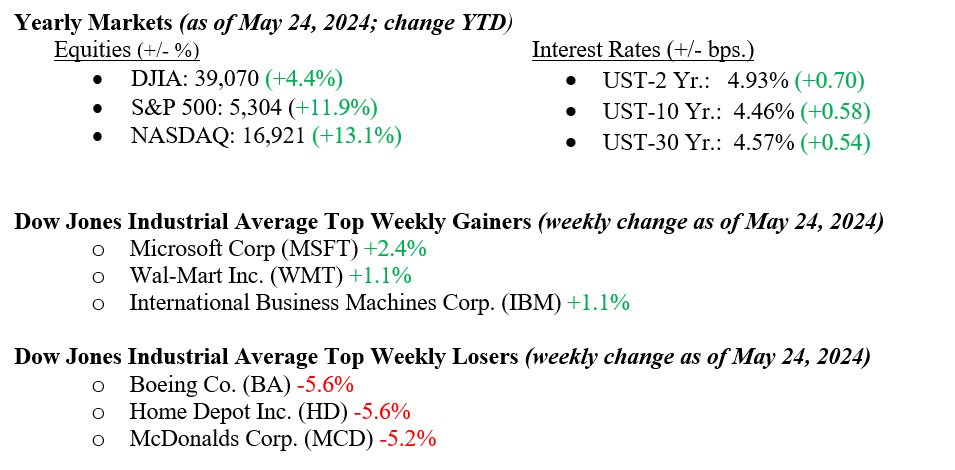

As a bevy of Fed speakers hit the trail professing their willingness to keep rates “higher for longer” to combat stubborn inflation, stock market indices greatly diverged in performance for the week. The tech-heavy NASDAQ rallied +1.4%, the S&P 500 was flat, while the Dow Jones Industrial Average fell -2.3%. The divergence in returns highlighted each sector’s sensitivity to interest rates. Cash-rich tech companies have lately been insulated from higher rates and continued to grow, while the industrial sectors of the economy are negatively impacted by continued higher rates. The 10-year U.S. Treasury closed the week at 4.46%, four basis points higher than the previous week. On the good news front, 96% of first-quarter earnings results in as of last Friday, companies in the S&P 500 recorded an average earnings increase of 6.0% versus the same quarter the previous year, according to FactSet, underpinning the continued growth in the U.S. economy.

U.S. & Global Economy

This week, we will see the revised 1st Quarter GDP figure; the prior reading showed +1.6%. Thus far, the strength of the U.S. economy has been nothing short of surprisingly resilient. Most sectors of the economy continue to show strength, led by the tech sector, which is largely led by AI (artificial intelligence). AI semiconductor chips, such as those produced by Nvidia, are in strong demand. We have publicly stated that simply talking about AI was a “winner” last year for most companies, but in 2024, we need to see results from investments in AI rather than talk. The real question is: how does AI increase efficiency and thereby increase the bottom line? We continue to wait patiently for that answer.

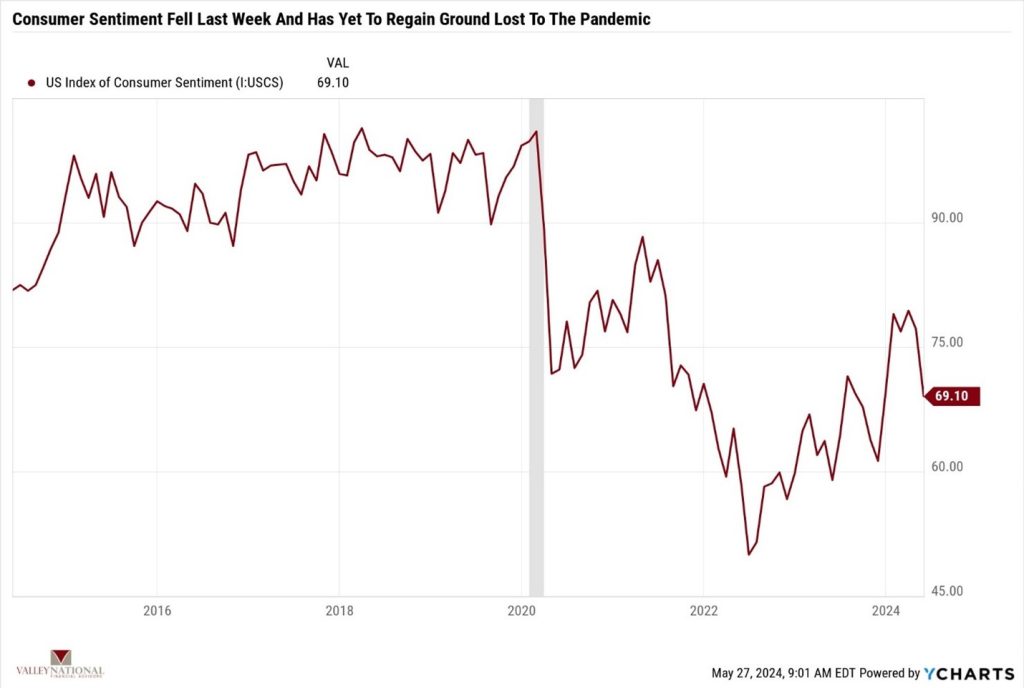

As measured by the University of Michigan, consumer sentiment (previously called consumer confidence) fell in May. While not too concerning, our consumer-based economy relies on workers’ ongoing confidence in spending and saving. Unfortunately, we have not yet regained the confidence levels seen prior to the pandemic (see chart 1 below from Valley National Financial Advisors and Y Charts).

Policy and Politics

There does not seem to be a reasonable timeline for any cessation in the two major global conflicts, Ukraine/Russia and Israel/Hama, even as pressure from other countries, humanitarian agencies, and the U.N. persists.

It was a relatively quiet week in Washington last week, and we expect the same this week with the Memorial Day Holiday. With only six months to go before the election, the U.S. Presidential election is finally coming into full focus. We have stated previously that given either choice (Trump or Biden), the markets understand what each candidate already offers and, therefore, have not priced in very much risk by either.

Economic Numbers to Watch This Week

- U.S. Initial Claims for Unemployment Insurance, prior 215,000

- US Real GDP QoQ for 1st Quarter 2024 (R), prior 1.60%

- U.S. PCE Price Index YoY for April 2024, prior 2.71%

- U.S. Core PCE Price Index YoY for April 2024, prior 2.82%

2023’s stunning stock market rally was largely led by the tech sector. The decent rally we have seen thus far in 2024, while impacted by the tech sector, has also breached out into other sectors, thereby broadening the rally. We continue to be cautiously optimistic about the markets primarily because the economy remains healthy, and consumers are largely doing well, with the key unemployment figure still below 4%. The Fed remains committed to a 2% inflation target and, therefore, will keep interest rates higher for longer. Thankfully, the economy has done well even in the face of relatively high interest rates. Please contact your advisor at Valley National Financial Advisors with any questions.