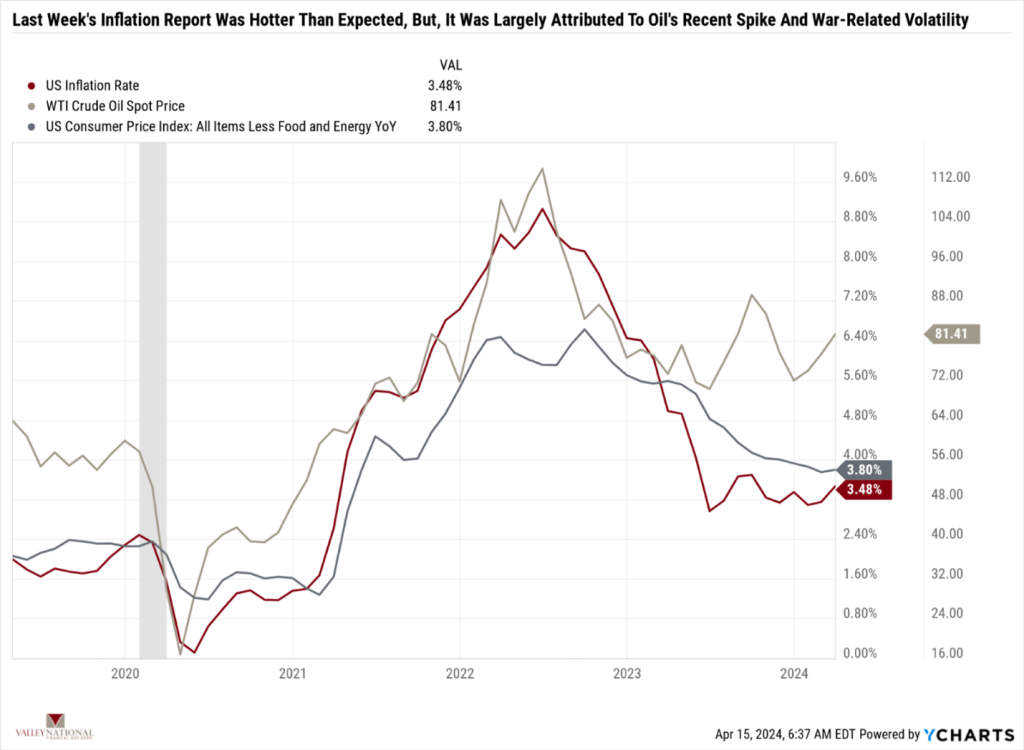

A hotter-than-expected inflation report on Wednesday and an uptick in Iran-Israel geopolitical tensions lead to a poor performance for all three major equity indexes in the week. The Dow Jones Industrial Average fell –2.4%, the S&P 500 Index dropped –1.6%, and the NASDAQ, propped up by a few healthy tech stock returns, only fell –0.5%. Corporate earnings season started with good earnings reports from several banks. However, the results were overshadowed by concern over the impact of higher interest rates on the bank’s net interest income. Along with the high U.S. Inflation report, oil spiked again due to increased geopolitical tensions. While the 10-year U.S. Treasury initially moved higher after the inflation report to 4.59%, the global tensions moved the 10-year Treasury lower by the week’s end to close at 4.50%.

U.S. Economy

Fed rate cuts are further off than expected as inflation is still hotter than desired. That has been our mantra for quite some time, as we believe the economy’s strength warrants holding off on any rate cuts for now. In Chart 1 below, from Valley National Financial Advisors and Y Charts, we show the U.S. Inflation Rate, U.S. Consumer Price Index Less Food & Energy, and WTI Spot Crude Oil Price. As shown in the chart, the recent price increase is attributed to the run-up in oil prices, which are always very volatile, and lately, it has been due to tensions in the Middle East. Inflation continues to move lower year-over-year with obvious bumps in the road, but the path from 9% inflation in 2022 to the 2% Fed target was never going to be linear or easy.

Policy and Politics

The melt-up in tensions in the Middle East is concerning as previously, the war was limited to Israel/Hamas; now, with Iran directly attacking Israel, we worry about what further escalation and expansion can occur. Certainly, Iran’s attack was limited in nature and mostly designed to be a weak show of retaliation for Israel’s attack on Iranian assets in Syria. The U.S. and U.K. (United Kingdom) are also now involved as they both helped to defend and defeat the Iranian drone attack. If this latest escalation settles down, we expect markets to follow suit and settle down as well. It is important to note that if there is further retaliation from either side, it would force a flight to safety and quality, and we would expect U.S. Treasuries to rally and yields to fall as a result, so stay tuned!

Economic Numbers to Watch This Week

- U.S. Housing Starts, prior 1.518M

- U.S. Existing Home Sales (monthly), prior 4.38M

- U.S. claims for Unemployment Insurance for the week of April 13, 2024, prior to 211,000

- 30-year Mortgage Rate for the U.S., prior to 6.88%

It is not too difficult to see a glass half empty these days as hotter-than-expected inflation data in the U.S. and global unrest and tensions escalating all around us. It remains vital to stay focused on important things like the underlying strength of the U.S. Economy. Companies are making money and, therefore, employing people. When consumers work, they are consuming, and our economy mainly relies on consumption. We expect the Fed to remain on track to lower rates this year, but later in the year and in much smaller doses than the markets are projecting. Please reach out to your advisor at Valley National Financial Advisors with any questions.