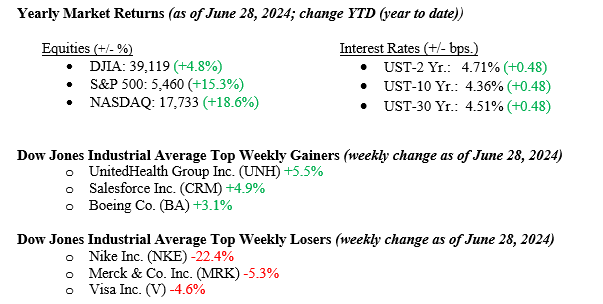

Last week, a mixed bag of returns for the equity markets was delivered. The Dow Jones Industrial Average and the S&P 500 Index were flat, while the NASDAQ, led by tech movers, managed to eke out a small gain of +0.2%. Meanwhile, the Russell 2000 Index of small-capitalization stocks rose +1.3% in a move that says lower rates are coming, as these stocks thrive on lower interest rates. Much of the markets’ movement was based on encouraging inflation data that was reported on Friday, showing that the U.S. Personal Consumption Expenditure Index (PCE) (2.56%) and Core PCE (2.57%) both came in lower than expectations. These figures, key indicators for the Federal Reserve, suggest a slowdown in inflation, likely prompting market expectations of future rate cuts. Meanwhile, last week, the 10-year U.S. Treasury closed at 4.36%, 11 basis points higher than the previous week. What is impressive is how rates have moved in tandem across the yield curve in 2024. See the numbers immediately below, which show that the 2, 10, and 30-year U.S. Treasury bonds have all risen exactly 48 basis points so far this year.

U.S. & Global Economy

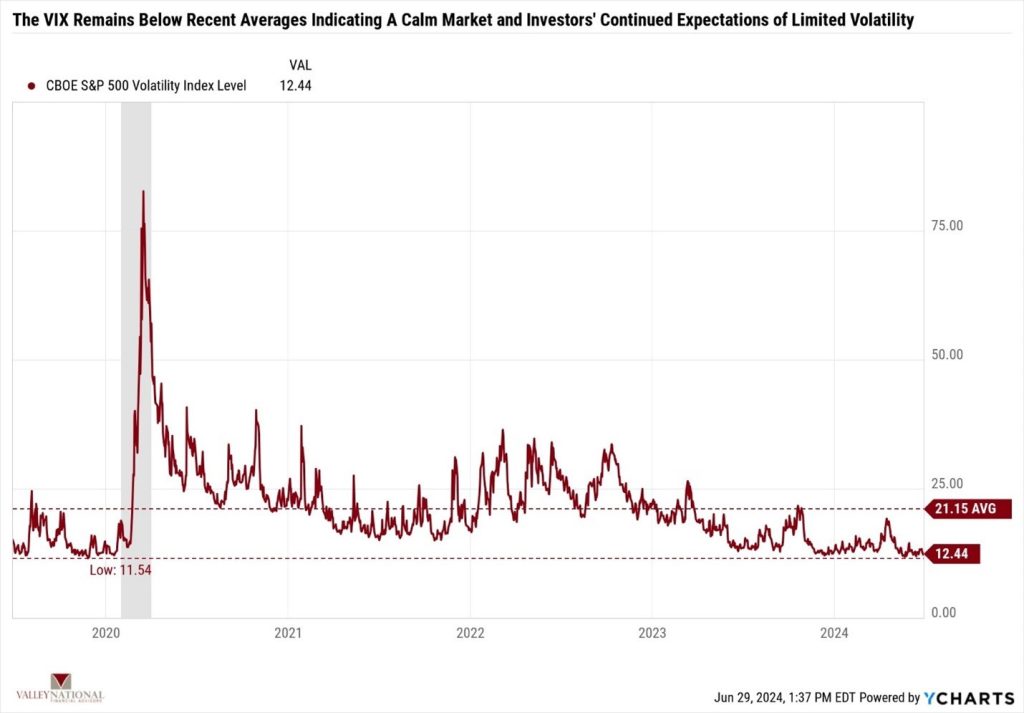

As mentioned above, the Federal Reserve’s preferred inflation gauge is the Personal Consumption Expenditure Index, which has fallen for over two years after peaking in June 2022. The CBOE S&P 500 Volatility Index (VIX) is a widely accepted measure of volatility in markets. The current level of the VIX is 12.44, which is well below the 5-year average of 21.15. See Chart 1 below by Valley National Financial Advisors and Y Charts showing the VIX. Equity and fixed-income markets have remained calm for most of 2024, with a modest exception in April during tax season. We believe the combined effects of a healthy economy, the relative calm in global markets, and the expectation of lower interest rates later in 2024 are keeping markets in a tight but calm trading range, especially as we move into the summer months when many Wall Street trading desks are thinly staffed.

Policy and Politics

President Biden and former President Trump squared off in their first formal debate on Thursday, June 27. While pundits and news services reported a win for former President Trump, we believe it is too early to call this race for the White House to be over. We anticipate polls to remain tight right through November. This, of course, is all based on today’s information, with President Biden and former President Trump remaining on their respective party tickets. Despite the complexities of local, national, or global politics, markets focus on factors beyond polls and presidential elections. Markets rely on job growth, healthy economies, and stable economic conditions – all of which largely remain present around the globe.

Economic Numbers to Watch This Week

- U.S. Job Openings: Total Nonfarm for May 2024, prior 8.059M

- ADP Employment Change for June 2024, Prior 152,000

- ADP Medial Pay YoY for June 2024, prior 5.00%

- U.S. Durable Goods New Orders MoM for May 2024, prior 0.65%

- U.S. Labor Force Participation Rate for June 2024, prior 62.50%

- U.S. Nonfarm Payrolls MoM for June 2024, prior 272,000

- U.S. Existing home sales for May 2024, prior 4.14 million.

- U.S. Leading economic indicators for May 2024, prior –0.6%.

- U.S. Unemployment Rate for June 2024, prior 4.00%

- U.S. Recession Probability for June 2025, prior 51.82%

Each week in The Weekly Commentary, we post the previous week’s largest gainers and losers in the Dow Jones Industrial Average. What strikes us most is how often great companies change their place on the gainers or losers list from week to week. Sometimes, a stock becomes a loser when its earnings results miss Wall Street’s expectations by a penny or two. In reality, successful companies do not fret over minor short-term earnings shortfalls; they prioritize building global enterprises and robust franchises that evolve into world-class firms, generating enduring wealth for shareholders and stakeholders alike. The markets understand this and are efficient at weeding out the real winners from the real losers. Please contact your advisor at Valley National Financial Advisors with any questions.