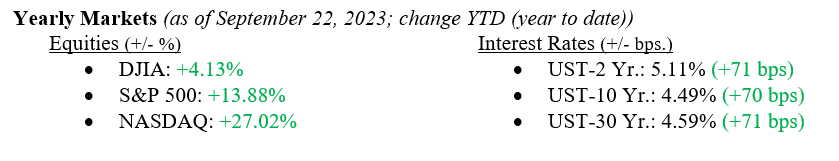

Equity markets suffered losses across the board last week as a pause in rate hikes by the FOMC (Federal Open Market Committee) did nothing to assuage investors’ concerns about the future direction of interest rates being anything but higher and higher for longer. The FOMC, while taking a widely expected pause in rate hikes, stated as plainly as possible that additional rate hikes may be necessary as the inflation war is not yet over. The Dow Jones Industrial Average fell –1.9%, the S&P 500 Index fell –2.9%, and the NASDAQ, the most susceptible index to higher interest rates as technology companies tend to borrow more, fell –3.6%. Further, the announcement from the Federal Reserve and confirmed during Chairman Jay Powell’s press conference pressured bonds, and the 10-year US Treasury rose to 4.49%, thereby offering investors the highest yield in more than ten years on the benchmark Treasury bond.

US Economy

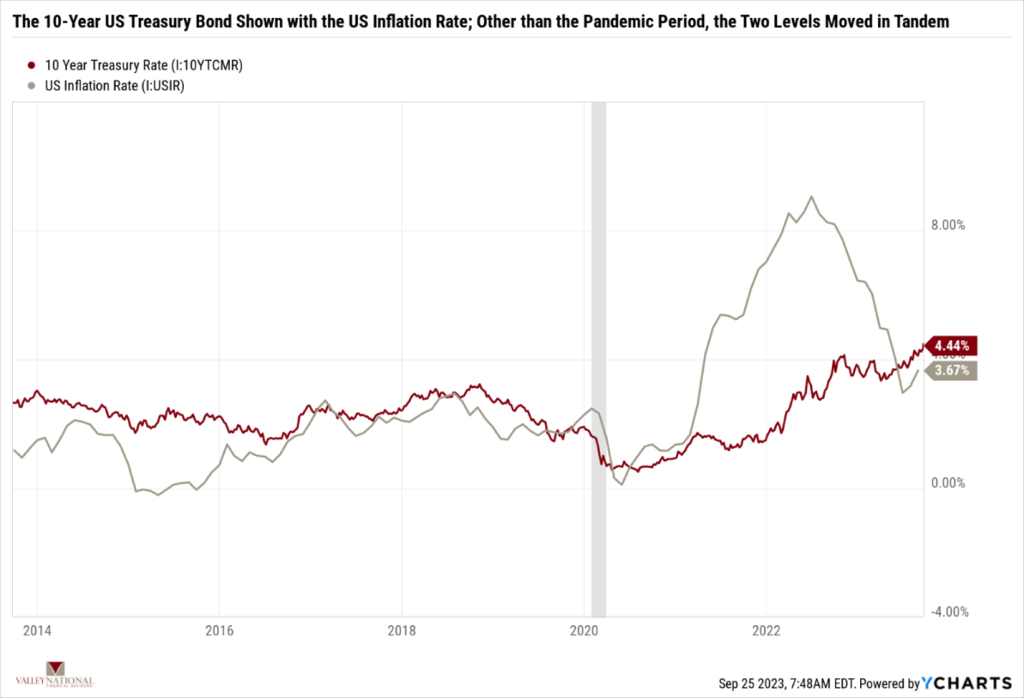

As mentioned, the 10-year U.S. Treasury hit a multi-year high of 4.49%. This move occurred after Fed Chairman Jay Powell noted that the inflation war is not over even though we have moved from over 9% in August 2022 to about 3%. The 3% level is not at their target rate of 2%, and they are not yet willing to hit the brakes on higher rates until we meet that level. Chart 1 below from Valley National Financial Advisors and Y Charts shows the 10-year U.S. Treasury yield and the U.S. Inflation Rate. What is interesting about this chart is how closely the two rates track each other – except, of course, for the outlying “Pandemic Period.” Markets and levels have a way of reverting to the norm or typical average, and we are seeing that now with interest rates simply catching up to the inflation rate and the inflation rate normalizing to interest rates.

