Wall Street is calling it the “Great Rotation.” We call it a needed market broadening beyond mega and large cap tech stocks to small capitalization stocks and industrials. Last week saw modest gains in the Dow Jones Industrial Average (+0.8%) and substantial gains in the Russell 2000 Index of small-capitalization stocks (+3.5%), while the S&P 500 (-0.8%) and the tech-heavy NASDAQ (-2.1%) both fell. The recent broadening occurred in sectors overlooked during the stock market rallies of 2023 and 2024. We believe this reflects strength and resilience, as it allows the market to broaden its scope beyond just a few leading companies, with other sectors now participating in the rallies. Indeed, the tech sector continues to generate substantial free cash flow. However, it is encouraging to see other areas of the economy performing well, as demonstrated by second-quarter GDP growth of 2.8%, which surpassed economists’ consensus forecasts. The 10-year Treasury yield fell 5 basis points, ending the week at 4.20%.

As mentioned above, the U.S. economy showed significant momentum in the second quarter as GDP expanded at an annual rate of +2.8%, which was well above expectations and soundly above the first quarter 2024 rate of +1.4%. We are seeing this growth in EPS releases for the second quarter. Last week, several industrial companies, including 3M Co, Mohawk Industries, and Norfolk Southern, reported earnings that exceeded expectations. This positive news further fuels the excitement surrounding the expanding market returns we are witnessing. Once again, technology companies are thriving, generating substantial free cash flow that is being reinvested into groundbreaking innovations such as artificial intelligence. This economic growth stands out because it is occurring despite high interest rates and declining inflation.

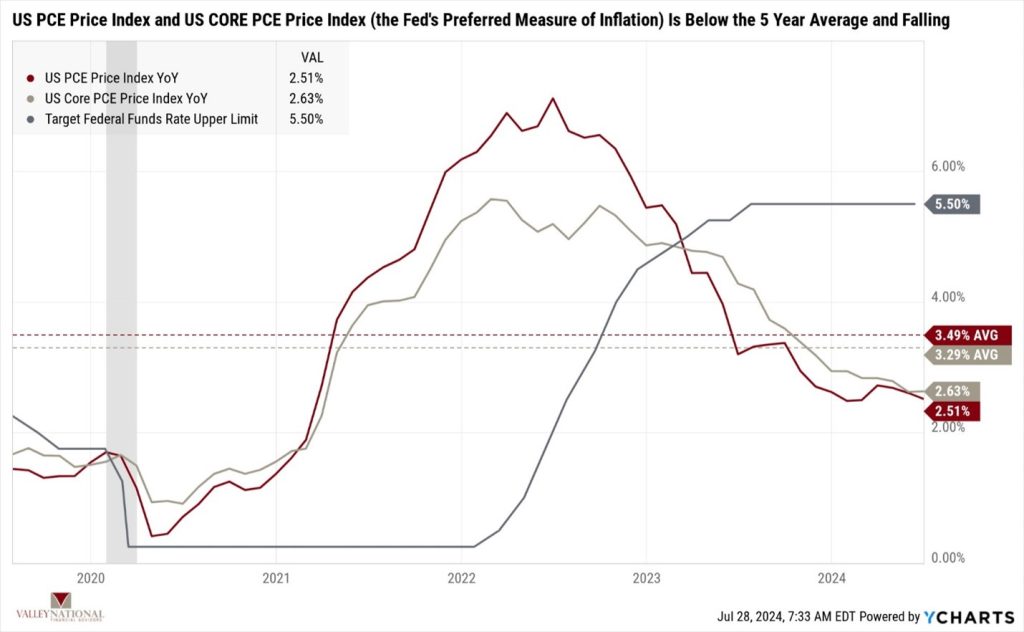

(See Chart 1 below from Valley National Financial Advisors and Y Charts showing U.S. PCE Price Index and Core PCE Price Index, both continuing to moderate). U.S. PCE is the Fed’s preferred measure of inflation, and this information will be paramount in their decisions this week as the FOMC meets July 30-31 in Washington. Markets now expect the Fed to keep interest rates unchanged following this meeting. At the beginning of 2024, most economists had predicted that rate cuts would have already begun by now. We believe the Fed will hold rates steady as inflation continues to decline and both the economy and the markets remain healthy, allowing the Fed to be patient.

The U.S. Presidential race is between former President Trump and current Vice President Harris. We expect the noise to continue over the next three months as the race is still too close to call, and there is much time between now and election day. Expect each party to lay out their differing glide paths for the U.S. economy locally and globally. We recommend tuning into the 2024 Summer Olympics over the next few weeks instead of getting caught up in the political drama.

Global turmoil continues to escalate as the conflict between Israel and Hamas extends into Israel and Lebanon, involving Hezbollah, and shows no signs of winding down. Surprisingly, this escalating unrest has yet to affect oil prices, which remain at $77 per barrel. However, heightened tensions in the Middle East always pose a risk, given their historically unpredictable nature.

Economic Numbers to Watch This Week

- Target Fed Funds Rate Upper Limit, current rate 5.50%

- U.S. Labor Force Participation Rate for July 2024, prior rate 62.6%

- U.S. Nonfarm Payrolls MoM for July 2024, prior among 206,000

- U.S. Unemployment Rate for July 2024, prior rate 4.1%

Equity markets are broadening their returns beyond just mega-cap tech names, which we believe is healthy for a sustained bull market. Small-capitalization stocks have rallied higher over the past three weeks, continuing the resurgence of the Russell 2000. Economic growth continues in the U.S. and has exceeded expectations, as evidenced by last week’s +2.8% GDP report. The FOMC meets this week to determine interest rates. We expect rates to remain unchanged as inflation is falling but has not yet reached Chairman Jay Powell’s target rate of 2.00%. Despite higher rates, equity markets are rallying, and long-term bond yields have fallen, indicating that lower rates will be the outcome for 2024. With the constant flow of news and information, it can be difficult to stay committed to your investment strategy. However, investors who remain steadfast and adhere to their long-term plans often build lasting, generational wealth. Please contact your advisor at Valley National Financial Advisors with any questions.