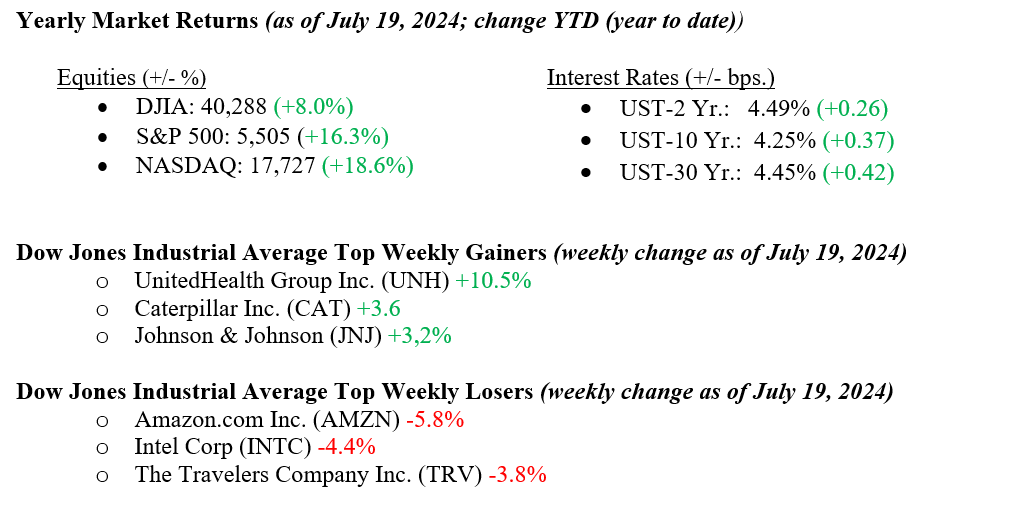

Initially reaching new highs across significant market indexes, the week ended with a notable shift as the tech sector experienced a sell-off amidst a global software outage affecting several vital industries. Despite this, the trend towards small-cap and cyclical stocks persisted, bolstered by rising anticipation of Federal Reserve rate cuts starting as early as September 2024. For the week, the Dow Jones Industrial Average moved higher by +0.7%, the Russell 2000 was higher by +1.7%, while the S&P 500 Index dropped -2.0% and the NASDAQ fell -3.7%. Small-capitalization stocks outperformed the broader indexes for the second week in a row. While many interpret this as a shift from one sector to another (from tech and large-cap to small-cap), we see it as a necessary expansion in the breadth of the stock market, a dimension lacking so far in 2024. The 10-year Treasury yield rose seven basis points to end the week at 4.25%.

U.S. & Global Economy

On Friday, significant disruptions reverberated across various sectors, such as air travel, banking, and healthcare. A global tech outage caused by a major malfunction at CrowdStrike, a leading provider of anti-hacking software, impacted 8.5 million MS Windows devices worldwide. As the weekend began, efforts to resolve the disruptions were underway, highlighting once more the vulnerabilities stemming from our heavy dependence on a few key IT providers. We expect more to come from this outage, including Congressional investigations.

Policy and Politics

Democratic Party bosses and major donors finally pushed President Biden to withdraw from the current presidential race and instead backed Vice President Harris as his replacement. If nothing else, the race got much more interesting for the next three months. Concerns around Biden’s “down ballot” impact worried supporters so much that the almost unheard-of result has occurred. Markets will now have to reprice the odds of a Harris v Trump race and the results on various economic sectors and industry participants.

Recent polls show Vice President Harris trails Mr. Trump by two percentage points nationally. This represents a slight improvement from President Biden’s previous position, where he trailed Mr. Trump by three percentage points.

Economic Numbers to Watch This Week

- Existing Home Sales for June 2024, prior amount 4.11M

- U.S. Durable Goods New Orders MoM for June 2024, prior rate 0.11%U.S.

- U.S. Real GDP for 2nd Q 2024, prior rate 1.40%

- U.S. PCE Price Index YoY for June 2024, prior rate 2.56%

- U.S. Core PCE Price Index YoY for June 2024, prior rate 2.57%

- U.S. Index of Consumer Sentiment for June 2024(R), prior level 66.0

For a mid-summer week, the news stories abounded with a major world IT outage, only to be topped by the upheaval in the Democratic Party, which saw Vice President Harris replace President Biden as their nominee. We anticipate the excitement to persist as the markets analyze the latest polls and their consequent effects on valuations and outlooks. All eyes this week will be on Thursday’s Q2 GDP report, Friday’s PCE Price Index report, and earnings from Tesla, Visa, and Alphabet/Google. Please get in touch with your advisor at Valley National Financial Advisors with any questions.