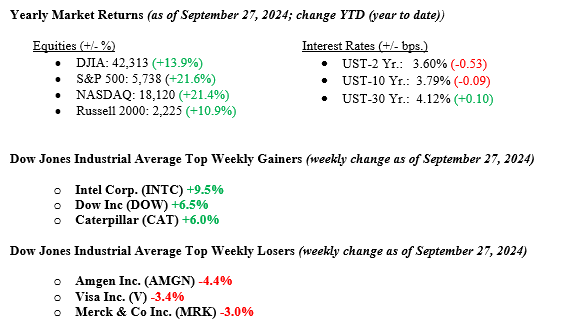

Equity markets rallied again last week as all major indexes showed increases, led by the NASDAQ, which rose +1.0%. The Dow Jones Industrial Average gained +0.59%, and the S&P 500 Index gained +0.62, both setting new all-time high records during the week. The NASDAQ lies just below its own record, which was set on July 11th of this year. Easing inflation, falling unemployment claims, continued economic growth, and a Fed aching to cut rates further in 2024 all contributed to the continued momentum higher in equity markets. Lastly, the 10-year U.S. Treasury bond yield rose six basis points, closing Friday at 3.79%.

U.S. & Global Economy

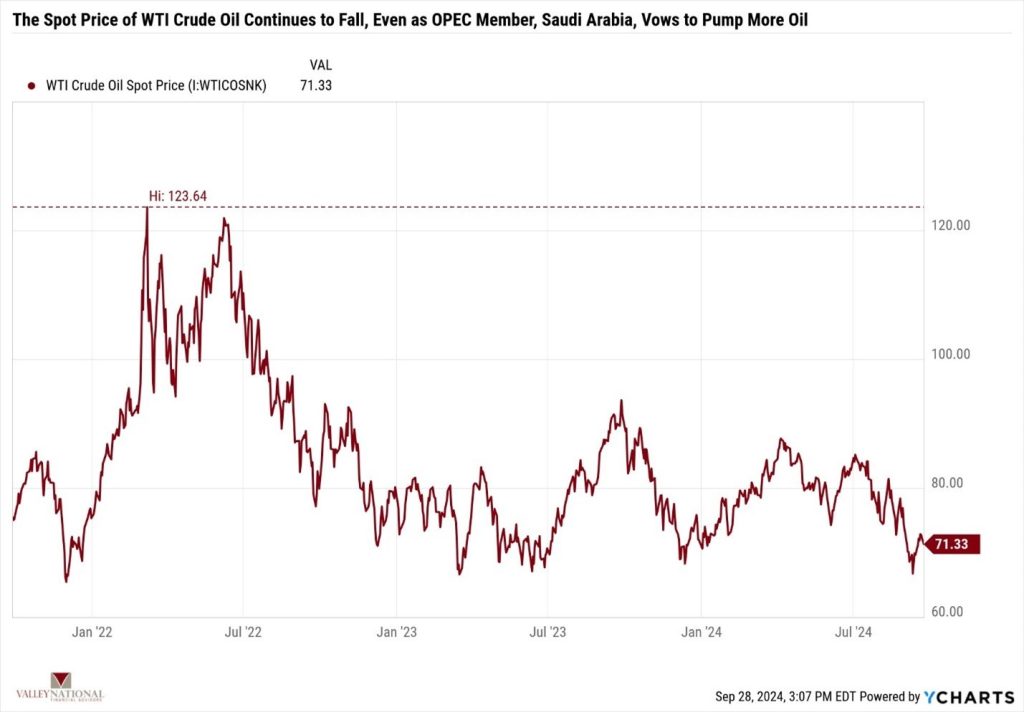

Last week, the U.S. Personal Consumption Expenditures (PCE) Index rose at an annual rate of 2.20% in August, falling below economists’ forecasts and marking the lowest level since February 2021. This inflation gauge, which is the Federal Reserve’s preferred measure, confirms that inflation continues to abate and move closer to the target rate of 2.00%. While the U.S. Core PCE Index rose slightly (2.70%) from the same month last year, this measure excludes food and energy. With the busy summer travel season now over and OPEC member Saudi Arabia agreeing to increase global oil supplies, there are indications that the Core PCE level may decline in September and October. See Chart 1 below from Valley National Financial Advisors and Y Charts, showing the 3-year price of WTI Crude Oil at $71.33/bbl, down from a 2022 high of $123.64/bbl. Oil is a critical input at all stages of manufacturing and commerce.

Policy and Politics

Global conflicts continue to escalate, with two key regions drawing attention. The ongoing Russia-Ukraine war is now well into its third year, showing no signs of resolution. Meanwhile, tensions in the Middle East have sharply intensified, particularly between Israel and various regional groups. Israel’s military operations against Hamas in Gaza have extended to confrontations with Hezbollah in Lebanon. The situation escalated further with the assassination of Hezbollah leader Hassan Nasrallah by Israeli forces, heightening fears of a wider regional conflict. Israel has issued warnings to Iran, Hezbollah’s main supporter, suggesting that the conflict could spread further. Under Prime Minister Benjamin Netanyahu, the Israeli government aims to defeat both Hezbollah and Hamas, a move that could drastically reshape the region’s security landscape. These developments have raised international concerns about the potential for a larger conflict involving multiple state and non-state actors.

With just over 30 days until the U.S. presidential election, the race is tighter than ever. Candidates are neck-and-neck as they vie for critical support. This week’s vice-presidential debate is set to play a pivotal role, providing an opportunity for running mates to sway undecided voters and strengthen their tickets.

Economic Numbers to Watch This Week

- U.S S&P final U.S. manufacturing PMI for Sept 2024, previous 47.0

- U.S. ISM manufacturing for Sept 2024, previous 47.2%

- U.S. Job openings for Aug 2024, previous 7.7 million

- U.S. ADP Employment for Sept 2024, previous 99,000

- U.S. Weekly Initial Jobless Claims for the week of Sept 28, 2024, previous 218,000

- U.S. S&P final U.S. services PMI for Sept 2024, previous 55.4

- U.S. ISM services for Sept 2024, previous 51.5%

- U.S. Nonfarm Payrolls for Sept 2024, previous +142,000

- U.S Unemployment Rate for Sept 2024, previous 4.2%

As we look ahead, this week’s September jobs report will offer valuable insights into the condition of the U.S. labor market, while updates on job openings and activity in both the services and manufacturing sectors, along with consumer confidence indicators, will be scrutinized further. Furthermore, we will keep a watchful eye on a potential port strike along the U.S. East Coast and the Gulf of Mexico, which could pose significant disruptions to supply chains and lead to delays in the flow of goods. While equity markets continue to move higher, we remain focused on potential risks stemming from geopolitical developments, Q3 earnings releases, and the U.S. presidential election. Please contact your advisor at Valley National Financial Advisors with any questions.