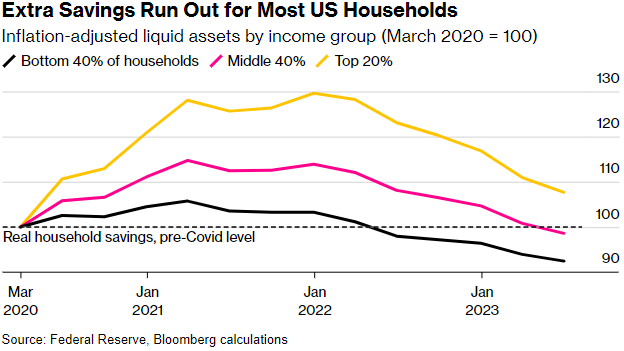

Uncertainty surrounding a potential government shutdown contributed to volatile equity markets last week, with the Dow Jones Industrial Average ending down 1.34%, the S&P 500 losing 0.74%, and the NASDAQ notching a small gain of 0.06%. Fortunately, the shutdown crisis was averted (for now), with Congress passing a bill over the weekend to keep the government funded through November 17th. We believe that until funding is secured for the long term, there will be continued tumult in the markets as stop-gap funding does not solve the underlying issues of a potential government shutdown. As always, please reach out to your advisor at VNFA with any questions or concerns about the markets.

Global Economy

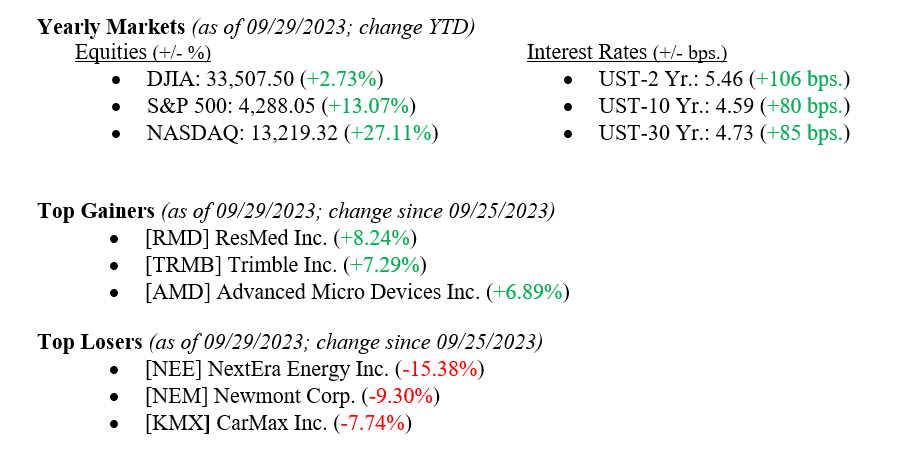

While we still believe the US economy is headed for a soft landing and will avoid a recession, we feel it is prudent to share some data to the contrary to help our readers form their own conclusions. Firstly, economic forecasting tends to assume that what will happen in the future is an extension of what has already happened. Still, we know that recessions are outlier events that do not fit neatly into linear models like this. Chart 1 below shows that optimism surrounding soft landings tends to peak before a recession, using news articles as a proxy.

Chart 1

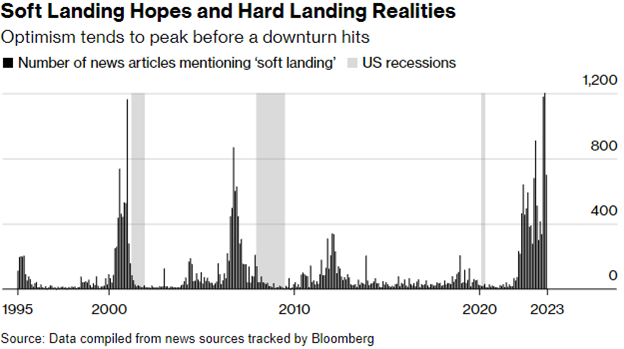

Additionally, the Fed’s forecast for unemployment rose from 3.8% to 4.1% in 2024 (a continuation of current trends), but remember what we just explained regarding forecasts. Chart 2 below shows various confidence intervals for unemployment forecasts leading into 2024. Unemployment is often an important metric for the health of the economy. Still, because the ranges shown in the forecast are so wide, we believe that only a large tail event could elevate levels to either end of the spectrum.

