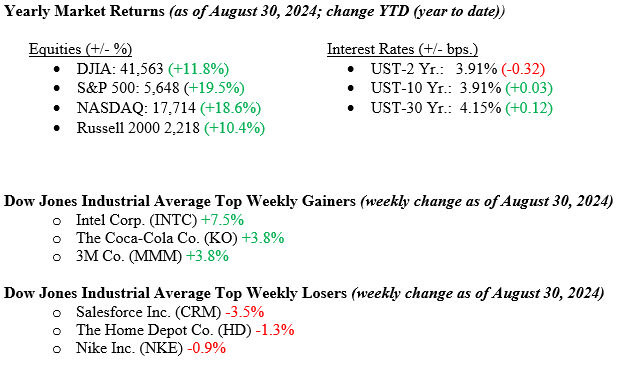

Last week, U.S. stock indexes showed mixed performance, with modest overall gains. The Dow Jones Industrial Average rose about 1%, setting a record and surpassing its mid-July high. The S&P 500 also saw a slight increase, nearing its mid-July peak, while the NASDAQ experienced a minor decline of 0.9%. This drop was partly due to NVIDIA’s earnings report. Despite the company reporting continued strong results, concerns about margin sustainability led to a notable impact on the NASDAQ. Nonetheless, the week was relatively calm, with encouraging economic data. The Personal Consumption Expenditures Index continued to show easing inflation, aligning with Federal Reserve expectations. Additionally, revising second-quarter GDP growth to 3.0% from 2.8% and improved consumer sentiment contributed to market stability. The 10-year U.S. Treasury bond yield rose ten basis points over the week, closing Friday at 3.91%.

U.S. & Global Economy

Last week’s economic reports offered a generally optimistic view of the U.S. economy. The Personal Consumption Expenditures (PCE) Index, the Federal Reserve’s preferred measure of inflation, indicated a continued reduction in price pressures, with core PCE increasing at an annual rate of 2.6% in July, slightly below expectations. This data bolsters the case for a potential rate cut at the upcoming Fed meeting. Additionally, the U.S. government upgraded its estimate for second-quarter GDP growth to 3.0% from 2.8%, primarily due to stronger consumer spending. Consumer sentiment also saw improvement, with the University of Michigan’s Consumer Sentiment Index climbing to 67.9—its first rise in five months. Although no major employment reports were released last week, markets are looking forward to the August jobs report, which will shed light on the labor market’s health following July’s addition of 114,000 jobs and a 4.3% unemployment rate, the highest in nearly three years.

Policy and Politics

Vice President Harris is leading former President Trump by about two percentage points in national polls and 0.5 percentage points in Pennsylvania, a key swing state. Prediction markets give Harris a 52% chance of winning in November. Since the Democratic convention, Harris’s support has slightly increased, though not as much as typical post-convention bounces. RFK Jr. dropping out and endorsing Trump has slightly boosted Trump’s numbers, though third-party candidates are still in the race. Prediction market odds have shifted slightly in favor of a Republican win or a divided government, with each having about a 30% chance. Harris’s favorability and approval ratings have risen, surpassing Trump’s. Harris’s first interview as the nominee is scheduled for August 29, and upcoming debates between Harris and Trump and Walz and Vance are set for September 10 and October 1, respectively.

The conflicts between Israel and Hamas, as well as between Russia and Ukraine, continue with little progress in diplomatic efforts. Both situations remain highly volatile, with ongoing risks of escalation and broader regional impact. Despite various attempts at negotiations, significant breakthroughs have yet to be achieved.

Economic Numbers to Watch This Week

- U.S. S&P final U.S. manufacturing PMI for August, prior 48

- U.S. Construction spending for July, prior –0.3

- U.S. ISM manufacturing for August, prior 46.8%

- U.S. Job openings for July, prior 8.18 million

- U.S. Factory orders for July, prior –3.3%

- U.S. ADP employment report for August, prior 122,000

- U.S. Weekly jobless claims for the week of Aug 31, 231,000

- U.S. S&P final U.S. services PMI for August, prior 55.2

- U.S. ISM services for August, prior 51.4%

- U.S. U.S. employment report for August, prior 114,000

- U.S. Unemployment rate for August, prior 4.3%

As the market ends summer near all-time highs, they continue to be supported by a growing economy, strong corporate profits, lower bond yields, and expectations of easier Fed policy. Rate cuts should support consumer and business spending and historically lead to strong equity returns when no recession exists. However, we’re keeping a close eye on three main risks: geopolitical tensions and the upcoming U.S. election could cause market fluctuations; a sluggish economy might be more sensitive to unexpected events; and slower economic growth could weaken earnings, making markets more vulnerable at high valuations. Additionally, the upcoming week will bring a heavy supply of economic data to digest, which may further influence market movements. As we approach the November election, historical patterns suggest potential for increased market volatility, underscoring the need for disciplined investing and diversified portfolios amidst possible leadership shifts. Please contact your advisor at Valley National Financial Advisors with any questions.