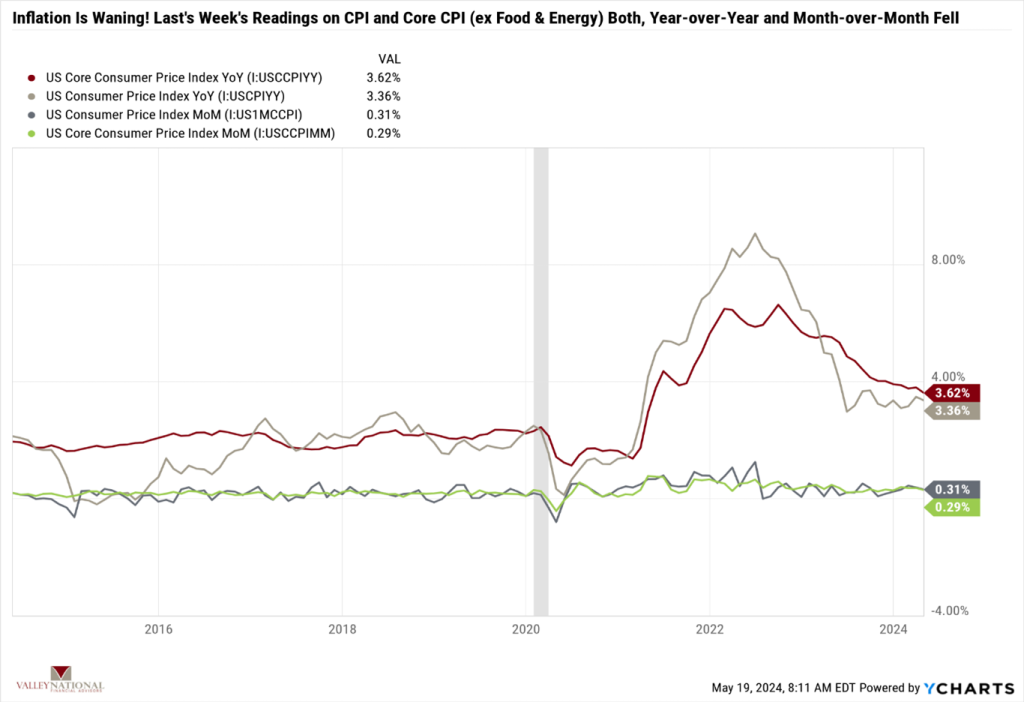

Certainly, the Dow closing above 40,000 was a big story on Wall Street last week. Still, we were just as impressed by the subtle move lower in the CPI reading on Wednesday and the U.S. Treasury market’s reaction to it, which once again confirmed that the Fed’s next move would be to lower rates. U.S. equities posted another positive week, the fifth in a row for 2024, with the Dow Jones Industrial Average increasing by 1.2%, the S&P 500 Index increasing by 1.5%, and the NASDAQ winning the week with an increase of 2.1%. The 10-year U.S. Treasury closed the week at 4.42%, eight basis points lower than the previous week.

U.S. & Global Economy

Last week’s economic data showed continued stability in the macroeconomic landscape. April’s consumer price report indicates a slight easing in inflationary pressures. However, retail sales softened marginally, likely due to temporary fluctuations rather than a significant decline in consumer activity. Industrial production and housing stats data reflect sectors struggling with elevated interest rates. Despite these challenges, the economy continues its modest growth trajectory amid persistent inflation and tightening monetary policy. Investors continue to closely monitor inflation metrics for clues on potential Federal Reserve policy adjustments. While April’s Producer Price Index (PPI) rose modestly above expectations, driven by higher service prices, the Consumer Price Index (CPI) showed improvement with a 0.3% increase in both headline and core inflation, with lower year-over-year rates. Notably, services prices exhibited a more favorable trend, matching the previous quarter’s pace. Projections for the Fed’s preferred inflation metric, the PCE deflator, suggest a moderate reading for April, indicating a possible continuation of inflation moderation amidst short-term fluctuations. However, sustained improvement in inflation may be necessary to prompt the Federal Reserve to enact interest rate cuts. Federal Reserve Chair Powell said he expects inflation to fall, but his confidence “is not as high as it was.”

On Friday, the second largest economy in the world, China, unveiled important new measures aimed at revitalizing both commercial and residential property markets. The new stimulus aims to reduce minimum mortgage down payments and eliminate interest-rate floors for first and second homes. This news came after a fresh batch of disappointing data on retail sales and property data.

Policy and Politics

Investors have become increasingly numb to geopolitical developments. In addition to still intense global conflicts between Russia and Ukraine and Israel and Hamas, last week saw the forging of closer ties between Russian President Putin and Chinese President Xi following meetings between the two leaders.

On Tuesday, President Biden implemented significant tariffs on Chinese products, including electric vehicles, advanced batteries, solar cells, steel, aluminum, and medical equipment. This move is expected further to escalate tensions between the world’s top two economies.

Regarding the election, President Biden is behind former President Trump by just under one percentage point in national polls and approximately two percentage points in swing states crucial for securing the electoral vote.

Economic Numbers to Watch This Week

- U.S. Existing Home Sales for April 2024, prior 4.19 million

- U.S. Initial Claims for Unemployment Insurance for the week of May 18, 2024, prior 222,000.

- U.S. New Home Sales for April 2024, prior to 693,000.

- U.S. Durable Goods Orders for April 2024, prior 2.6%

Despite some economic concerns, the stock market surged to new record highs, propelled by optimistic inflation figures, strong corporate earnings, and anticipation of forthcoming interest-rate reductions. China’s efforts to bolster its property market amidst declining housing prices added further global optimism. In addition, decreased market volatility and the sustained outperformance of growth stocks underscored investor confidence. While stagnant U.S. retail sales and some weaker-than-anticipated U.S. housing market updates hinted at lingering apprehensions regarding interest rates and inflation, overall, the outlook remains healthy, particularly with corporate earnings poised to continue higher, signaling continued economic strength. Please contact your advisor at Valley National Financial Advisors with any questions.