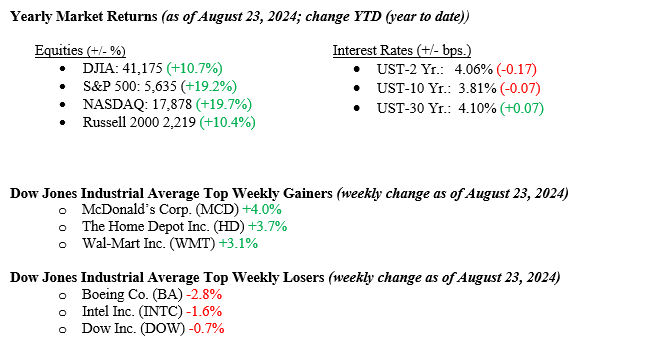

U.S. stock indexes rallied for another week, with the small-capitalization sector leading as the Russell 2000 Index increased by +3.6%. The Dow Jones Industrial Average increased by +1.3%, the S&P 500 Index increased by +1.5%, and the NASDAQ was up by +1.4%. Early in the week, positive earnings reports were complemented by Fed Chairman Jay Powell’s highly anticipated speech at the Jackson Hole Summit. Powell suggested that the time might soon be right for the Fed to reduce interest rates in his address. Additionally, Chairman Powell noted that inflation is close to the 2% target, suggesting that if the economy continues to grow, the Fed may have successfully achieved the sought-after soft landing for the economy. The 10-year U.S. Treasury bond yield fell eight basis points for the week, closing Friday at 3.81%.

U.S. & Global Economy

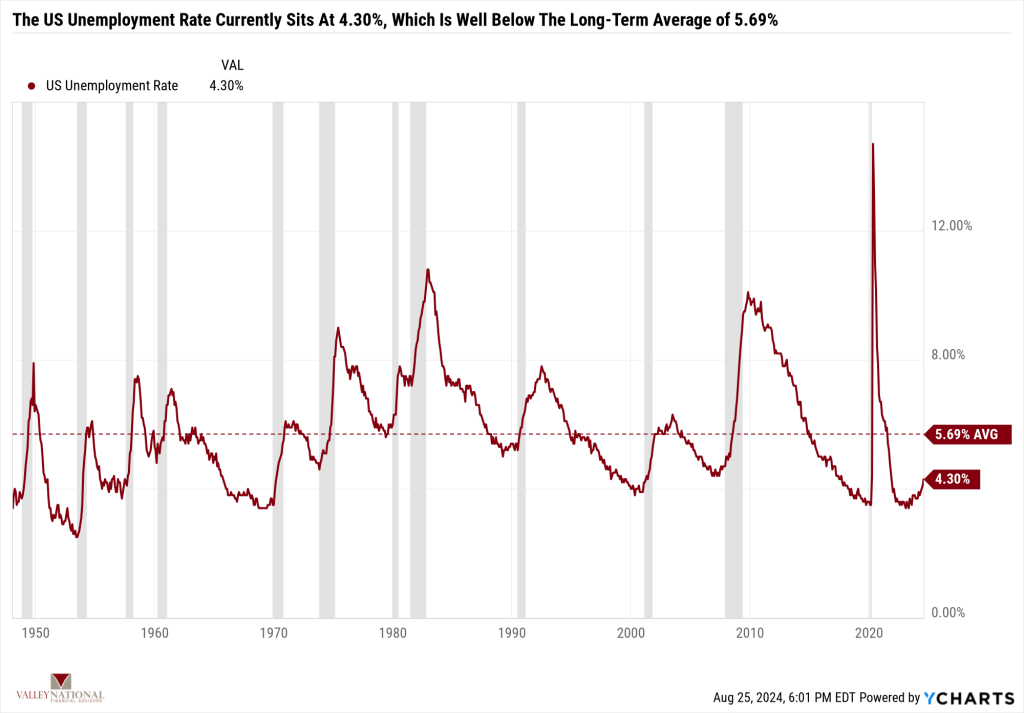

Last week, the employment sector saw some interesting economic revisions. The U.S. government’s revising initial job growth estimates resulted in a sizeable downward adjustment of 818,000 jobs created in March 2024. While downward revisions are standard, one of this magnitude is not typical and means the strength in the job market has not been as healthy as we expected. Sadly, economics relies on accurate data, and we at Valley National Financial Advisors do our best to report using the data we receive. While unsettling, the new data points to a labor market that is still growing and healthy but not as healthy as we thought. However, Chart 1 below from Valley National Financial Advisors and Y Charts shows that the U.S. Unemployment Rate currently sits at 4.30%, well below the long-term average.

Last week, it was reported that the sales of existing homes rose in July, driven by a recent drop in mortgage rates—the first decrease in four months. The housing market remains crucial to U.S. economic growth, as homeownership and retirement assets are a significant source of wealth for Americans. The housing market may gain significantly if the Fed successfully shifts from higher to lower interest rates.

Policy and Politics

Currently, Vice President Harris leads former President Trump by approximately 1.5 percentage points in national polls and is slightly ahead in Pennsylvania, the critical swing state for the electoral win. Prediction markets suggest a 52-54% chance of a Harris victory in November. Since her campaign began, Harris has improved her polling margins compared to Biden’s exit, gaining about two points nationally and one point in Pennsylvania. Since August 1, the likelihood of a Republican White House has decreased by ten points, while the chance of a divided government with Harris as President and Republicans controlling one or both houses of Congress has increased by eleven points. Despite these shifts, the overall outcome remains highly uncertain.

The Russia-Ukraine and Israel-Hamas conflicts remain severe and impactful. The war in Ukraine has persisted for three years, with ongoing clashes in the east and south as Ukrainian forces repel Russian advances. In Gaza, violence between Israeli troops and Hamas continues sporadically, leading to significant civilian suffering and infrastructure damage. The U.S. and Western allies continue supporting Ukraine and Israel while diplomatic efforts seek peaceful resolutions.

Economic Numbers to Watch This Week

- U.S. Durable Goods Orders for July, prior –6.7%

- U.S. Consumer Confidence for August, prior 100.3

- U.S. Initial Claims for Unemployment Insurance for the week of August 24, 2024, prior 232,000

- U.S. GDP (second revision) for Q2 2024, prior 2.8%

- U.S. PCE Index for July, prior 0.1%.

- U.S. Core PCE Index for July, prior 0.2%

- U.S. Consumer sentiment (final) for August, prior 67.8%

On Friday, investors will receive new inflation data with the release of the Fed’s preferred PCE index. Headline PCE inflation is expected to rise slightly to 2.6% from 2.5%, while core PCE inflation (excluding food and energy) is projected to rise to 2.7% from 2.6% last month. Both figures are below the Fed’s 2024 forecast, which estimated 2.6% for headline inflation and 2.8% for core inflation. Additionally, Nvidia (an AI leader) is set to report its second-quarter fiscal 2025 earnings after the market closes on Wednesday, August 28th. Analysts anticipate year-over-year solid growth, with revenue expected to exceed $28.84 billion and earnings per share predicted to rise to 59 cents. Investors will be keen to see continued strength in Nvidia’s data center segment and any updates on delays affecting its new Blackwell AI chip. While short-term data can provide valuable insights, focusing on long-term goals and investment strategies is essential. Please contact your advisor at Valley National Financial Advisors with any questions.