Chart 2

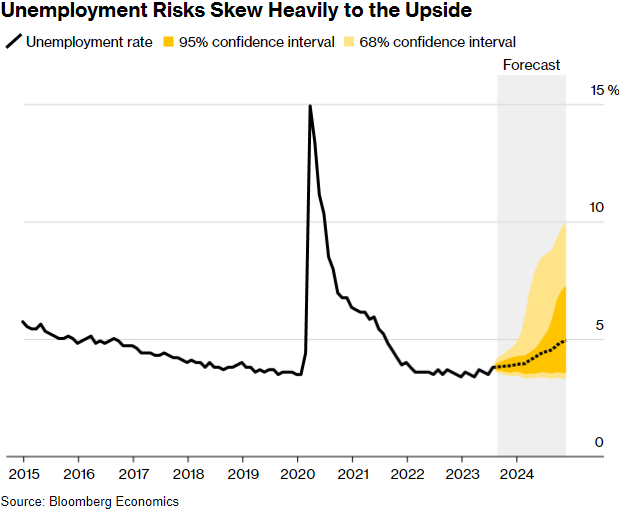

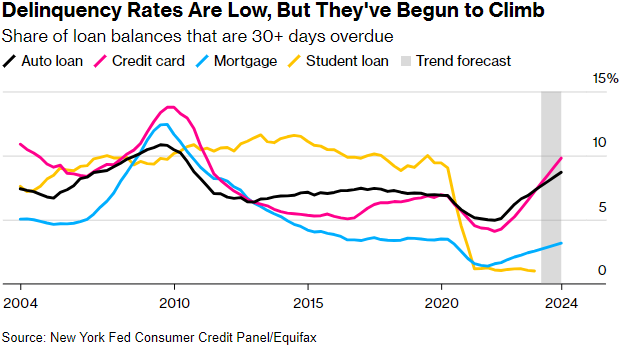

Finally, consumer excess savings are beginning to dip below the pre-Covid levels, which in turn are correlated with increasing delinquency rates across consumer debt. Chart 3 shows the trend of real household savings from March 2020 through now. Chart 4 shows delinquency rates of auto loans, credit cards, mortgages, and student loans through the present, plus the forecast through year-end. Again, we at VNFA do not believe that there will be a recession within the foreseeable future. While our belief is still optimistic, we—just like the Fed—will consider all of this as we remain data-dependent for both expectation revision and strategy development for our clients.

Chart 3

Chart 4

Policy and Politics

On Saturday, the U.S. avoided a government shutdown as Congress passed a stop-gap bill to keep the government funded through November 17th. Uncertainty surrounding this contributed to market volatility for several weeks, but we do not believe that markets will ease, given the short-term nature of this bill. Unfortunately, the budget cycle is something that happens every year or two as Congress pushes off today’s problems for someone in the future to deal with. If there is a shutdown after November 17th, it is expected to cause a 0.1-0.2% reduction in quarterly economic growth for every week it persists. The worst-case scenario is a full-quarter shutdown (highly unlikely) that could drag down GDP growth by up to 2%. All this shows that the shutdown threat is not gone, and we expect it to remain a point of contention leading into the holiday season. Until there is a long-term solution to the issue, stop-gap funding will not quell the markets.

What to Watch

- Monday, Oct. 2nd

- 4:30PM: Retail Gas Price (Prior: $3.963/gal.)

- Tuesday, Oct. 3rd

- 11:00AM: Job Openings, Total Nonfarm (Prior: 8.827M)

- Thursday, Oct. 5th

- 8:30AM: Unemployment Insurance Initial Claims (Prior: 204,000)

- 12:00PM: 30 Year Mortgage Rate (Prior: 7.31%)

- Friday, Oct. 6th

- 8:30AM: Average Hourly Earnings MoM | YoY (Priors: 0.24% | 4.29%)

- 8:30AM: Labor Force Participation Rate (Prior: 62.80%)

- 8:30AM: Unemployment Rate (Prior: 3.80%)

- 3:00PM: Consumer Credit Outstanding MoM (Prior: 10.40B USD)