William Henderson, Chief Investment Officer

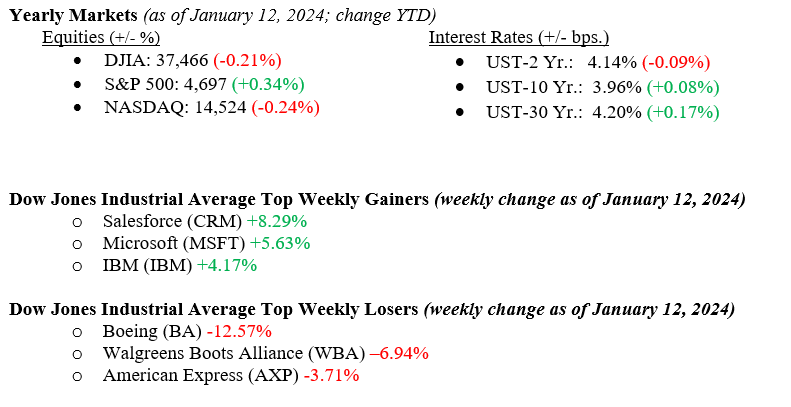

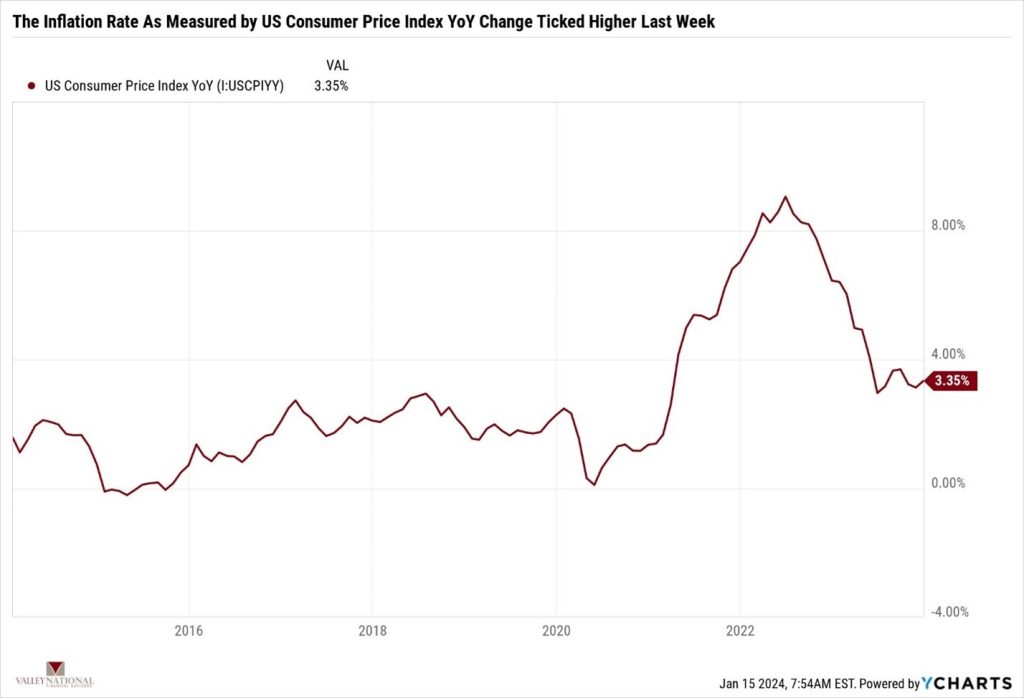

Equity markets snapped back last week, with each major index returning positive, yet varying, returns for the week ended January 12, 2024. The Dow Jones Industrial Average returned just +0.34%, while the S&P 500 Index returned +1.84%, and the tech-heavy NASDAQ returned +3.09%. Indeed, the returns varied by index, but the direction was the same for all three – positive for the week. While the U.S. inflation rate, as measured by the year-over-year consumer price index, ticked a bit higher last week, the general trend in inflation continues to be lower. See Chart 1 below from Valley National Financial Advisors and Y Charts. Further news from Boeing (BA) around the grounding of the 737 Max planes put significant pressure on the stock price, and much of the Dow’s performance vs. the broader indexes is attributed to BA.’s price movement. In the fixed-income markets, the 2-year and the 10-year U.S. Treasury moved lower, with the 10-year ending the week at 3.96%, nine basis points lower than the previous week.

U.S. Economy

As mentioned above, inflation moved slightly, signaling to the Fed and Chairman Jay Powell that the inflation story still has a few more chapters left. While not a significant jump, the tick higher from 3.14% to 3.35% shows that the final move to 2.00% may take a bit longer than previously thought. Further, we at Valley National Financial Advisors believe that the markets are too aggressively pricing in rate cuts, specifically as early as March of this year. We expect the economic data to dictate rate cuts and not until the second half of 2024. We are also watching the volatile energy markets due to continued global turmoil and clear escalations in the Middle East, with the U.S. & U.K. taking out Houthi military targets in Yemen.

Policy and Politics

U.S. Speaker of the House, Mike Johnson, and U.S. Senate Leader Chuck Schumer reached a tentative spending deal last week that should avert a government shutdown. We expect final details out of Washington this week. The U.S. presidential election cycle kicks off with the Iowa Caucuses starting this week. Along with 50% of the world’s population, Americans will head to the polls this year to elect many new leaders in local, state, and national elections.

What to Watch This Week

- U.S. Building Permits for Dec 2023, released 1/18 prior to 1.46M

- U.S. Housing Starts for Dec 2023, released 1/18, prior 1.56M

- 30-year U.S. Mortgage rate for the week of Jan 18, released 1/18, prior rate 6.66%

- U.S. Initial Claims for Unemployment Insurance for the week of Jan 13, released 1/18, prior 202,000.

We will continue to get 4th Quarter EPS reports from companies this week. Most big banks (JPM, BA, Wells Fargo) reported higher earnings last week, beating Wall Street Analyst expectations. This week is a holiday-shortened trading week, but watch for further EPS releases from the financial sector, including PNC, Goldman Sachs, and Schwab. While inflation ticked up a modest bit last week, the path is clear at this point, and the heavy lifting in the inflation battle is behind us. The markets are pricing in rate cuts this year; as usual, the timing of said rate cuts will be critical, and all the while, we will watch the data and listen to the Fed. Reach out to your advisors at Valley National Financial Advisors for questions or help.