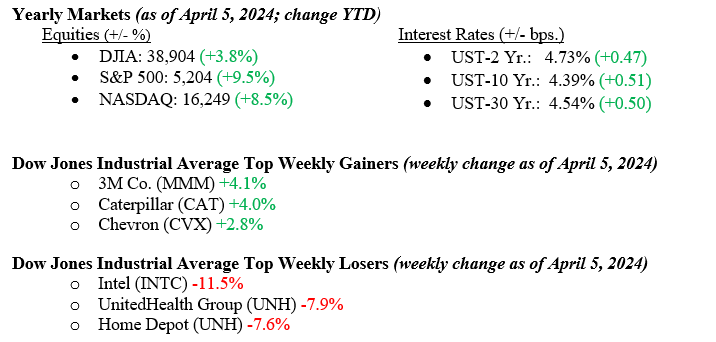

Geopolitical tensions combined with updates on labor markets fueled a volatile week of trading in both stocks and bonds. The Dow Jones Industrial Average fell -2.3% for the week, the S&P 500 Index fell –1.0%, and the NASDAQ fell -0.8%. Energy was the best-performing sector for the week (+2.8%), while Health Care was the worst-performing sector (-3.9%). First-quarter earnings season begins this week with the large-cap banks. JP Morgan, Wells Fargo, and Citigroup will report results this Friday. As the “higher for longer” feeling sunk into the fixed-income markets, traders reacted by selling bonds, and as a result, the 10-year Treasury rose 18 basis points to close the week at 4.39.

U.S. Economy

Strong economic results raised overall concerns about the Federal Reserve rate cut timeline. The week ended positively with a robust jobs report indicating a healthy labor market, low unemployment, and steady wage growth, easing inflation worries. Despite concern over Fed actions, markets closed with optimism, interpreting the jobs report as a sign of continued economic and corporate growth. We continue to closely monitor the price of oil, which surged to a six-month high on Friday. A sustained upward trend in oil prices could reignite inflationary pressures, complicating Federal Reserve efforts to manage inflation. See the chart below from Trading Economics, which shows Crude Oil prices over the last year.

Policy and Politics

Over the weekend, news of the Israeli military’s withdrawal of ground troops from the Gaza Strip sparked optimism. This comes as Egypt offers to host a new round of talks aimed at reaching a ceasefire and hostage release deal. Both Israel and Hamas have agreed to participate. Over the last week, Russian drone attacks in Kharkiv intensified last week, causing casualties and damage. National polls indicate a continued tight race with President Biden and former President Trump neck-and-neck as Democrats claim a significant fundraising lead over Republicans.

Economic Numbers to Watch This Week

- U.S. Consumer Price Index for March 2024, prior 0.4%

- Minutes of Fed’s March FOMC meeting.

- U.S. Producer Price Index for March 2024, prior 0.6%

- U.S. Import Price Index for March 2024, prior 0.3%

Last week, several Federal Reserve presidents provided updates, reinforcing the view that the economy continues to perform well. We look forward to updates from multiple large banking institutions later this week, which should provide valuable data points on the banking industry and economy. As more companies start releasing their earnings in the upcoming weeks, we will be listening for indications of improved sales and earnings growth across a wider spectrum of businesses beyond the dominant mega-cap tech stocks. Geopolitics will continue to be a risk that could derail the otherwise healthy macroeconomic outlook. Please reach out to your advisor at Valley National Financial Advisors with any questions.