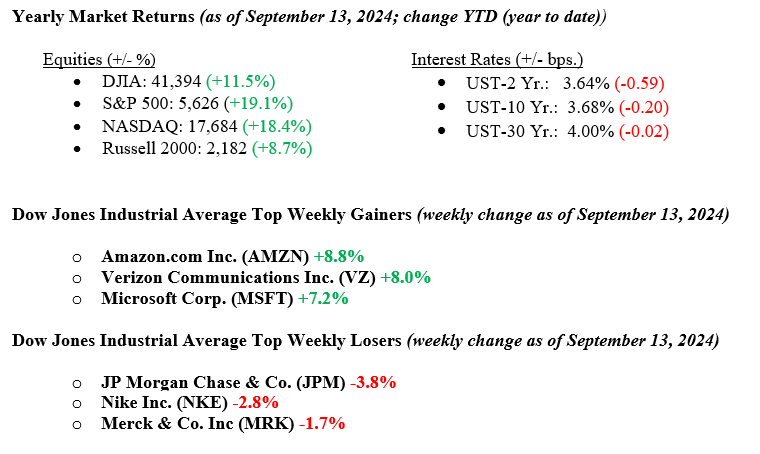

Last week, U.S. stock indexes experienced a whipsaw rally on the heels of the prior week’s sell-off. All major U.S. indexes reported gains, with the NASDAQ rallying +6.0%, the S&P 500 gaining +4.0, and the Dow Jones Industrial Average gaining +2.6%. Although last week’s rally appeared primarily driven by declining U.S. inflation data, the underlying strength is the consistent earnings growth of U.S. companies. According to FactSet, the estimated Q3 2024 (year-over-year) earnings growth rate of the S&P 500 Index is 4.9%. At that rate, it will mark the 5th quarter of year-over-year earnings growth for the index. This earnings momentum and this week’s widely expected interest rate cut by the Federal Reserve are forming a tailwind that U.S. equities are quietly enjoying. Lastly, the U.S. Treasury bond market has priced at the expected rate cut, and as a result, the 10-year U.S. Treasury bond yield fell four basis points, closing Friday at 3.68%.

U.S. & Global Economy

Last week saw the release of several important economic indicators in the U.S. The National Federation of Independent Business (NFIB) Small Business Optimism Index fell by 2.5 points in August to 91.2, marking its 32nd consecutive month below the 50-year average. The August Consumer Price Index (CPI) showed inflation easing to 2.5% year-over-year, better than the 2.7% expected, though core consumer prices remained steady at 3.2%, matching expectations. The Producer Price Index (PPI) slowed to 1.7% year-over-year in August, down from a revised 2.1% in July. Core PPI remained at 2.4% year-over-year but rose a higher-than-expected 0.3% month-over-month. Lastly, the University of Michigan’s preliminary consumer sentiment index for September increased to 69.1 from 67.9 in August, signaling a modest improvement in consumer optimism despite ongoing inflation concerns.

Policy and Politics

In the U.S. presidential race last week, Vice President Kamala Harris and former President Donald Trump squared off in a televised debate on September 10, with Harris reportedly delivering a solid performance. Recent polls reveal a tight contest, with Harris holding a narrow lead nationally and in crucial battleground states. Trump has suggested he may skip future debates, while Harris has shown enthusiasm for participating in more. Betting odds currently favor Harris, giving her a 51.1% chance of winning compared to Trump’s 47.4%. Overall, the race remains intensely competitive and uncertain at this point.

Geopolitical conflicts remain unchanged, though they continue to pose significant risks. The lack of progress in addressing these issues may lead to growing complacency among investors, who might view these ongoing conflicts as non-factors. This complacency poses a risk, as unresolved geopolitical tensions could suddenly escalate, introducing new uncertainties and potentially impacting global markets and economic stability.

Economic Numbers to Watch This Week

- U.S. Retail & Food Services Sales for August 2024, prior 0.38%

- Target Federal Funds Rate Upper Limit, current level 5.50%

- U.S. Initial Claims for Unemployment Insurance for the week of Sept. 14, 2024, prior to 230,000

- U.S. Housing Starts for August 2024, prior 1.238M

- 30-Year Mortgage Rate, prior 6.20%

U.S. markets have been volatile all year with several +/- 5.0% moves in major equity indexes and multiple 20+ basis point moves in the 10-year U.S. Treasury. While this may seem unusual to investors, it is anything but extraordinary. It is standard for markets to have big up and down days at any time during a market cycle, particularly during a bull market, as we are experiencing now. As stated above, we expect the FOMC to cut interest rates this week, most likely by 25 basis points. This rate cut, ongoing earnings momentum, and continued healthy gains in employment should add further tailwinds to an already strong U.S. economy. Lastly, the reduction in interest rates is expected to positively affect mortgage rates, potentially alleviating some of the affordability challenges currently affecting the housing market. Please contact your advisor at Valley National Financial Advisors with any questions.