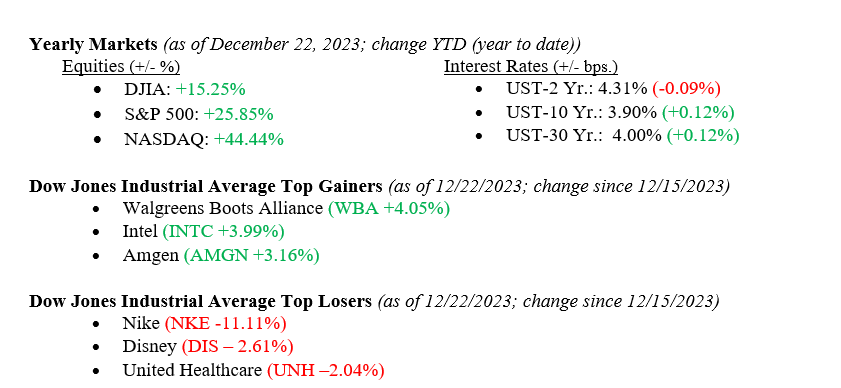

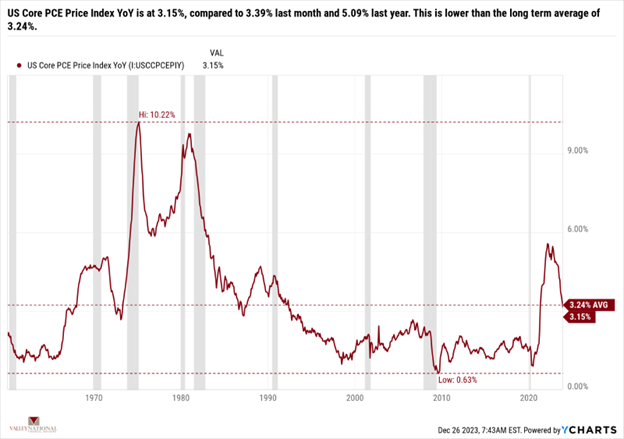

Equities continued their rally last week, with each major index moving higher for the eighth week in a row, with small cap stocks moving higher by a whopping 3%, capping a 24% rise in the Russell 2000 Small Cap Index for the same eight-week period. Strong readings in consumer sentiment (confidence) and the Fed’s favored inflation index, the U.S. Core PCE (Personal Consumption Expenditure) Price Index, fell to 3.165%, lower than last month and last year and below the all-time average. This reading pressured the Fed to announce “Mission Accomplished” to combat inflation. The markets enjoyed these favorable economic reports as they pushed the soft-landing narrative, which posits that the Fed can raise rates enough to reduce inflation but not slow the economy so much as to force a recession. Interest rates barely moved last week, with the 10-year U.S. Treasury falling one basis point to close the week at 3.90%.

U.S. Economy

We have been clear all year about the continued and surprising strength of the U.S. economy. We know the U.S. economy is about 70% consumption-based – which means consumer-based. All year, unemployment has been at record lows as all Americans who wanted to work had a job and, therefore – consumed! Last week, the University of Michigan’s December sentiment reading rebounded to 69.7 from 61.3 in the previous month, the strongest reading of consumer opinion in months and clearly pointing to continued optimism about the economy and easing inflation. As mentioned earlier, the Fed’s favored measure of inflation is the U.S. Core PCE Index, which dropped to 3.15% last week. See Chart 1 below from Valley National Financial Advisors and Y Charts. Importantly, the 3.15% reading fell below the long-term average of 3.24%.

Policy and Politics

Washington, DC, remains on Christmas break this week but will need to hit the ground running next week as the budget agreement reached last fall expires on January 19, and a new budget must be negotiated to avoid a partial government shutdown. We received some warming news about the Russia/Ukraine war as Vladimir Putin vowed he might be open to a cease-fire. However, the Israel/Hamas war dragged on, and further Middle East tensions accelerated. We continue to watch both events.

What to Watch

- U.S. Initial Claims for Unemployment Insurance for week of December 23, 2023, released 12/28/23, prior 205,000.

- U.S. 30 Year Mortgage Rate for week of December 28, 2023, released 12/28/23, prior rate 6.67%

Thus far in 2023 (granted, we only have three trading days left in the year), the markets have rewarded the patient investor. Fed Chairman Powell seems to have delivered his “Goldilocks” scenario, as the economy has done quite well in 2023 despite a continued aggressive path on rate hikes needed to combat inflation. Inflation has come down as stock market indexes have given us double-digit returns yearly. Certainly, the Magnificent 7 Mega-Cap Tech Stocks carried the day and led the way, but all major indexes were dragged along, too. If 2023 was the year of the consumer, 2024 may be the year of earnings as companies try to balance additional labor for sustainable growth with a need to produce growing earnings for Wall Street. Looking out three-to-six months, we remain cautiously optimistic about the U.S. economy, the U.S. consumer, and the markets. Have a Happy New Year, and please contact your financial advisor at Valley National Financial Advisors with any questions.