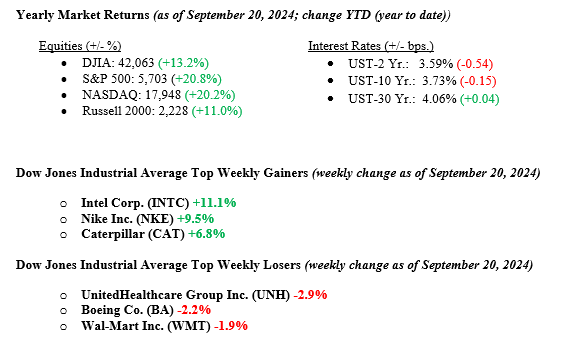

Last week, major stock market indexes continued their upward trend. The Dow Jones led the way with a strong 1.7% total return, followed by the NASDAQ with a 1.5% gain, and the S&P 500 at 1.4%. Both the Dow and S&P 500 reached new all-time highs. The market’s momentum was fueled by the long-awaited first rate cut in interest rates by the Federal Reserve and positive remarks from Federal Reserve Chairman Jerome Powell during his press conference. The last time stocks hit record highs due to a Fed rate cut was in 1995, after which the S&P 500 rose 23% the following year. For the week, the energy sector was a standout, surging 3.8%, while consumer staples and real estate both saw declines of over 1%. Lastly, the 10-year U.S. Treasury bond yield rose five basis points, closing Friday at 3.73%, further steepening the yield curve, especially as short rates continued to fall. The yield curve (the line between short and long interest rates) first turned negative in February 2022, and most economists immediately predicted a recession. At that time, we believed the economy was strong in all sectors and that a recession was unlikely. Since then, markets have rallied, and the US GDP has grown considerably. We always said to watch the data, and we will still believe in that thesis.

U.S. & Global Economy

Last week saw a flurry of economic data releases, many of which were strong indicators of an expanding economy. Retail sales rose 0.6% in August, exceeding expectations and indicating resilient consumer spending. Industrial production increased by 0.4%, boosted by a surge in auto manufacturing. The housing market showed signs of improvement, with housing starts jumping 10.6% and builder confidence rising. Initial jobless claims fell to 219,000, the lowest level since May, indicating a healthy labor market. However, the Conference Board’s Leading Economic Index declined for the sixth consecutive month, and existing home sales dropped to their lowest level since October 2023. On Wednesday, the U.S. Federal Reserve cut its key lending rate by 0.50%, a larger reduction than the 25 basis points many had anticipated. Supported by 11 of 12 voting members, this adjustment leaves the Fed funds range at 4.75% to 5.00%, with more cuts likely in November and December.

Policy and Politics

Unfortunately, global unrest and turmoil continue, and last week, tensions between Israel and Hezbollah escalated sharply, with Hezbollah firing over 100 rockets into northern Israel, prompting heavy Israeli airstrikes on Hezbollah targets in southern Lebanon. One airstrike in Beirut killed at least 37 people, including senior Hezbollah leaders. Additionally, explosions involving Hezbollah communication devices occurred in Lebanon, causing injuries and damage. Hezbollah has stated it will only cease attacks if there is a ceasefire in Gaza, linking the two conflicts. These ongoing hostilities have sparked fears of a larger regional conflict, prompting the U.S. to advise its citizens to leave Lebanon. At the same time, the UN warned of potential catastrophe if the situation worsens. Added to Middle East tensions, we still have an ongoing Russia/Ukraine war and saber-rattling by China in the South China Sea.

Economic Numbers to Watch This Week

- U.S. S&P flash U.S. services PMI for Sept 2024, previous 55.7

- U.S. S&P flash U.S. manufacturing PMI for Sept 2024, previous 47.9

- U.S. Consumer confidence for Sept 2024, previous 103.3

- U.S. New Home Sales for Aug 2024, previous 739,000

- U.S. Weekly Initial Jobless Claims for the week of Sept 21, previous 219,000

- U.S. Durable-goods orders for Aug 2024, previous 9.8%

- U.S. PCE index (Month over Month) for Aug 2024, previous 0.2%

- U.S. Core PCE Index (Month over Month) for Aug 2024, previous 0.2%

Now that the Fed meeting has concluded and the long-awaited first-rate cut is in the books, markets are shifting focus to upcoming employment and expected inflation reports in the coming weeks. Investors seek new data to evaluate the likelihood of a “soft landing,” which refers to slowing inflation alongside continued economic growth. This week will bring a variety of important indicators, including updates on manufacturing and services, housing market activity, and consumer confidence. On Friday, investors will receive an updated reading on the Fed’s preferred inflation indicator, the Personal Consumption Expenditures Price Index. We close with a quote from Federal Reserve Chair Jerome Powell: “The U.S. economy is in good shape; it’s growing at a solid pace. Inflation is coming down. The labor market is in a strong place. We want to keep it there.” Please contact your advisor at Valley National Financial Advisors with any questions.