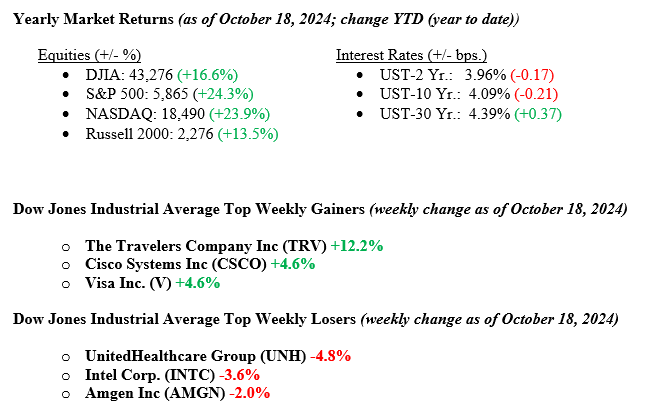

Last week, major U.S. indexes continued their move higher, with the S&P 500 and Nasdaq Composite notching six consecutive weeks of gains, thanks to solid earnings and outlooks from financial and technology companies. The S&P 500 rose by 0.93%, the Dow Jones gained 1.02%, and the Nasdaq increased by 0.91%. Small-cap stocks outperformed, with the Russell 2000 surging over 2%. Oil prices dipped below $70 per barrel as concerns about potential Israeli strikes on Iran’s oil infrastructure eased. Meanwhile, ten-year Treasury yields fluctuated but settled at 4.10%, influenced by healthy economic data, including better-than-expected retail sales and jobless claims figures. As the week ended, markets adjusted to the idea that the Federal Reserve would likely cut rates in November and December. Current 30-Day Fed Funds futures prices suggest a 99% likelihood of a 25-basis point cut at the November Fed meeting.

U.S. & Global Economy

Last week’s economic data releases revealed a largely positive picture. U.S. retail sales increased by 0.4% in September, exceeding expectations and indicating strong consumer spending across most retail sectors, with core sales rising by 0.7%. This suggests promising growth for the third quarter. Conversely, industrial production fell by 0.3%, attributed to disruptions from Hurricane Helene and a strike at Boeing, with August’s growth revised downward. In the labor market, initial jobless claims unexpectedly declined to 241,000 for the week ending October 12, despite earlier spikes due to hurricane impacts. Meanwhile, the number of people receiving jobless benefits for more than a week rose slightly but was still below projections.

China’s economic trajectory remains a crucial area of concern for investors. It was reported last week that China’s economy expanded 4.6% year-over-year in the third quarter, slightly exceeding expectations but still below the government’s target of around 5%. On a quarter-over-quarter basis, growth was 0.9%. Other positive indicators included a 5.4% rise in industrial production and a 3.2% increase in retail sales, boosted by higher demand for household appliances. However, inflation continued to cool, with annual inflation at 0.4% in September—the lowest in three months—and a significant drop in the producer price index by 2.8% from the previous year.

Policy and Politics

Geopolitical tensions are high as we approach the end of 2024, with several key areas impacting global stability. The ongoing conflict in Ukraine continues to strain relations between Russia and the West, while tensions in the Middle East have intensified following recent clashes between Israel and Iran. In the Asia-Pacific region, non-military confrontations in the South China Sea are increasing, and U.S.-China relations remain tense, especially regarding Taiwan and technology. The global race to innovate and regulate artificial intelligence creates distinct geopolitical blocs. The upcoming U.S. presidential election adds uncertainty to the international landscape, potentially affecting global alliances and trade. These issues underscore the interconnectedness of global affairs, highlighting the need for nations and businesses to adopt thoughtful strategies in this complex geopolitical environment.

Economic Numbers to Watch This Week

- U.S. Leading Economic Indicators for Sept 2024, previous –0.2%

- U.S. Existing Home Sales for Sept 2024, previous 3.86 million

- U.S. Fed Beige Book release

- U.S. Weekly Initial Jobless Claims for the week ended Oct 19, previous 241,000

- U.S. S&P flash U.S. services PMI for Oct 2024, previous 55.2

- U.S. S&P flash U.S. manufacturing PMI for Oct 2024, previous 47.3

- U.S. New Home Sales for Sept 2024, previous 716,000

- U.S. Durable-goods orders for Sept 2024, previous 0.0%

- U.S. Consumer Sentiment final for Oct 2024, previous 68.9%

Next week will be busy as around a quarter of S&P 500 companies, including Tesla, SAP, Nucor, Coca-Cola, Amazon, and GE Aerospace, are set to report their third-quarter results. Earnings season is underway, and early reports are looking good. Major financial companies have already posted results that mostly beat expectations. So far, 50% of the 66 reported companies exceeded consensus estimates, just above the long-term average of 48%. The growth forecast for S&P 500 earnings has jumped from 4.2% to 6.5%, marking the fifth straight positive quarter. While tech is expected to lead, the strong economy—reflected in the Atlanta Fed’s GDP estimate of 3.4%—suggests earnings growth could spread to more sectors. This may help narrow the gap between big tech earnings and the rest of the market, supporting a more diverse leadership and highlighting the need for proper diversification. We’ll be keeping an eye on these earnings for clues about corporate spending and proposed tariff policies. If you have questions or need more insights, feel free to reach out to your advisor at Valley National Financial Advisors.