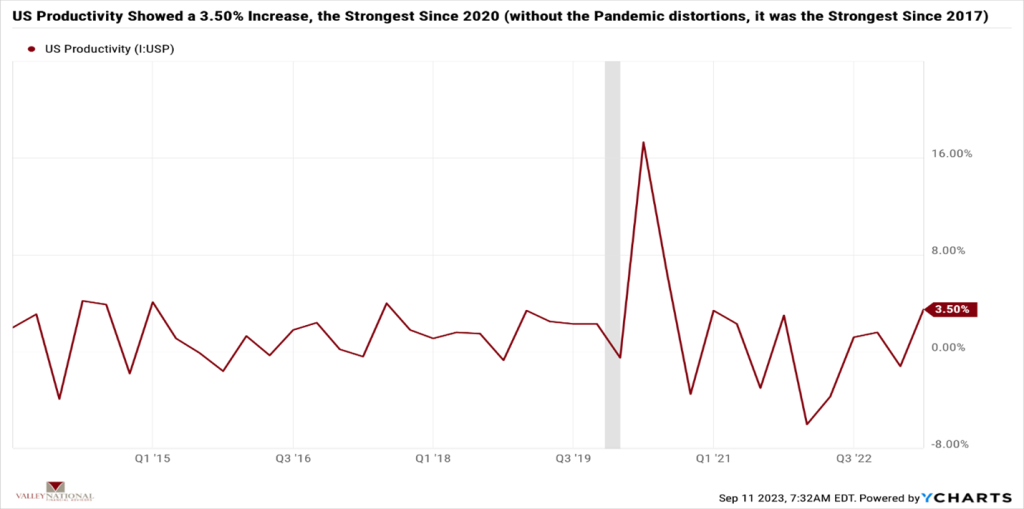

As mentioned above, three economic reports last week were viewed as positive for the economy and impacted interest rates as expected, with the 10-year U.S. Treasury increasing yield to 4.26%. Further, the continued strength in the economy continues to confound the “recession callers,” in fact, many economists have walked back their calls for a recession in the near term. The first unexpected economic report was the drop in weekly unemployment claims to 216,000, the lowest level of Americans filing for unemployment insurance in six months. As discussed at VNFA, labor is one of the strongest indicators of a healthy economy. If consumers are working, they are consuming, and consumption makes up 70-75% of the U.S. Economy. The Institute for Supply Management Report and U.S. Productivity moved unexpectedly higher last week. See Charts 1 & 2 below from Valley National Financial Advisors and Y Charts.

What to Watch

- Monday, September 11th

- Retail Gas Price at 4:30PM (Prior: $3.925/gal.)

- Wednesday, September 13th

- U.S. Inflation Rate at 8:30AM (Prior: 3.18%)

- Thursday, September 14th

- 30 Year Mortgage Rate at 12:00PM (Prior: 7.12%)

- Friday, September 15th

- U.S. Index of Consumer Sentiment at 10:00AM (Prior: 69.50)

The U.S. Economy continues to grow in both the manufacturing and services sectors. U.S. households want to travel and engage in leisure activities such as sporting events and concerts. The labor market remains healthy, and most economists and prognosticators have walked back their calls for a recession anytime soon. Federal Reserve Chairman Jay Powell has clearly stated that further interest rate movements (the next FOMC (Federal Open Market Committee) Meeting is September 19-20) will be completely data dependent. We stand with Chairman Powell at this point and believe the markets are far more efficient than most investors understand. We remain cautiously optimistic about the economy and the markets for the rest of 2023. Certainly, we have concerns about issues like China unilaterally banning government employees from using an Apple iPhone and the global implications of such a move. But these concerns are tempered by solid gains in employment and continued productivity growth here in the U.S. Do not miss Apple’s release of the iPhone 15 on September 12 and the latest U.S. Inflation Rate. Please reach out to your professional at Valley National Financial Advisors for assistance or questions.