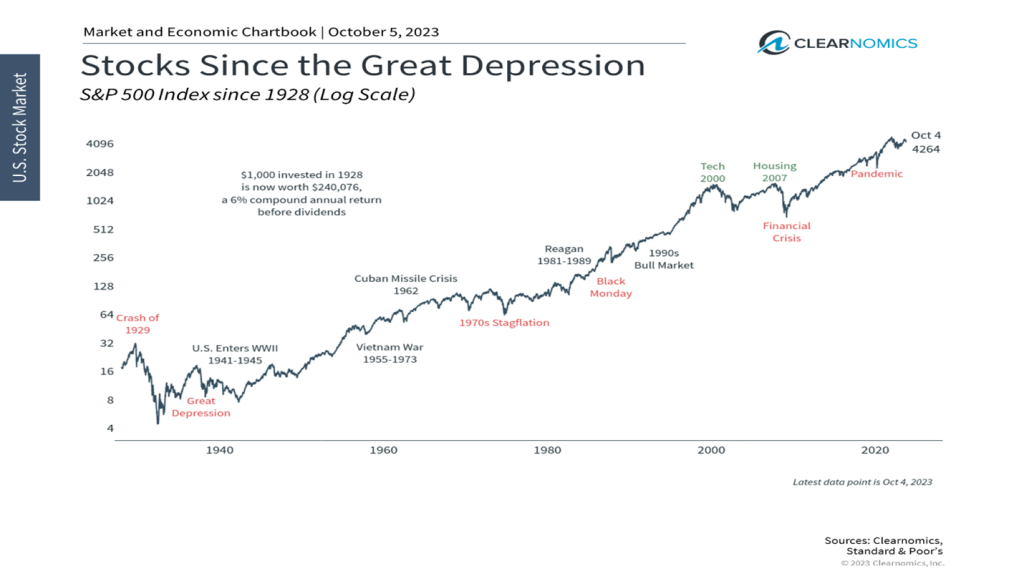

Equity markets were mixed last week, with the Dow Jones Industrial Average falling –0.30%, while the S&P 500 Index rose +0.48% and the NASDAQ rose +1.60%. However, last week is already deep in the rear-view mirror as we now move to an area that stock markets hate but have also proven to be resilient over time. With the attacks on Israel last weekend, which added to our previous concerns involving the US House of Representatives tossing out Speaker McCarthy and sticky inflation, we have added three words to our investment outlook: turmoil, fear, and uncertainty. However, markets are forward-looking and efficient (as seen in Chart 1 below).

US Economy

There is a new level of uncertainty permeating the markets as the full level of escalation within the Israeli/Hamas conflict is yet to be determined. With U.S. citizens involved in the casualties and hostages, the situation is serious and will involve more parties than just Israel and Hamas. Further, if other world players were involved in the planning or execution of this event, the conflict would become even more widespread. Two points are important to remember now: 1) there is always a flight to safety and quality in times like this. U.S. Treasury Bonds should be part of everyone’s portfolio, whether owned directly or via a mutual fund or ETF (Exchange Traded Funds). And 2) markets are efficient and have a long-term perspective. Chart 1 from Valley National Financial Advisors and Clearnomics shows the S&P 500 Index since the Crash of 1929. The point of this chart is simply to show that markets have weather storms for years, whether they were political (wars), economic (recessions), or market-driven (crashes).

On a different note, the U.S. Labor market showed its stubborn resilience last week and further pushed off the risks of a near-term recession as the gain of 336,000 new jobs in September was the largest gain in eight months and about double what the average economist had forecast. Additionally, the unemployment rate remained at a near-term record low level of 3.8%.

Policy and Politics

It is too early to determine the depth and impact of the attacks on Israel by Hamas, as the level of escalation is foggy at best. We have yet to see a drastic move in U.S. Treasuries as the 10-year U.S. Treasury remains unchanged from last week at 4.80%, which on the surface says this event may be contained regionally. We are seeing opposing forces on the fixed-income markets right now with inflation and an aggressive Fed raising rates while fear and uncertainty are just on the sidelines, waiting for an exogenous event to occur or the current situation in Israel to escalate. This event is on top of other global issues, such as the lingering Russia/Ukraine war and tensions with China/Taiwan. From an investor’s perspective, recall Chart 1 above and expect markets to muddle through this and other events, but only over extended periods of time.

What to Watch

- U.S. Retail Gas Price/Gallon, released 10/10/23, prior price $3.93/gal.

- U.S. Core Producer Price Index YoY for September 2023, released 10/11/23, prior 2.16%

- U.S. Producer Price Index YoY for September 2023, released 10/11/23, prior 1.63%

- U.S. Consumer Price Index YoY for September 2023, released 10/12/23, prior 3.67%

- U.S. Index of Consumer Sentiment for October 2023, released 10/13/23, prior 68.10.

As mentioned above, we have moved to a period of uncertainty and turmoil, and as we all know, markets hate both factors as they breed fear. See directly above for this week’s economic releases. We get many critical numbers that the Fed will be interested in seeing, specifically Core PPI and Consumer CPI, which are the main gauges of inflation. The markets have been anticipating the end of the Fed tightening cycle, but we need to see further softening in the inflation data first, so these are important numbers to watch. U.S. Consumers are gainfully employed and remain resilient in spending, but their resiliency could be tested in the coming months, so stay vigilant of the data and global events and reach out to your advisor at Valley National Financial Advisors for assistance or questions.