By: Chief Investment Officer, William Henderson

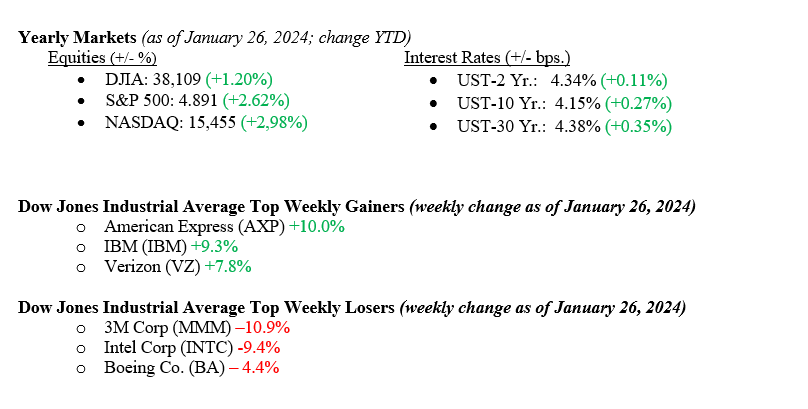

Positive economic news in the form of strong 4th quarter 2023 Real GDP (Gross Domestic Product) (+3.3%) and a lower year-over-year reading on the Core PCE (Personal Consumption Expenditure) Price Index (2.93%) gave equity markets the needed stimulus to move higher on the week with each major market index rallying. Further, year-to-date returns on all three major market indexes are now in positive territory (see figures immediately below), with technology stocks leading the way, as evidenced by the NASDAQ. Fixed income markets stayed quiet in front of this week’s FOMC (Federal Open Market Committee) meeting, where Fed Chairman Jay Powell will discuss monetary and the future direction of interest rates. The 10-year U.S. Treasury remained unchanged to week to close at 4.15%.

U.S. Economy

As mentioned, the U.S. economy continues to exceed economists’ expectations with robust growth quarter after quarter and year after year. Last week, we saw the 4th quarter 2023 Real GDP rise 3.3% at an annualized rate, well above consensus. This was undoubtedly a slowdown from the 4.9% pace we saw for the 3rd quarter of 2023; it pushed full-year Real US GDP to 3.1%, for a year when most of the so-called “experts” were instead calling for a recession. We believe the ongoing strength of the U.S. economy moving into 2024 will weigh heavily on the FOMC’s decision around the timing, magnitude, and number of rate cuts we see this year. While economists and prognosticators can argue whether we see rate cuts in March or June, the point is that the direction of interest rates (certainly in 2024) will be lower, which is good news for equities.

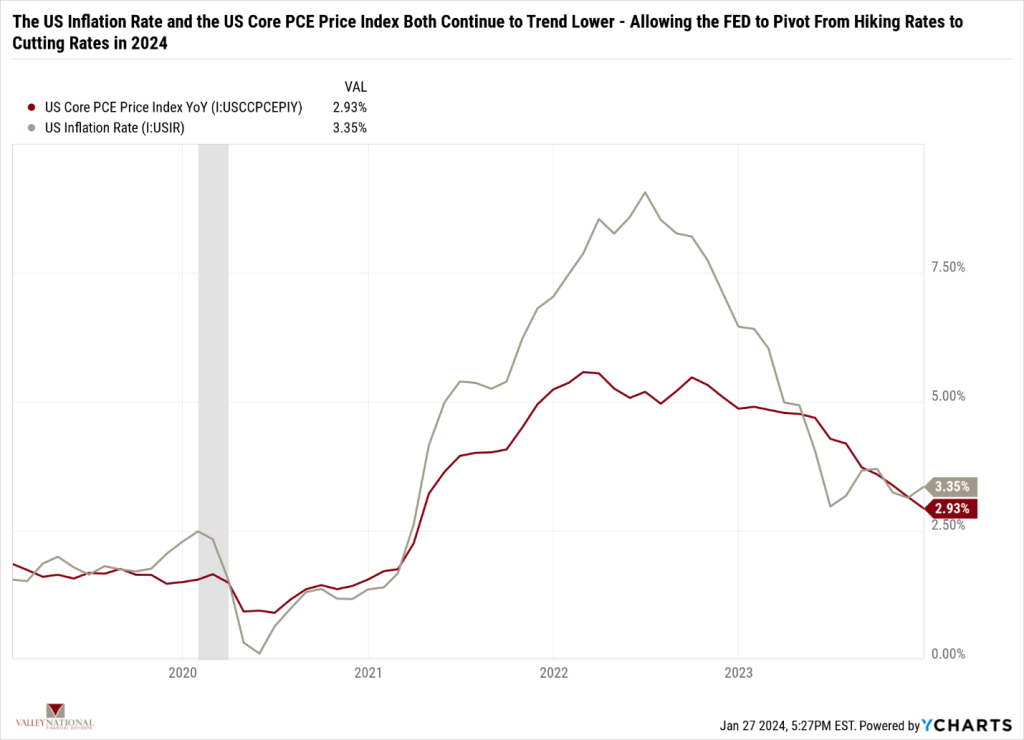

Another critical piece of economic news we saw last week was that the year-over-year Core PCE Price Index declined by 0.22% to 2.93% (see Chart 1 below from Valley National Financial Advisors and Y Charts). Core PCE is one of the indicators the FOMC follows closely to help gauge the direction of inflation. The continued move lower in Core PCE highlights the effects of recent monetary policy (higher interest rates) to combat inflation.

Policy and Politics

As readers of The Weekly Commentary know, we tend to be optimists here and typically view the glass as half-full most of the time. That said, the continued widespread global turmoil worries us, especially the Israel/Hamas War and the spillover effects we are seeing in the Middle East. Over the past weekend, three U.S. service members were killed, and at least 34 were injured in what is assumed to be an Iranian-backed militia’s drone strike on a U.S. base in Jordan. This marks the first time American troops were killed in hostile actions by enemy militants. We have stated clearly before that as long as conflicts, whether Israel/Hamas or Russia/Ukraine, remained regional, the impact on the markets would be minimal and manageable. While we do not yet know what President Biden’s reaction will be, the ongoing risks are escalating.

What to Watch This Week

- U.S. Job Openings: Total Nonfarm for Dec 2023, released 1/30, prior 8.79M

- Target Fed Funds Rate (FOMC Meeting) released 1/31, current upper limit rate 5.50%

- U.S. Nonfarm Payrolls MoM (Month Over Month) for Jan 2024, released 2/2, prior 216,000.

- U.S. Unemployment Rate for Jan 2024, released 2/2, prior 3.7%

- U.S. Labor Force Participation Rate for Jan 2024, released 2/2, prior 62.50%

- U.S. Index of Consumer Sentiment for Jan 2024, released 2/2, prior 78.8.

The U.S. economy continues to surprise to the upside in terms of growth and expansion. Inflation continues to moderate, giving Chairman Powell and the FOMC room to lower interest rates, but timing remains the issue. Please reach out to your advisor at Valley National Financial Advisors for assistance. However, global turmoil not only persists but is worsening as the Israel/Hamas War is spilling over to the greater Middle East and impacting trade routes through the Red Sea. Corporate earnings remain positive, and many 4th quarter reports surpass estimates. Not surprising is that the technology sector continues to lead the way. Any major escalation is a global event that will trigger a flight to safety via the U.S. Treasury. There is a lot of economic data to digest this week, with the FOMC meeting on Wednesday, then the unemployment rate for January, and finally the Index of Consumer Sentiment on Friday. Pay attention to the news, watch the data, and be vigilant.