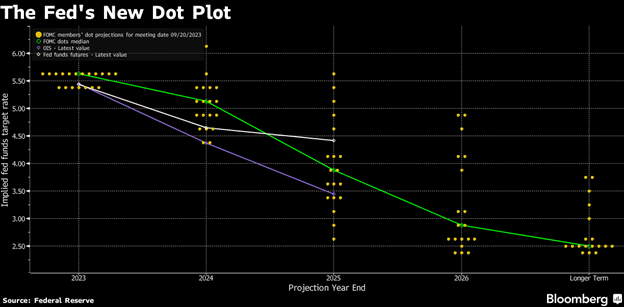

We have always held the Fed at their word and believe that interest rates will remain higher for longer and there is potentially another rate hike or two coming. While this is not in itself shocking, it does push away the notion that rate cuts are on the way, and that is what the stock market was hoping for but did not get last week from Chairman Powell. In fact, the new Dot Plot chart (a visual of each FOMC voting members’ estimate of where the Fed Funds rate will be at a future point, show below in Chart 2 from the Federal Reserve), shows that most of the FOMC members expect rates to remain static well into 2024, in contrast to equity markets which continue to hope rate cuts are coming sooner rather than later.

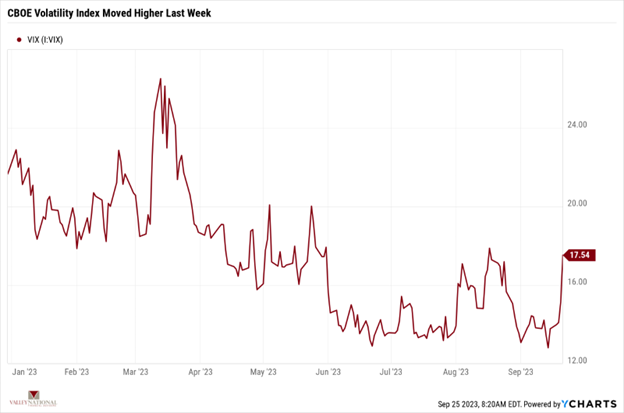

Our final chart, highlighted many times before, is the VIX (Volatility Index), which measures market “expectations” of future volatility or risk. (Chart 3 from Valley National Financial Advisors and Y Charts). Last week saw a jump in the VIX Index to 17.54 from a recent low of 12.8 during this past summer. We would simply say that volatility, like Wall Street traders, takes a holiday over the summer, and risk is returning and moving toward the norm. That said, issues remain on the dashboard that worry us: another Government Shutdown looming, strikes in the Auto and Entertainment industries, resumption of Student Loan payments, and finally, a consumer that could be getting tired, especially after a summer spending spree. Like the market itself, the VIX Index could be seeing the same worries we are seeing.

What to Watch

- U.S. Durable Good New Orders (Month Over Month), released 9/27/23, prior level –5.15%

- U.S. Real GDP (Gross Domestic Product) (Quarter over Quarter) for the 2nd Quarter, released 9/28/23, prior level 2.10%

- U.S. Core PCE (Personal Consumption Expenditure) Price Index (Year Over Year), released 9/29/23, prior level 4.24%

- U.S. Index of Consumer Sentiment, released 9/29/23, prior level 67.70

Certainly, as mentioned above, concerns abound, but let us also take measures of the continued strength in the economy, thanks to the consumer and the labor market, as the unemployment rate remains at 3.8%. Conversely, job openings are declining, indicating that companies are beginning to pull back on their years-long hiring spree. Remember that rate hikes by the Federal Reserve Bank are designed to slow the economy, but that process can take months (typically 9-18 months) to impact economic activity. As everyone is saying these days: “Bonds Are Back.” This is a fancy way of saying you are finally getting something in return for owning bonds – in the case of the 10-year Treasury – your return is 4.5%. Bonds coupled with a well-designed and balanced equity portfolio should provide healthy returns at the appropriate risk level. Take heed of the warnings but try not to get lost in the noise. Lastly, speak with your financial advisor for assistance or questions.