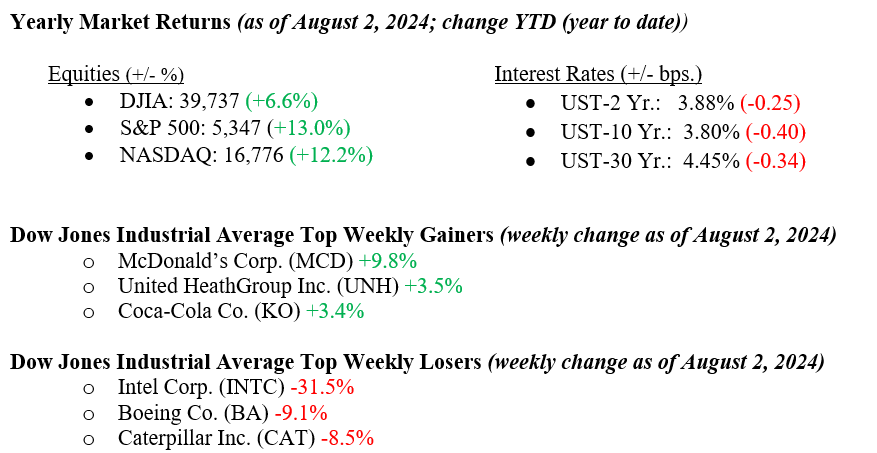

Last week, the stock market experienced significant declines across major indices. The Dow Jones Industrial Average fell 2.1%. The tech-heavy Nasdaq Composite Index was hit even harder, dropping 3.3%, while the S&P 500 Index also retreated, losing 2.0%. Weaker-than-expected employment data drove these declines, heightened by geopolitical risks and mixed corporate earnings reports. Despite the recent turbulence, the S&P 500 finished July with a 1.1% gain, marking its eighth positive month out of the past nine, while the Dow outperformed with a 4.4% monthly gain. The Nasdaq, however, declined by 0.8% in July. Changes in the interest-rate outlook and recent economic data led to a rally in government bonds, causing the 10-year U.S. Treasury bond yield to fall to around 3.80% by Friday.

U.S. & Global Economy

As mentioned above, last Friday’s July employment report revealed disappointing results, with sluggish payroll and household employment growth and a 0.2 percentage point rise in the unemployment rate to 4.3%. Despite this, we caution against interpreting these figures as indicative of a new trend, as temporary factors, such as calendar quirks and the impact of Hurricane Beryl, may have influenced the data. The increase in unemployment is primarily due to temporary layoffs and ongoing labor market frictions, not necessarily signaling an imminent recession. Job openings and overall economic demand remain healthy, and while corporate revenue growth has slowed, it remains positive. In contrast to last week’s employment data, we’ve had strong GDP, retail sales, and consumer confidence reported in the previous two weeks. Given the Fed’s substantial capacity to cut rates, the markets expect three consecutive 25-basis point reductions in the latter part of the year. However, a more severe rate cut could occur if August’s employment data mirrors July’s weakness.

Policy and Politics

Recent polls show that Vice President Harris trails former President Trump by about one percentage point nationally and three points in the crucial swing state of Pennsylvania. Prediction markets currently give Trump slightly under a 60% chance of winning in November. Since President Biden dropped out, Democrats have gained ground, improving their standing nationally and in crucial states like Pennsylvania, Virginia, New Hampshire, and Minnesota. Despite these gains, Trump remains ahead in enough states to secure an electoral victory. Vice President Kamala Harris secured enough votes in the Democratic National Convention virtual roll call to secure the Democratic presidential nomination. Potential VP candidates currently being considered include Governor Josh Shapiro, Senator Mark Kelly, and Governor Tim Walz.

Last week, tensions between Israel and Iran increased. Israel is preparing for possible attacks from Iran and regional militias following the recent killings of Hezbollah and Hamas officials. Meanwhile, the U.S. is providing defensive support to Israel while advocating for a cease-fire agreement in Gaza.

Economic Numbers to Watch This Week

- U.S. S&P final U.S. services PMI for July 2024, 55.0% prior

- U.S. ISM services for July 2024, 48.8% prior

- U.S. trade deficit for June 2024, -$75.1 billion prior

- U.S. Consumer credit for June 2024, $11.3 billion prior

- U.S. Weekly Jobless claims for the week of Aug 3, 2024, 249k prior

The recent market volatility underscores the importance of maintaining a well-diversified portfolio. While equities have experienced a sell-off, the bond market has stood out positively, with the Bloomberg Aggregate Bond Index rising over 2% last week. Fed Chair Powell’s economic update last Wednesday was reassuring, though Friday’s disappointing employment report leaves uncertainty about whether this is the start of a longer-term trend. However, recent GDP, retail sales, and consumer confidence data remain healthy. Earnings reports have been mostly favorable, with notable weak results generally linked to company-specific challenges or overly optimistic estimates rather than broad market weaknesses. Despite some increased talk of the AI impact on corporate America “taking time,” the secular AI growth trend appears intact based on recent updates provided by mega-cap tech companies. At this point, the economy is not screaming recession, but some data points have turned negative. Please contact your advisor at Valley National Financial Advisors with any questions.